- Home

- Taxpayer Bill Of Rights (TABOR)

Policy Basics: Taxpayer Bill of Rights (TABOR)

TABOR constitutional amendments severely limit states’ revenues and their ability to make prudent budget choices. Colorado, the only state to adopt the restrictive measure, has suffered a worsened economic climate under TABOR and has failed to meet its education and public health commitments to its residents.

A Taxpayer Bill of Rights, or TABOR, is a constitutional measure that limits the annual growth in state (and sometimes local) revenues or spending to the sum of the annual inflation rate and the annual percentage change in the state’s population. (For example, if the general inflation rate is 2 percent and the state’s population grows by 1 percent, state revenue available for expenditures can increase by 3 percent. The balance must be refunded to taxpayers.) Overriding these limits requires voters’ approval or some other high bar, such as a supermajority vote of the legislature.

Colorado enacted the nation’s only TABOR in 1992 but suspended it for five years in 2005 in response to a sharp decline in public services. No other state has adopted it.

TABOR’s “Population-Plus-Inflation” Formula

TABOR forces large, annual cuts to services that families and businesses rely on and that support state economic prosperity.

TABOR’s population-plus-inflation formula is not backed by any credible economics or fiscal policy research, and it constrains policymakers’ abilities to make prudent budget choices.

The formula does not keep pace with the normal growth in the cost of maintaining services, let alone the need to make new investments or improvements. Inevitably, TABOR forces large, annual cuts to services that families and businesses rely on and that support state economic prosperity, as Colorado’s experience shows.

Here’s why:

- Population. The segments of the population requiring the most state services, such as senior citizens and children, often expand more rapidly than the population overall. For example, Florida — where voters defeated a TABOR measure in 2012 — projects that its total population will grow by 23 percent between 2020 to 2040 but that its 65-and-older population will grow more than twice as fast, by 52 percent.

- Inflation. The inflation measure that TABOR proposals use — the U.S. Bureau of Labor Statistics’ “Consumer Price Index-All Urban Consumers” (CPI-U) — does not accurately measure the cost of providing state services. It gauges changes in the cost of goods and services that individual consumers buy, like housing, transportation, and food, rather than the services that state governments pay for, like education and health care. The cost of providing public services grows much faster than the general rate of inflation for consumer goods, in part because labor-intensive public services are less likely to reap the efficiency and productivity gains achieved by other sectors of the economy. For example, teachers can only teach so many students, and nurses can only care for so many patients.

Economic growth already limits how much a state can spend each year. But under a TABOR, a state can maintain health and other services for the elderly (or expand them to meet growing need) only by cutting other areas of the budget, such as education.

TABOR’s Impact on Colorado

Colorado’s national rankings on a number of public services plummeted under TABOR.

Colorado’s public services have suffered under TABOR. Due to TABOR’s forced deep spending cuts, Colorado’s national rankings on a number of critical public services plummeted in the years after it adopted TABOR in 1992. For example:

- Colorado fell from 35th to 49th in the nation in K-12 spending as a percentage of personal income between 1992 and 2001.

- Colorado’s college and university funding as a share of personal income declined from 35th in the nation to 48th by 2008.

- Colorado fell to the bottom of national rankings in providing children with full vaccinations. It even suspended its vaccination program between 2001 and 2002 because it could not afford to buy vaccines.

- The share of low-income children in the state without health insurance doubled between 1992 and 2005, while falling in the rest of the nation.

Furthermore, Colorado’s business climate and economy deteriorated under TABOR. The measure contributed to a credit downgrade in 2002 and alarmed business leaders by undermining the state’s ability to invest in its basic infrastructure and workforce.

Tom Clark, former Executive Vice President of the Denver Metro Chamber of Commerce, stated, “For businesses to be successful, you need roads and you need higher education, both of which have gotten worse under TABOR and will continue to get worse.” Similarly, Gail Klapper, president of the Colorado Forum (an organization of 60 of the state’s leading CEOs), said, “The business community has said this is not good for business, and this is not good for Colorado.”

In 2005, Colorado voters approved a measure to suspend TABOR’s formula for five years to allow the state to rebuild its public services. Unfortunately, the suspension did not last long enough for the state to recover fully from the period that TABOR was in effect, and the Great Recession further undermined that effort.

TABOR continues to cause ongoing fiscal headaches for Colorado. For example, the combination of TABOR and the 1982 Gallagher Amendment, which aimed to distribute taxes equally between residential and commercial property, will cost the state $340 million in lost property tax revenue in 2019 alone. Partly as a result, Colorado teachers are paid only 65 percent of what other college graduates make in the state, a penalty that is larger than in any state other than Arizona. Teachers in several Colorado districts went on strike in 2018 and 2019, largely citing low pay and increasing costs of living.

TABOR also narrows the state’s budget choices in responding to cuts to federal aid to states. That’s important since the part of the federal budget that includes most aid to states outside of Medicaid remains below its levels of a decade ago. And additional cuts could hit in future years if President Trump’s proposed deep additional cuts are enacted. TABOR makes it extremely difficult for the state to raise additional needed revenues to make up the difference without triggering a taxpayer refund.

TABOR Proposals in Other States

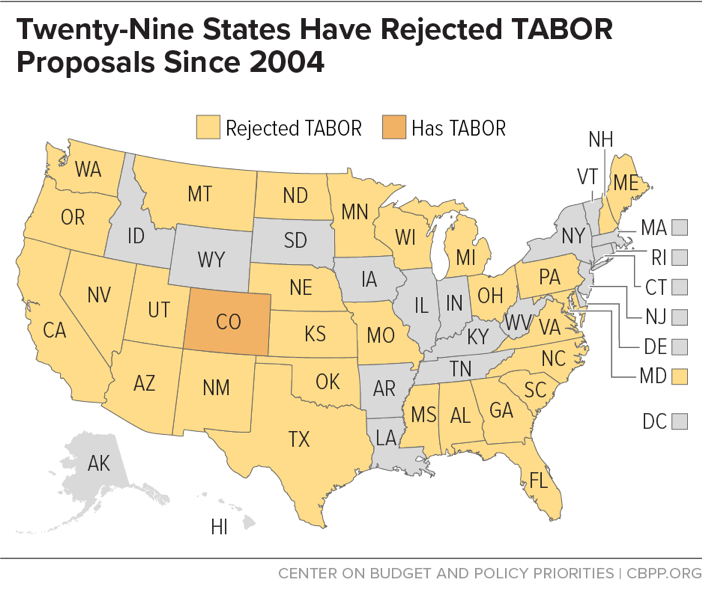

Since 2004, proponents have promoted TABORs in at least 29 states. In five states — Florida, Maine, Nebraska, Oregon, and Washington — these proposals reached the ballot but were rejected by voters between 2006 and 2012. Colorado thus remains the only state with a TABOR.

In early 2019, Alaska Governor Mike Dunleavy proposed two constitutional amendments that would severely restrict the state’s ability to invest in its future and that share characteristics similar to Colorado’s TABOR. Senate Joint Resolution 4 would require voter approval for any bill that the legislature passes to increase taxes. It would also require lawmakers to sign off on any tax-related ballot measures that voters approve, a step that no other state requires. Senate Joint Resolution 6 would enact a restrictive spending limit that adjusts for inflation only. Neither of these joint resolutions moved forward in Alaska’s 2019 legislative session.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.