Statement by Chad Stone, Chief Economist, on the April Employment Report

Today’s jobs report brings more sobering news about the depth and duration of the recession. Even if the economy hits bottom soon and begins growing again, it will take time to reverse the severe job losses and sharp increase in unemployment that have already occurred.

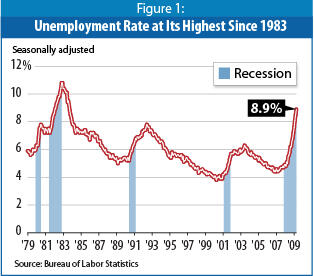

The official unemployment rate hit 8.9 percent in April, the highest it has been since 1983 (see chart). But that figure does not portray the full difficulties that job seekers face. The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — rose to 15.8 percent in April, an increase of 7.1 percentage points since the recession began and the highest level on record in data that go back to 1994.

These job market realities highlight the important role that the strengthened unemployment insurance (UI) measures in this year’s economic recovery law play in cushioning the impact of substantial and widespread unemployment on workers and their families and on the economy as a whole. Along with temporarily providing additional weeks of UI and higher benefit levels to laid-off workers, that law provides federal funds to reward states that reform their UI eligibility standards to bring more hardworking families into their UI program. Twelve states have already taken such measures and at least 20 more are expected to do so this year, the National Employment Law Project reports.

The coming months will be crucial for evaluating whether the substantial economic recovery measures already in place are working as expected to help turn the economy around. Even if a turnaround is imminent, high unemployment will persist for some time into the recovery. That’s why it is important that as many states as possible take advantage of the incentive funding to modernize their UI programs. In addition, the temporary UI measures in the recovery law expire at the end of this year. Policymakers should be prepared for the need to extend them into 2010.

About the Jobs Report

The recession that began in December 2007 has entered its 17th month, making it longer than any other post-World War II recession. Unemployed workers face a harsh environment in which to find a new job.

- Private and government payrolls combined have shrunk for 16 straight months, and net job losses since the start of the recession total 5.7 million. (Private sector payrolls have shrunk by 6.0 million jobs over the same period.)

- After five months of job losses averaging 680,000 a month, nonfarm payrolls fell another 539,000 in April. Government employment increased, while private sector employers shed 611,000 jobs.

- The official unemployment rate, which was 4.9 percent at the start of the recession in December 2007, reached 8.9 percent last month, its highest level since September 1983.

- The percentage of the population with a job (59.9 percent) is at its lowest level since July 1985.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — stood at 15.8 percent in March, up 7.1 percentage points since the recession began and the highest level on record in data that go back to 1994.

- Well over a quarter (27.2 percent) of the 13.7 million unemployed have not been able to find a job despite looking for 27 weeks or more. Normally, workers would exhaust their UI benefits after 26 weeks.

With jobs so hard to find, policymakers were wise to make additional weeks of UI benefits available to the long-term unemployed. Under the Emergency Unemployment Compensation (EUC) provisions of the economic recovery law, all states are eligible for an additional 20 weeks of federally funded benefits and states with unemployment rates above 6 percent are eligible for an additional 33 weeks of benefits. Currently 43 states qualify for the 33 weeks. States with especially high unemployment rates can also qualify for additional weeks of benefits under the Extended Benefits (EB) provisions of the regular UI program, and the recovery law temporarily made those benefits fully federally funded as well (normally states pay half).

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.