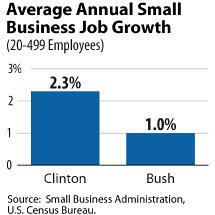

Critics have claimed that President Obama’s proposal to roll back tax cuts for families with incomes above $250,000 would kill job growth in the small business sector. But under the Clinton Administration, when the tax treatment of high-income families was very similar to what President Obama has proposed, small businesses generated jobs at twice the rate as under the Bush tax code. [1]

Thus, the last two decades provide a useful test of the argument that the President’s proposed tax changes would badly damage small business job creation. Small business employment rose by an average of 2.3 percent (756,000 jobs) per year during the Clinton years, when tax rates for high-income filers were set at very similar levels to those that would be reinstated under President Obama’s budget.[2]

But during the Bush years, when the rates were lower, employment rose by just 1.0 percent (367,000 jobs). (See Figure 1.)

Critics have also argued that rolling back the tax cuts for families above $250,000 would raise taxes for many or even most small businesses. This, too, is incorrect; very few small business owners have enough income to face the President’s proposed tax increases for high-income filers. For example, data from the Urban Institute-Brookings Institution Tax Policy Center indicate that only 2.2 percent of filers with small business income would be in the top two income tax brackets and thus be affected by the proposal to allow the top two marginal tax rates to return to pre-Bush levels after 2010, when the 2001 tax cuts are scheduled to expire.[3]

Many more small business owners would receive tax cuts than tax increases under President Obama’s budget, because the number of small business owners who would benefit from extending the 2001 and 2003 tax cuts for households below $250,000 and the additional tax cuts the budget proposes dwarfs the number who would be affected by allowing the tax cuts at the top to expire.

| Table 1:

Average Annual Job Growth in Small Businesses (20-499 Employees) |

| | Start | End | Avg. % Growth | Avg. Job Growth |

| Clinton (1993-2000) | 31,245,872 | 36,536,659 | 2.3% | 755,827 |

| Bush (2001-2006*) | 36,780,814 | 38,614,220 | 1.0% | 366,681 |

| Source: Small Business Administration, U.S. Census Bureau * 2006 is the latest year for which these data are available. Note: An analysis of job growth for all small businesses with fewer than 500 employees shows a similar disparity, with the pace of job growth during the Clinton years being twice the pace from 2000 to 2006. This paper highlights firms with 20-499 employees because critics of the Obama proposal have focused on this group. |