- Home

- Case For A Social Security Cost-of-Livin...

Case For a Social Security Cost-of-Living Adjustment in 2010 Is Weak

If Policymakers Feel a Need to Act, They Should Consider a One-Time Payment

Under current law, there will be no cost-of-living adjustment (COLA) in Social Security in 2010 — the first time that has happened since automatic cost-of-living adjustments began in 1975. Several bills before Congress would grant a special increase in Social Security payments for 2010.

The inflation data, however, do not support an increase: overall consumer prices have fallen significantly in the past year and are not expected to return to their earlier peak until mid-2011. In addition, when no Social Security COLA is provided, Medicare Part B premiums — which are deducted from Social Security checks — are frozen for most beneficiaries so that the Social Security checks do not drop (see the box below).

If policymakers nevertheless choose to act, they should grant a flat, one-time payment as an economic stimulus measure rather than an across-the-board percentage increase that undermines the mechanics and purpose of Social Security’s indexing provisions.

COLAs Were Adopted to Replace Ad-Hoc Increases

Before 1975, Congress periodically granted across-the-board increases in Social Security benefits — acting ten times between 1950 and 1974 (and six times between 1965 and 1974). The 1969-71 Social Security Advisory Council, a congressionally mandated panel convened every four years to review the program, urged legislators to replace this ad hoc system with automatic increases that would assure beneficiaries of stable purchasing power. Groups representing senior citizens supported the proposal, as did a number of fiscal conservatives who believed that providing an automatic COLA would be more fiscally responsible than basing Social Security benefit levels in part on the outcomes of periodic congressional bidding wars.

In 1972, Congress voted overwhelmingly to adopt automatic COLAs beginning in 1975, with the increases based on the Consumer Price Index for Urban Wage and Clerical Workers (the CPI-W). They also provided for automatic adjustments in the wage and salary level up to which Social Security payroll taxes are levied — the so-called “taxable maximum” — in step with average wage growth. With some refinements (notably in 1977 and 1983), this structure remains intact today.

Prices Have Fallen Significantly Since the Last Benefit Increase

The Bureau of Labor Statistics (BLS) calculates that overall consumer prices have fallen significantly since then (see Figure 1). Energy prices have declined by nearly one-quarter, and prices for other goods and services have increased only modestly. Since the purpose of COLAs is to preserve beneficiaries’ purchasing power, the decline in overall prices means that beneficiaries do not need a COLA in January 2010.

In fact, if Social Security and other indexed benefits that use the CPI-W — Supplemental Security Income (SSI), railroad retirement, veterans’ compensation and pensions, and federal civil service and military retirement — were strictly pegged to the inflation rate, their recipients would receive a negative COLA (i.e., a reduction in benefits) of 2.1 percent in January 2010. Fortunately for those recipients, the programs’ statutes bar a downward adjustment of benefits.

The Congressional Budget Office and the Social Security trustees do not expect the CPI-W to return to its summer 2008 peak until mid-2011. Under that assumption, Social Security beneficiaries and recipients of other indexed benefits will get their next COLA in January 2012. In the meantime, their benefits are safe from reduction.

If Policymakers Decide to Provide an Increase, a Lump-Sum Payment Is the Preferable Approach

Although the automatic-adjustment provisions are working exactly as intended, policymakers face some pressure from constituents to increase benefits. Several bills have been introduced that would grant a special increase. They take two different approaches:

- Some proposals would decree an across-the-board increase next year, disregarding the program’s usual indexing provisions. H.R. 3557 would pay Social Security beneficiaries an increase equal to the average of the last ten years’ COLAs (or 3.0 percent); H.R. 3572 would provide an increase of 2.9 percent.

- Other proposals would make a flat, lump-sum payment to beneficiaries. H.R. 3672 would make a one-time payment of $150 to Social Security beneficiaries; H.R. 3597 would make a one-time payment of $250 to recipients of Social Security, SSI, railroad retirement, and certain veterans’ benefits.

These proposals are costly. A 3 percent increase would cost $15 billion to $20 billion annually in Social Security benefits in 2010 and beyond. (The two bills that propose an across-the-board increase contain no mechanism for cancelling that increase, or subtracting it from future COLAs, so the higher benefits would last for the rest of their recipients’ lifetimes.) A lump-sum payment of $150 for Social Security beneficiaries would cost about $8 billion, while the proposed one-time payment of $250 would cost about $14 billion (including SSI and other programs). The costs for the latter two bills would occur only in 2010 — although proposals likely would be put forward to make these payments again in 2011, since regular COLAs are not expected to resume until January 2012.[1]

If legislators feel compelled to grant an increase, a flat, one-time payment explicitly aimed at stimulating the economy is superior to a percentage raise described as a COLA. Such a flat payment would be more progressive, affording a proportionately larger bonus to people with low incomes. It would help people pay their Part D premiums and other out-of-pocket medical costs — expenses that don’t particularly vary by income. And it avoids tinkering with Social Security’s indexing machinery, thereby smoothing the way to a resumption of regular COLAs at the start of 2012.

Furthermore, because lower-income people are more likely to spend rather than save any extra money they receive, a flat payment would provide more of a boost to the economy than a percentage increase — which is why Congress included a flat, one-time $250 payment to Social Security, SSI, and veterans’ pensions beneficiaries in the American Recovery and Reinvestment Act (ARRA) earlier this year.

If policymakers opt for another flat, one-time payment, there is no justification for not including SSI and veterans’ pensions beneficiaries, since those two programs — like Social Security — are expected to pay no COLA next year. Both are means-tested programs that pay benefits solely to low-income people who are elderly or have disabilities.

There Would Be No COLA in 2010 Under Alternative Inflation Measures Either

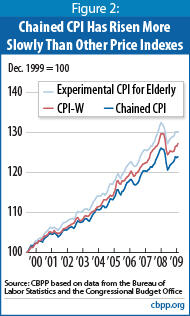

The CPI-E has tended to grow slightly faster than the CPI-W. From December 1999 through September 2009, the CPI-E rose an average of 2.8 percent annually, while the CPI-W climbed an average of 2.7 percent per year (see Figure 2).[2] Nevertheless, like the CPI-W, the CPI-E has fallen in the last year, and there would be no COLA in 2010 if it were the index used to determine COLAs. (It also should be noted that the CPI-E suffers from significant technical limitations that should deter policymakers from adopting it for official use. [3])

Does the CPI Overstate Inflation?

Many economists have concluded that the standard CPI modestly overstates inflation. To address problems in this area, the Bureau of Labor Statistics (BLS) made several changes in the official CPI over the last decade.[4] There is, however, one source of upward bias that the changes in the official CPI have not addressed — what is called “upper level substitution bias.” The standard CPI measures the cost of a fixed basket of goods and services; it does not reflect the savings that households obtain when they switch their purchases to closely related items that are becoming relatively less costly — for example, when families respond to an increase in beef prices by buying more chicken.

Instead of making the significant conceptual change in the way the official CPI is calculated that would be needed to deal with upper level substitution bias, BLS instead has developed an alternative, “chained” CPI that removes this source of bias. The chained CPI rose by an average of 2.2 percent per year between December 1999 (when it first became available) and September 2009 (see Figure 2). That is 0.3 percentage points per year slower than the CPI-W (and 0.5 percentage points slower than the CPI-E). Like those other two indexes, the chained CPI has fallen since last summer, and its use, too, would lead to a zero COLA in 2010.

The chained CPI more accurately reflects shifts in spending patterns in the face of price changes. For that reason, some analysts have recommended that it be used to determine future COLAs in Social Security and other benefit programs as well as the annual adjustments in the features of the federal income tax code that are linked to inflation, such as the tax brackets, the standard deduction, and the personal exemption. [5]

Large Majority of Medicare Beneficiaries Protected from Expected Premium Increase

Most Social Security recipients who are 65 or older, and most disabled-worker beneficiaries under age 65, participate in Medicare and opt to have their Medicare Part B (Supplementary Medical Insurance) premiums withheld from their Social Security check. Part B premiums, which finance one-quarter of that program’s costs, would normally rise in 2010 in tandem with increases in Medicare Part B costs. However, several provisions of federal law will shield all but a small minority of Social Security beneficiaries from this premium increase.

A “hold harmless” provision of the Social Security Act guarantees that, in most cases, an individual’s Social Security check may not shrink as a result of an increase in the Medicare Part B premium. In the absence of this provision, the Part B premium would rise for enrollees from $96.40 a month in 2009 to an estimated $103 a month in 2010 (the levels are higher for beneficiaries with high incomes). Instead, because there will be no Social Security COLA, the Part B premium will remain frozen at $96.40 in 2010 for most Social Security beneficiaries who participate in Medicare Part B. a

The largest group of people whom the hold-harmless rule does not protect — about 17 percent of all Medicare enrollees — consists of so-called “dual eligible” beneficiaries whose Part B premiums are paid by the Medicaid program rather than subtracted from their Social Security checks. The two other groups who are ineligible for the hold-harmless protection are:

- New Medicare enrollees (3 percent of all Medicare participants). These beneficiaries’ Social Security check would decline when they paid a Medicare premium for the first time even if there were a Social Security COLA, so they are not covered by the hold-harmless rule.

- High-income enrollees (5 percent of participants). These enrollees — with income over $85,000 for individuals and $170,000 for couples — pay Medicare Part B premiums that are scaled to their incomes. They are the only people who will experience a drop in their Social Security checks from the interaction of a zero COLA and Medicare premium increases.

In September, the House passed H.R. 3631, which would hold next year’s Part B premium at $96.40 for all enrollees and thereby shield all Medicare enrollees from a premium increase. The Senate has not yet considered this legislation, which would raise the deficit by about $2.8 billion.

(Note: No hold-harmless provision applies to premiums for the Medicare Part D prescription drug benefit. That benefit is offered by a variety of providers that offer differing benefits and charge differing premium amounts. Analysts expect the average Part D premium to go up by about $2 a month in 2010.)

a See the Director’s blog for April 22 and 23, 2009 at www.cbo.gov. See also “The Social Security COLA and Medicare Part B Premium: Questions, Answers, and Issues,” Kaiser Family Foundation, May 2009.

Policymakers Should Also Review Other Aspects of Indexing

The automatic adjustment provisions of Social Security have operated smoothly since 1975, achieving their goals of protecting beneficiaries’ purchasing power and avoiding sudden, ad hoc changes in policy that could weaken the program’s finances. But the current “COLA drought” might spur lawmakers to review several of the system’s aspects:

- Lawmakers should consider detaching several wage-indexed features of Social Security from the COLA. Social Security taxes (including both the employee and employer shares) equal 12.4 percent of earnings up to $106,800 in 2009. Under current law, this “taxable maximum” is indexed to wage growth. The taxable maximum increases, however, only if there is a COLA and thus is expected to remain frozen at this year’s level for the next two years (see Table 1).

Many experts regard this as an anomaly that is out of step with the general way that automatic adjustments work in Social Security. Simply de-linking the taxable maximum from the COLA and letting it rise in accordance with increases in wages as it normally does, irrespective of whether a COLA is paid in the same year, would generate several billion dollars in Social Security revenues in the next few years.

Social Security’s so-called “earnings limit” (or “retirement test”), which reduces benefits for some recipients who have significant earnings, also will be frozen this year and next because it, too, is not permitted to rise with wages in years when there is no Social Security COLA. This threshold is now $14,160 for beneficiaries under age 66 and will stay there until COLAs resume. It, too, could be modified so it continues to rise with wages in years in which there is no COLA.

| TABLE 1: Taxable Maximum And Retirement Test Amounts, Under Current Law And Under Option to “De-Link” From Cost-of-Living Adjustments | ||||

| Maximum Taxable Earnings | “Retirement Test”a | |||

| Current Law | Alternative | Current Law | Alternative | |

| 2009 | $106,800 | $106,800 | $14,160 | $14,160 |

| 2010 | $106,800 | $110,400 | $14,160 | $14,640 |

| 2011 | $106,800 | $112,800 | $14,160 | $15,000 |

| 2012 | $115,800 | $115,800 | $15,360 | $15,360 |

| Source: CBPP based on Congressional Budget Office August 2009 baseline a For people under the normal retirement age (currently 66), Social Security benefits are reduced by $1 for every $2 of earnings above this threshold. A higher amount ($37,680) and a lower offset rate ($1 reduction for every $3 of excess earnings) apply to people in the year they reach the normal retirement age. | ||||

- Lawmakers should consider basing COLAs on the average CPI over 12 months rather than in a single quarter . Using prices over only a three-month period raises the risk of a COLA — or the lack thereof — being determined on the basis of just a few months of unusually high (or low) prices. This is essentially what happened last year — the CPI data for the June-September quarter of 2008 that determined the COLA that took effect in January 2009 were unusually high.

Automatic adjustments in other parts of Social Security and in other programs often take a longer period into account. For example, Social Security’s wage-indexing provisions use annual averages, and the features of the income tax code that are indexed such as the tax brackets, standard deductions, and personal exemptions rely on a 12-month measure of inflation. Using a 12-month average measure for the Social Security COLA would lessen the type of swings we are now seeing, where an unusually high COLA this year will be followed by two years with no COLA at all.

End Notes

[1] All four proposals would finance at least some of the resulting cost through taxes. H.R. 3597 would temporarily apply the Social Security payroll tax to earnings above $250,000 and below $359,000. Earnings between the current-law taxable maximum ($106,800) and $250,000 would continue to be exempt from payroll tax. H.R. 3557, H.R. 3572, and H.R. 3672 would allow the taxable maximum to rise in step with wage increases, as explained below.

[2] Because this comparison begins in December and ends in September, it uses seasonally adjusted data (although the Social Security Act generally calls for basing COLAs on non-seasonally adjusted data).

[3] See Kenneth J. Stewart, “The experimental consumer price index for elderly Americans (CPI-E): 1982–2007,” Monthly Labor Review, April 2008, pp. 19-24, and Clark Burdick and Lynn Fisher, “Social Security Cost-of-Living Adjustments and the Consumer Price Index,” Social Security Bulletin, Vol. 67, No. 3 (2007), pp. 73-88.

[4] See David S. Johnson, Stephen B. Reed, and Kenneth J. Stewart, “Price measurement in the United States: a decade after the Boskin Report,” Monthly Labor Review, May 2006, pp. 10-19.

[5] See CBPP, “A Balanced Approach to Restoring Fiscal Responsibility,” July 2008.