HISPANICS’ LARGE STAKE IN THE SOCIAL SECURITY DEBATE[1]

By Fernando Torres-Gil, Robert Greenstein, and David Kamin[2]

|

PDF of

this report En Espanol: HTM | PDF

Related Reports: The Importance Of Social Security To The

Hispanic Community |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

Supporters of replacing part or all of Social Security with private accounts have argued that Hispanics receive relatively little for their payroll tax contributions to Social Security and would fare better under a system of private accounts. In fact, the opposite is the case. Research by government agencies and respected private institutions shows that:

- Hispanics receive more in Social Security benefits for each dollar they pay into the system than either non-Hispanic whites or blacks.

- Elderly Hispanics rely more on Social Security than does the elderly population as a whole. Without Social Security, over half of elderly Hispanics would live in poverty. Thanks to Social Security, less than a fifth do.

- Young Hispanics tend to have fewer assets, and are less likely to participate in an employment-based retirement plan, than other young people. Thus, while young Hispanics will likely be more prosperous than their parents, they too will need Social Security’s retirement benefits (as well as its disability and survivors benefits).

- The President’s Social Security plan, which reduces the

program’s funding shortfall entirely through benefit cuts that slice deep into

the benefits of middle-class retirees, would harm Hispanics. Hispanics would

be better off under plans that employ a balanced mix of benefit reductions and

progressive revenue changes. Simply stated, Hispanics would be harmed

disproportionately if large cuts are made in a system from which they

disproportionately benefit.

Also, the President’s plan places the burden of reducing the shortfall almost entirely on younger workers and future generations. This would disproportionately harm Hispanics because the Hispanic population is overwhelmingly young.

Social Security solvency can be restored in ways that do not seriously threaten the benefits Hispanics receive from the program. These reforms can be combined with adjustments, such as a meaningful minimum benefit for low-income retirees, that would be of particular help to Hispanics.

Hispanics Receive a Higher Rate of Return in Social Security

Social Security disproportionately benefits certain categories of people: people with lower incomes (because Social Security is designed to replace a larger share of pre-retirement income for those with low lifetime earnings than for those with high lifetime earnings); people who live longer (because they collect benefits for more years than those with average or below-average life spans); people who become disabled (because Social Security includes disability benefits for them and their families) and people with more children (because Social Security provides benefits to the minor children of retired, deceased, and disabled workers). All four of these characteristics are more commonly found among Hispanics than among other groups.

As a result, every reputable study, including those by the Government Accountability Office (GAO), economists at the Social Security Administration (SSA) and the Urban Institute, and other researchers, finds that Hispanics receive a higher average rate of return on their Social Security contributions than the rest of the population. For example, studies by Harvard economists Jeffrey Liebman and Martin Feldstein found that Hispanics’ rate of return is about 35 to 60 percent higher than for the population as a whole. As one study stated, in Social Security, “Hispanics have returns and transfers that are significantly above those for whites and blacks.”

A 1998 Heritage Foundation report, in contrast, claimed that Hispanics’ rate of return in Social Security was so low that they would do much better if the entire program were replaced with a system of private accounts. However, the Heritage report has been widely discredited; its many critics include SSA’s highly respected chief actuary Stephen Goss and former SSA chief actuary Robert Myers, who for decades was the leading adviser on Social Security to congressional Republicans. Further, as Goss noted in an official memorandum from the actuaries, even “by [Heritage’s] own calculations…Hispanic Americans would be expected to receive a substantially higher rate of return from Social Security than would the general population, on average.”

Hispanics do better than other groups in Social Security because the program disproportionately benefits people with low incomes, higher-than-average disability rates, more children per family, and long lives — all of which characterize Hispanics. If Social Security were entirely replaced with private accounts, these elements of the program would disappear, and each worker’s benefits would be tied directly to his or her earnings. That would be harmful to Hispanics.

Elderly Hispanics Rely on Social Security — and Younger Hispanics Will Too

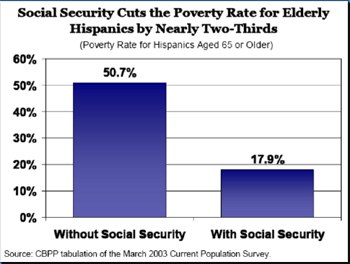

Some 1.2 million elderly Hispanics receive Social Security benefits. Those benefits reduce the poverty rate among elderly Hispanics by nearly two-thirds, from 51 percent to 18 percent.

Social Security’s anti-poverty effects are roughly similar across the Hispanic community, irrespective of country of origin, as the table shows.

Social Security provides a larger share of the retirement income of elderly Hispanics than for the elderly population as a whole, since elderly Hispanics receive a relatively small share of their income from pensions and retirement savings. Fifty-one percent of elderly Hispanic beneficiaries rely on their Social Security checks for 90 percent or more of their income.

|

Figure 1 |

||

|

|

||

|

Social Security’s Poverty-Reducing Effects |

||

|

Country of Origin |

Poverty Rate Without Social Security |

Poverty Rate with Social Security |

|

All Hispanic |

50.7% |

17.9% |

|

Mexican |

51.6% |

20.1% |

|

Cuban |

53.7% |

15.0% |

|

Central/South American |

42.3% |

12.4% |

|

Puerto Rican |

50.9% |

16.3% |

|

Source: CBPP tabulations of March 2003 Current Population Survey data. |

||

|

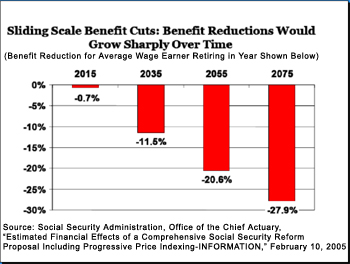

Figure 2 |

||

|

|

||

Social Security is also particularly important for the retirement security of today’s young Hispanic workers. One reason is that Hispanic workers are far less likely than whites or blacks to participate in employer-sponsored retirement plans. In 2003, only 29 percent of Hispanic workers aged 21-64 participated in an employer-sponsored retirement plan, compared to 53 percent of white workers and 45 percent of black workers, according to a study by the Employee Benefit Research Institute. In addition, Hispanic participation in these plans has actually fallen slightly since 1987 (the first year for which the EBRI report provides data), while white and black participation has increased.

Given this large and growing gap in retirement plan participation, it seems likely that future Hispanic retirees will also rely more heavily on Social Security than the rest of the population.

The President’s Plan Would Disproportionately Harm Hispanics

Since Hispanics gain more from Social Security benefits than other groups do, they are likely to do worse under reform plans that rely solely on benefit cuts to reduce the Social Security shortfall than under plans that employ a balanced mix of benefit reductions and progressive revenue changes.

Also, since Hispanics are an overwhelmingly young population, they are likely to do worse under plans that make young workers and future generations bear most of the sacrifices to preserve Social Security. (Only five percent of Hispanics are aged 65 or older today, compared to 12 percent of the U.S. population as a whole. By 2050, 15 percent of Hispanics will be aged 65 or older.)

The President’s Social Security proposals fare poorly on both of these counts:

- The President’s plan relies entirely on benefit cuts to

reduce the Social Security shortfall. The President’s “sliding scale

benefit reductions” would reduce benefits for all workers who earn more than

about $20,000 today; roughly seven of every ten workers would be affected.

The benefit cuts would grow sharply as income rose above $20,000. For a

worker earning the equivalent of $37,000 today who retires in 2045, benefits

would be cut by about $3,300 a year. If this worker earned the equivalent of

$59,000 today, the benefit cut would be about $6,400 a year. (For workers who

retire in years after 2045, the benefit cuts would be even steeper, as

explained below.) Also, any worker who chose to create a private account

would experience a second benefit cut.

The pain of these benefit cuts would be much sharper for the middle class than for high-income individuals, since middle-income Americans rely on Social Security to replace a much larger share of their pre-retirement income than wealthy individuals do. Moreover, these benefit cuts would close only about 59 percent of the 75-year Social Security shortfall, as measured by the Social Security Trustees. Thus, the Administration may eventually endorse deeper cuts than those shown here.

- The

President’s plan spares older workers and current retirees from significant

benefit reductions and makes later generations bear much steeper cuts as a

result. The President’s plan exempts those aged 55 or older from any

benefit cuts. For workers below that cutoff, the cuts would start small but

grow for each new group of retirees.

This generational imbalance is exacerbated by the fact that the plan calls for the government to borrow trillions of dollars to create a system of private accounts. That would greatly increase the debt burden on younger generations. As economist Lawrence Kotlikoff, a supporter of private accounts, writes, “the dirty little secret underlying most Social Security privatization schemes is that they head precisely down this road” of “dumping the entire…bill in our kids’ laps.” Since a large share of Hispanics are young and would be forced to pay that bill, such a move is not in Hispanics’ interest.

To its credit, the President’s plan would exempt many poor workers from benefit cuts. The President’s plan also would enhance the minimum benefit for some low-income workers (although it is unclear whether the proposed minimum benefit would endure or would phase out over several decades). Nonetheless, middle-income Hispanic workers would face sharp benefit reductions in retirement, and Hispanics as a whole would fare worse under the President’s plan than under plans that combine much more modest benefit cuts with progressive revenue enhancements.

Strengthening Hispanics’ Retirement Security

-

Hispanics’ retirement security needs to be strengthened. The President’s proposal to scale back Social Security substantially would have the opposite effect, as Social Security is the one form of retirement security that now works well for Hispanics. Hispanics generally would fare better under Social Security solvency plans that impose smaller benefit cuts on middle-income workers and ask workers with very high incomes to shoulder more of the load. That could be done through progressive revenue changes, such as the following:

-

The estate tax, which Congress is considering repealing permanently, could be scaled back and retained, and its revenues dedicated to Social Security. Retaining the tax at its 2009 level, with a $3.5 million exemption per individual ($7 million per couple) and a top rate of 45 percent, would preserve enough revenue to close about 30 percent of the Social Security shortfall over the next 75 years, according to the Social Security Administration’s chief actuary. Moreover, at that exemption level, only the wealthiest three of every 1,000 people who die would owe any estate tax as of 2011, according to the Brookings-Urban Tax Policy Center. The fraction of Hispanics subject to the tax would be even more miniscule, given their lower wealth levels.

-

Many have suggested raising the maximum level of wages and salaries subject to the Social Security payroll tax, now set at $90,000. Alternatively, economists Peter Diamond and Peter Orszag have suggested imposing a modest (three to four percent) surcharge on earnings above $90,000 and devoting those revenues to Social Security. Either measure would raise substantial revenues but affect only about six percent of all workers — and two percent of Hispanic workers.

In addition, a meaningful minimum benefit should be established in Social Security to ensure that beneficiaries do not live in poverty, and attention should be given to the fact that some legal immigrants are not eligible for retirement benefits from Social Security because they have not worked in the country for at least ten years. (To be eligible based on fewer years of work, an individual’s country of origin must have a “totalization” agreement with the United States.) In a recent report, the National Council of La Raza called for action on both of these issues.

Hispanics also should be given incentives to save more for retirement. The existing tax incentives for retirement saving give their biggest benefits to the people who least need them: high-income households, who already are much better prepared for retirement than people who are less well off. Economist Peter Orszag, director of the Brookings Institution’s Retirement Security Project, has proposed a series of policy changes that would improve retirement security among low- and middle-income families. Such reforms would be especially beneficial for Hispanics.

These reforms include: making enrollment in 401(k)-type retirement plans automatic unless employees opt out of the plan; expanding the current saver’s credit, which provides a tax subsidy to moderate- and lower-income families who contribute to a retirement account; changing rules in programs like food stamps and Medicaid so families are not disqualified for those benefits simply because they have modest retirement savings; and allowing workers to deposit part of their tax refund directly into a retirement account while preserving the rest for other purposes. Such steps would help build retirement security for Hispanics and for Americans as a whole.

End Notes:

[1] For a more extensive discussion of these issues and citations for the data and studies mentioned here, see Fernando Torres-Gil, Robert Greenstein, and David Kamin, “The Importance of Social Security to the Hispanic Community,” Center on Budget and Policy Priorities, June 2005, and Fernando Torres-Gil, Robert Greenstein, and David Kamin, “Hispanics and Social Security: The Implications of Reform,” Center on Budget and Policy Priorities, June 2005.

[2] Fernando Torres-Gil is Director of the UCLA Center for Policy Research on Aging and acting dean of the UCLA School of Public Affairs. Robert Greenstein is executive director, and David Kamin is a research assistant, at the Center on Budget and Policy Priorities.