Capital Gains Tax Cuts Slashed Taxes of Top 400, While Their Incomes SoaredCapital Gains Tax Cuts Slashed Taxes of Top 400, While Their Incomes Soared

End Notes

[1] The data are discussed in Tom Herman, “There’s Rich and There’s the Fortunate 400,” Wall Street Journal, March 5, 2008, and Len Burman, “The Rich Are Different,” http://taxvox.taxpolicycenter.org/ and can be found on the Tax Policy Center website at http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=260&Topic2id=48.

[2] Other evidence suggests that overall federal tax rates for those at the very top also fell during this period. In an important recent study, economists Thomas Piketty and Emmanuel Saez examined trends in effective individual income, corporate income, payroll, and estate taxes on high-income households, looking at groups up to the top one-hundredth of 1 percent of the population. Their research shows that over the period covered by the new IRS data (1992-2005), payroll tax rates on very high-income households increased, but effective corporate and estate tax burdens fell by more than enough to compensate. See Thomas Piketty and Emmanuel Saez, “How Progressive Is the U.S. Federal Tax System? A Historical and International Perspective,” Journal of Economic Perspectives, Winter 2007.

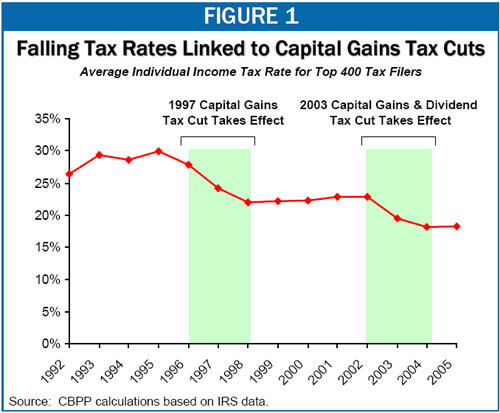

[3] Both the capital gains tax cuts took effect mid-year. As a result, they had some effect on effective tax rates in the year of enactment, but their full effects were not felt until the following year; hence, the effects of these tax cuts are reflected in the data over the 1996-1998 and 2002-2004 periods. Reductions in marginal income tax rates enacted in 2001 and accelerated in 2003 undoubtedly also had a significant impact on tax rates for this group.

[4] These figures include only capital gains and dividends that qualify for the preferential capital gains and dividend tax rates.