- Home

- State Tax Changes In Response To The Rec...

State Tax Changes in Response to the Recession

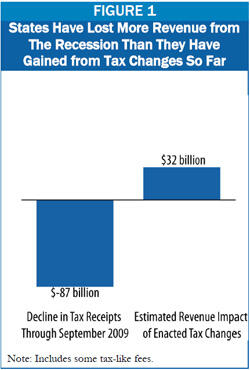

The national recession has had such a devastating effect on state finances that states took in $87 billion less in tax revenue from October 2008 through September 2009 than they collected in the previous 12 months. This 11 percent decline, the steepest on record, resulted from the impact on tax collections of lost jobs, reduced wages, and lowered economic activity.

At the same time, the recession has driven up the number of people needing various state services. This, along with the requirement that states have balanced budgets, has increased the pressure on states to deal with the unprecedented revenue shortfalls in a variety of ways. Nearly all states have cut spending. In addition, most have opted for a balanced approach that includes revenue.

To recoup lost revenue, states have taken such actions as eliminating tax exemptions, broadening tax bases, and in some cases increasing rates as well as raising a number of fees. Doing so is part of an established pattern; states historically have turned to revenue increases as part of the response to recessions. They have found that raising new revenue provides more short-term economic benefit than relying only on spending cuts and does not have an adverse impact on longer-term economic performance.

This report analyzes tax changes enacted in 2008 and 2009. It finds those tax changes to be substantial and widespread.

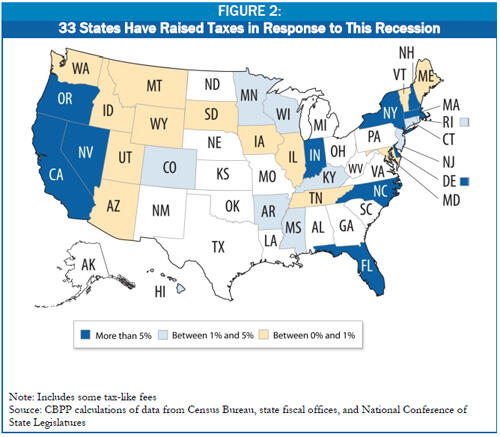

In 33 states, tax changes are increasing annual revenues, relative to what the state otherwise would have collected, by $31.7 billion. Even after accounting for a few states that lowered taxes, net tax changes for 2008-2009 total $29.7 billion in expected revenues, or 3.8 percent of total state revenues. The difference between the fall-off in revenues and the limited impact of the tax actions enacted is shown in Figure 1.

In 20 states, tax changes are providing a significant boost to revenues — that is, they are producing additional revenue of more than 1 percent of the prior year’s total revenues. Ten of those states have raised taxes by more than 5 percent of the prior year’s collections: California, Delaware, Florida, Indiana, Massachusetts, Nevada, New Hampshire, New York, North Carolina, and Oregon.

Overall, 13 states raised new revenue from personal income taxes, 17 enacted sales tax increases, 22 increased excise taxes on tobacco, alcohol, or motor fuel, 17 increased business taxes, and 24 increased fees or other taxes.

In dollar terms, sales and excise tax changes account for 37 percent of the net increase, or $11.0 billion. Nearly one-third of the expected new revenues — $9.8 billion — came from personal income tax changes. The remaining nearly $9.0 billion — close to one third of the total — is made up of corporate taxes, miscellaneous taxes, and fees.

Corporate tax changes account for 11 percent of the revenue increase, or $3.1 billion, equal to slightly less than 0.5 percent of state revenues.

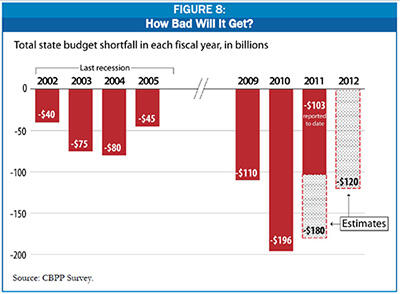

State tax actions are likely to continue to occur in legislatures over the next two years. There usually is a lag between the time a national recession ends and the recovery of state and local government budgets. This is because unemployment tends to be the last economic indicator to improve, and employment levels are crucial to revenues returning to pre-recession levels. In the past two recessions, state budget shortfalls continued for several years after the recession officially ended. The current recession, with state revenues having suffered an unprecedented drop, could have an even longer recovery period. Additional tax measures would help states address budget gaps that are projected to reach $180 billion in fiscal year 2011 and another $120 billion in 2012.[1]

It is common and reasonable for states to enact tax changes following the onset of a recession, when declining revenues and increased costs create large budget gaps. The size of the current recession and resulting record budget gaps create a particularly strong case for revenue raisers.

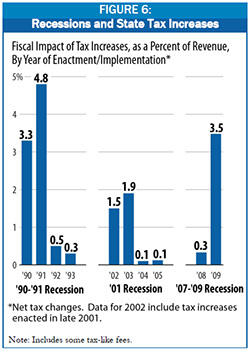

In the wake of the recession of 1990-91, states enacted tax changes that raised revenue by 8.9 percent compared to what they otherwise would have collected. Following the somewhat less severe 2001 recession, states enacted tax measures to raise revenue by 3.5 percent. With the current recession having such a profound impact, and state budget gaps being larger as a result, state tax actions over the past two years have already exceeded those taken in the 2001 recession. It is possible that states will have to raise additional taxes by at least as much as they have already done since the start of this recession, as revenue and economic projections indicate large shortfalls are likely to continue.

Because this recession is both depressing revenue and increasing public need for assistance by so much, tax measures are the only way to avoid a cuts-only solution to current state budget crises. Avoiding sole reliance on spending cuts and embracing instead a balanced approach that includes revenues is important for the health of state economies. When states and localities cut spending, they reduce employee wages and payments to private-sector vendors and individuals — actions that, in turn, reduce the amount that those firms and individuals spend. This creates a ripple effect that can jeopardize recovery. Tax increases can avert some of the reduction in economic activity, particularly when levied on higher-income households and profitable corporations.[2]

Even the states that have already enacted substantial tax increases will likely revisit the issue soon, in part because many of the 2008 and 2009 tax increases were enacted as temporary measures and are scheduled to expire after two or three years. Of the $30 billion in new taxes, as much as $20 billion will expire by December 2011 — some even sooner. State economies will not have fully recovered by that time, meaning those expirations likely will not be affordable. If states do not extend those tax increases, the revenue could prove hard to replace.

The Tax Actions of 2008 and 2009

The national economy started to decline in late 2007. Gross Domestic Product fell throughout 2008 and much of 2009, costing states considerable revenue. Receipts from income taxes, sales taxes, and corporate taxes all dropped because workers and investors were making less money, families and businesses were spending less, and corporate profits were down. The reduction in tax revenues has so far cost states $87 billion, or 11 percent of their revenues. This is the steepest decline since the U.S. Census Bureau began tracking state revenues collections in 1960.

As a result, when state policymakers began work in early 2008 on budgets for the 2009 fiscal year, they faced large gaps between expected revenues and anticipated spending on public needs. When they met in 2009 to work on budgets for the 2010 fiscal year they faced even larger gaps. Additional gaps have been announced since then as revenues continued to decline. The combined gaps for fiscal years 2009 and 2010 have reached $300 billion.

Required by their laws to balance their budgets, states responded to the unprecedented shortfalls in a combination of ways other than taxes.

- They have drawn down reserve funds and used other sources of one-time funds; states’ reserves, at an all-time high going into to the recession, are now largely gone.

- They have reduced outlays: state general-fund spending declined 4 percent in fiscal year 2009 (which in most states was July 1, 2008 to June 30, 2009) and another 4.8 percent for 2010, even as the need for public services has grown.

- And they have utilized federal assistance, largely through the American Recovery and Reinvestment Act enacted in February 2009, which is filling about one-third of state budget gaps for 2009 and 2010.

But those actions proved in many states to be insufficient to make up for all of the revenue lost through the impact of the recession. Budgets still could not be balanced. In response to the crisis, most states also enacted measures to increase revenue. These principally involved increases in tax rates, measures to subject more items or purchases to existing taxes, and eliminating various tax credits, deductions, and exemptions.

This analysis examines tax actions states have taken since the recession began — those enacted in 2008 and 2009. It includes both newly enacted tax actions and newly implemented installments of previously enacted tax actions. Increases in certain fees, such as motor vehicle registration, are also included. And it measures the size of these actions in terms of their full-year impact on state revenues, to allow for meaningful comparisons with previous years’ actions. Other actions that maintain existing policies, such as extending a tax that was to expire or delaying a scheduled tax cut, are not captured, although these actions also clearly have a revenue impact.

Overall, 33 states raised new revenues, relative to what otherwise would have been collected during 2008 and 2009, of $31.7 billion a year. There also was a counter-trend during this period. In a contradiction to their urgent need for more revenue, a number of states cut taxes. By far, most of the tax cuts occurred in 2008 — before the full extent of the recession was well known — and most were relatively small. The largest tax cuts to take effect during this period were installments of measures that were enacted prior to the recession and scheduled to phase in gradually. They affected revenues after the recession began. In any event, the total dollar impact of the tax cuts in states with overall tax cuts in 2008 and 2009 — $2.1 billion — has been far smaller than the tax increase.

Nationwide, tax changes enacted in all states during 2008 and 2009 totaled a net increase of $29.7 billion in states’ expected revenues, an amount equal to 3.8 percent of prior year revenue. While some states enacted tax increases that raised relatively small amounts of new revenue, 20 states’ actions are expected to increase revenues significantly (i.e., by more than 1 percent of the prior year’s revenues):

Ten states raised revenues by at least 5 percent: California, Delaware, Florida, Indiana, Massachusetts, Nevada, New Hampshire, New York, North Carolina, and Oregon.

Another ten raised revenues by between 1 and 5 percent: Arkansas, Colorado, Connecticut, Hawaii, Kentucky, Minnesota, Mississippi, New Jersey, Rhode Island, and Wisconsin.

Significant tax increases have occurred in all regions of the country. States have enacted increases in all of the major taxes they levy — personal income taxes, general sales taxes, business taxes, and excise taxes. Personal income taxes and sales taxes, the largest sources of state tax revenue, have experienced the greatest increases.[3]

Personal Income Taxes

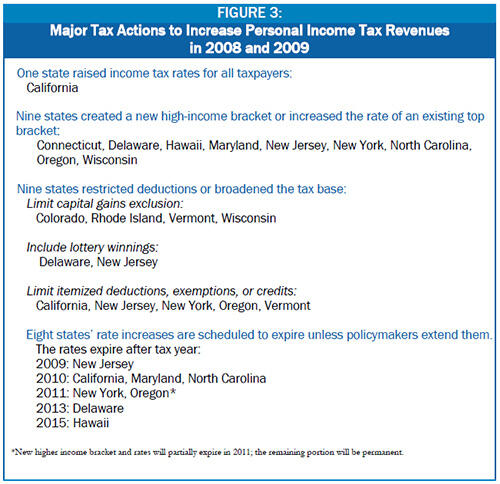

Eleven of the states that enacted significant revenue-raisers in 2008 and 2009 did so, at least in part, through their personal income tax. As a result, personal income tax revenues are estimated to increase by $11.4 billion relative to what otherwise would have been collected— about one-third of all tax increases nationwide. The largest increases, as a share of total tax revenues, were in California, Connecticut, Delaware, New Jersey, New York,[4] Oregon, and Wisconsin. Figure 3 highlights major changes that states enacted in their personal income tax.

Eight of the 11 states increased taxes primarily on high-income taxpayers, with new brackets and/or higher rates at upper income levels. Maryland enacted a similar increase, although the changes amounted to less than 1 percent of total tax revenue. Only one state, California, raised rates on all levels of income.

Nine of the 11 states increased revenue from their income tax by reducing certain exclusions, such as preferential treatment of capital gains, or limiting the amount of deductions that taxpayers can claim.

A large share of the revenue from these tax increases for the 11 states that enacted significant increases is scheduled to expire by December 30, 2011. Temporary tax increases account for $10 billion out of the $11.4 billion raised by these states. For example, New Jersey’s high-income brackets were in place for just one tax year, while the increases in California and North Carolina were enacted for two years, expiring in January 2011. Oregon’s measure raising the top rates will lower them beginning in tax year 2012, though not all the way to the 2008 level. The high-income brackets in Connecticut and Wisconsin are not scheduled to expire.

Several of these states provided some targeted income tax reductions as part of a larger tax increase. New Jersey continued phasing in an increase of the earned income tax credit that began in 2007. Wisconsin created a deduction for high health insurance premiums, excluded retirement income from taxable income, and expanded the state’s property tax credit.

States that reduced their income taxes in 2008 and 2009 include Georgia, Louisiana, Michigan, Missouri, and New Mexico. Some of the changes that were enacted, such as expanding the earned income tax credit in Michigan, reduced the taxes on lower-income taxpayers. In Ohio, the final installment of a phased-in income tax cut had been scheduled to take effect this year. However, in late December, the governor and legislature agreed to postpone it for two years.

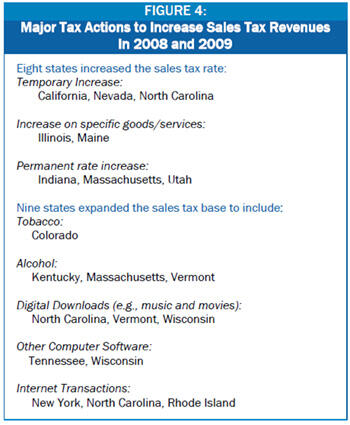

Sales Taxes

Among the states that had significant increases, the largest increases as a share of tax revenue were in California, Indiana, Massachusetts, Nevada, and North Carolina. Each of these states, except Nevada, raised the general sales tax rate by one cent or more. Nevada increased the rate by about one-third of a cent (0.35 percentage points). As with the personal income tax increases, these sales tax increases are mostly temporary. They are scheduled to expire in June 2011 in California, Nevada, and North Carolina; they are permanent only in Indiana and Massachusetts.[5]

States also broadened their sales tax bases. Three states did so by extending the tax to items previously subject only to an excise tax: alcoholic beverages in Kentucky and Massachusetts, and tobacco products in Colorado. Other states, including North Carolina and Wisconsin, extended the tax to cover digital downloads from the Internet, such as music and movies. Of these measures, only Colorado’s expansion is temporary.

Other states extended sales tax to transactions that, although already legally taxable, often go untaxed. New York, North Carolina, and Rhode Island, for example, extended the obligation to collect sales tax to include certain out-of-state online retailers. [6]

While most of the sales tax increases of the past two years occurred in 2009, most of the reductions were quite small and occurred in 2008. They were aimed mostly at exempting certain goods and services used in manufacturing, with the largest such reduction enacted in Louisiana. Two states, Arkansas and West Virginia, reduced sales taxes on groceries.

A concern about sales tax increases is that they are regressive, meaning that low- and moderate-income families pay more as a share of their income than higher-income families. Two states that raised sales tax rates, Indiana and North Carolina, mitigated the regressive impact by increasing the earned income tax credit for low-income families.

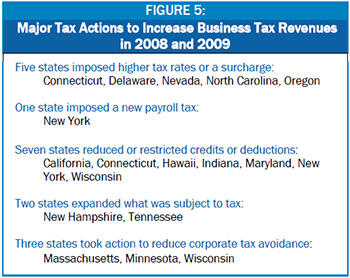

Business Taxes

States that increased taxes significantly (i.e., by more than 1 percent of the prior year’s revenues) increased business taxes by $4 billion. New York accounted for $1.9 billion of that amount, including $1.5 billion from a new tax on business payrolls to support public transportation in the New York City metropolitan area. (New York also reformed some tax credits and extended various business taxes to some additional firms.)

Business tax rates were increased in Nevada (which raised the rate on its business payroll tax on larger companies while lowering it on smaller ones), Delaware, and Oregon. The increase expires in Delaware after 2013 and in Nevada midway through 2011; the increase in Oregon is partially rolled back after 2012.

Connecticut imposed a surcharge on larger firms, which will expire in 2011. North Carolina likewise imposed a surcharge on its corporate taxpayers, but the state also expanded business tax credits, which more than offset the revenue increase.

Massachusetts and Wisconsin adopted combined reporting, which in effect treats a parent corporation and its subsidiaries as a single entity for state income tax purposes.[7] In Massachusetts,

combined reporting more than offset the revenue loss from a reduction in the corporate income tax rate in the initial years.

Other states revised various business tax subsidy programs. Hawaii and Wisconsin anticipate additional business revenues from adjustments they made in their subsidy or tax credit programs. California generated revenues by restricting businesses’ ability to offset income with prior-year losses and by limiting businesses’ use of tax credits, but since these limitations were in place only for 2008 and 2009, they increased revenues only modestly. [8]

Many of the 17 states that reduced business taxes instituted new credits or expanded existing credits. Michigan initiated one of the larger new programs, with the purpose of encouraging development of new technologies to benefit hybrid car production. Along with Georgia and Utah, Michigan also put in place credits to encourage the making of movies and television shows in-state.

Excise Taxes

In 22 states, excise taxes on tobacco, motor fuel, or alcohol were raised in 2008 or 2009. The total new revenue from excise tax changes is $3.0 billion — over 9 percent of newly enacted taxes. Only one state made minor reductions in these taxes.

Almost three-quarters of the total revenue increase from excise taxes occurred in 2009. More than 80 percent ($2.5 billion) came from increases in tobacco taxes in 20 states. In all but two of these states, excise taxes were part of broader packages to increase taxes.

Other Taxes and Fees

In addition to the taxes discussed above, states impose numerous other, smaller taxes, such as excise taxes on restaurant meals and hotel rooms and tax-like fees, especially on motor vehicle registration

and licensing. During 2008 and 2009, 24 states increased a number of these types of taxes and fees. Net increases in these 24 states (minus net reductions in three other states) raised $6.1 billion, or 20 percent of the net revenues generated by all state measures.

Three states raised particularly large amounts of new revenues from such “other” taxes and fees — Colorado, Florida, and Nevada. These include transportation-related fees in Colorado, a variety of license fees on businesses and motor vehicles in Florida, and hotel taxes and other items in Nevada.

What Tax Actions Will States Take in 2010 and Beyond?

State Tax Actions Have Not Yet Been as Great as in Some Past Recessions

Similarly, in response to the 2001 recession, more than 30 states enacted significant revenue increases, with 15 increasing revenues by 5 percent or more. The tax increases occurred over three years and raised overall state revenues by 3.5 percent.

During each of these periods, states increased a range of taxes — personal income, corporate income and other business taxes, sales and excise taxes, as well as fees and other miscellaneous taxes.

The current recession has led to greater tax increases than occurred in response to the 2001 recession, but has not yet led to tax increases as great as those in response to the recession of the early 1990s. In 2008 and 2009, as noted above, 20 states have already raised their revenues significantly, with overall increases in revenues totaling 3.8 percent. Experience suggests that states are likely to continue raising revenues for several years after the recession has technically ended.

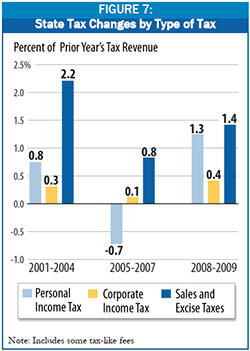

The tax increases of 2008 and 2009 include more revenue from personal income taxes, and less from consumption taxes, than those enacted in response to the 2001 recession. (See Figure 7.) However, as noted above, many of these personal income tax measures are slated to expire soon — while sales and excise tax increases are more likely to be permanent. A lasting impact of this recession, therefore, could be increased state reliance on consumption taxes.

Without Additional Tax Actions, States May Resort To Excessive, Economically Harmful Cuts to Services

The impact on state budgets of the current recession has been much greater than in previous downturns. States are facing the steepest decline in tax receipts on record, and state budget shortfalls in the first years of this downturn have been far larger than those caused by the 2001 recession. Moreover, in two-thirds (35) of the states, new budget gaps have developed for the current fiscal year since they adopted their budgets. [9] Nationally, projected shortfalls for 2010 and 2011 are even larger than the shortfalls states faced in 2008 and 2009, and are not likely to ease much even in 2012. To make matters worse, the recession has also increased the need for public services that states provide, as residents lose jobs, income, and health insurance.

Every state except Vermont is required to balance its operating budget each year or biennium (for states that operate under a two-year budget period). Unlike the federal government, states cannot maintain services during an economic downturn by running a deficit. Their options to balance their budgets are limited. After drawing down reserves, states face choices that involve reducing spending and increasing revenues.

harm vulnerable residents but also worsen the recession by reducing overall economic activity. When states cut spending, they lay off employees, cancel contracts with vendors, reduce payments to businesses and nonprofits that provide services, and cut benefit payments to individuals. All of these steps remove demand from the economy, which is particularly harmful during a recession when the private sector is faltering.

States were able to avoid even larger spending cuts (particularly in health care and education) and tax increases by using federal recovery funds. The federal assistance to states provided in the American Recovery and Reinvestment Act is closing an estimated 30 to 40 percent of state budget gaps. But this state fiscal relief — primarily for Medicaid — is scheduled to expire by December 2010, and funds for fiscal stabilization will be mostly drawn down by then as well. However, large budget shortfalls will remain.

| Table 1: | ||

| Indicator | States That Increased | States Without Significant |

| Personal Income | 6.0% | 6.2% |

| Employment | 1.6% | 1.8% |

| Median Wage | 3.1% | 3.1% |

| Source: Bureau of Labor Statistics, Bureau of Economic Analysis, and CBPP calculations of data from the NCSL and state revenue departments. Note: States were grouped according to the amount of gross tax increases between 2002 and 2004, excluding Colorado. States that | ||

The Economic Consequences of Raising Taxes

For states short of revenue to meet public needs, tax increases — particularly on higher-income households — can lessen reliance on spending cuts of a magnitude that would harm vulnerable residents and threaten economic performance. Like spending cuts, tax increases remove some demand from the economy by reducing the amount of money people have to spend. But as Nobel prize-winning MIT economist Joseph Stiglitz and Peter Orszag (then a Brookings Institution economist and now the director of the Office of Management and Budget) explained in a 2001 analysis, tax increases can be less detrimental to state economies than budget cuts because some of the additional tax payments will be made from savings rather than from money that would otherwise be spent. Since higher-income families tend to save more of their income than less-affluent families, tax increases on them are the least damaging approach. [10]

It is sometimes argued that raising taxes will slow the rate of states’ economic recovery. Available data do not appear to support this argument. Tax measures that states used to help balance budgets during the 2002-04 period appear to have had no adverse effect on states’ economies. When compared on major measures of economic progress, states that raised taxes performed at roughly the same level as states that did not. Table 1 compares the 29 states that raised taxes during the 2002-04 period with those that did not. It shows that during the subsequent period of economic recovery — from 2004 through 2007 — the states that raised taxes fared about as well as those that didn’t. In short, neither economic theory, nor recent history, support allowing a fear of weakened economic growth to affect the decision of whether or not to raise taxes.

Some states that have raised taxes during the current recession still face large projected shortfalls, in part because their tax increases were only temporary. For those states whose tax increases are to expire before the states fully recover, extending the temporary measures would provide much-needed revenue. Several other states are now facing increased budgetary pressures in part because they reduced taxes during the past two years. For states scheduled to carry out previously enacted tax reductions, such as New Mexico, postponing those reductions would likely be less detrimental to the state’s economy — and to vulnerable residents — than the deeper spending cuts that would occur if revenues were not retained.

Conclusion

Since the beginning of the most severe national recession since the Great Depression, states have experienced an unprecedented decline in revenues while having to address increased public needs stemming from rising unemployment. The budget gaps states have faced the past two years have been greater than the shortfalls reported during all four years of the prior recession.

To close the budget gaps created by this recession, at least 42 states cut spending the past two years; 33 raised revenues. For 20 of these states, the revenue increases were significant, equivalent to at least 1 percent of their total revenues. All types of taxes — personal income, sales, business, and excise taxes and a wide variety of fees — were increased.

Budget shortfalls are likely to continue at least over the next two years and could be as large as the gaps in the past two. Two-thirds of the states are facing midyear deficits for fiscal 2010 and 38 already have addressed or are facing budget gaps in 2011. As revenue forecasts continue to be bleak, additional shortfalls may develop.

The availability of federal recovery assistance over the past two years lessened the need for states to make cuts or raise taxes. However, as matters stand, federal aid is not likely to be available after December 2010, at least not in the manner provided under the American Recovery and Reinvestment Act. States will then have to address these large budget shortfalls with measures that include deeper spending cuts and more increases in taxes.

The tax actions that states have taken during the past two years may provide the basis for further measures. Tax increases adopted as temporary can be extended. Tax reductions already adopted can be postponed or rolled back. Expanding the sales tax to more services and to Internet sales would add to revenues not only during this period of recovery but also as states’ economies continue to grow.

This recession has had such a profound impact on state budgets that the solution cannot be just to make more spending cuts. The effects of doing so on people in need and on states’ economies would jeopardize recovery. Rather, a balanced approach that includes revenues is the prudent course for states to take.

APPENDIX 1: Details of Major Tax Increases Enacted in 2008 and 2009 for States that Increased Taxes, by Tax Type

Personal Income Taxes

- In 2009, California enacted a temporary 0.25 percentage point increase in each of the state’s income tax brackets, effective for tax years 2009 and 2010. A tax credit for dependents was also temporarily reduced. Income tax measures are expected to increase tax revenues by more than $5 billion in the coming fiscal year.

- Colorado ended taxpayers’ ability to deduct capital gains income derived from assets or businesses located within the state. This change will generate about $15.8 million per year in new income tax revenues.

- In 2009, Connecticut enacted permanent changes to its brackets and rates. A new top bracket starts at $500,000 for single filers, $800,000 for heads of households, and $1 million for married couples filing jointly. The tax rate on incomes above those thresholds increased to 6.5 percent from 5 percent and will take effect for tax year 2009. This change is estimated to raise $400 million.

- Delaware temporarily increased the top marginal tax rate by one percentage point to 6.95 percent on income over $60,000. This change will generate about $70 million in new revenues in 2010. Also, Delaware eliminated an exemption from taxes for lottery winnings.

- Hawaii adopted a measure temporarily creating three new state income tax brackets. Beginning in tax year 2009, for married couples the rates will be 9 percent on income between $300,000 and $350,000, 10 percent between $350,000 and $400,000, and 11 percent above $400,000. The previous top tax rate was 8.25 percent on all income over $96,000. These changes are expected to increase tax revenues by nearly $100 million during the fiscal 2009-2011 biennium and are set to expire after tax year 2015. The state raised the standard deduction and the personal exemption by 10 percent, which will lower tax bills for low- and moderate-income families. However, these increases will not apply until 2011.

- In Maryland, a new top rate of 6.25 percent took effect in 2008 on income greater than $1 million, regardless of filing status. The increase is scheduled to expire after three years. Maryland also added three new rates ranging from 5 to 5.5 percent, with no expiration date, on income from $150,000 to $1 million for single filers and $200,000 to $1 million for joint filers. This is estimated to raise $113 million.

- New Jersey increased income taxes on households with incomes above $400,000. For one year, the tax rate on joint filers with incomes between $400,000 and $500,000 will rise to 8 percent from 6.37; the rate on income between $500,000 and $1 million will increase to 10.25 percent from 8.97 percent; and a 10.75 percent rate will apply to income over $1 million. These changes will generate about $1 billion in fiscal 2010. Additionally, New Jersey will tax lottery winnings over $10,000 beginning in 2009. This action is estimated to increase revenues by $8 million.

- In 2009, New York enacted two new temporary income tax rates for the highest-income filers. For households with taxable income above $500,000, regardless of filing status, the tax rate rises to 8.97 percent from 6.85 percent; for those with taxable income below $500,000 but above $200,000 for single individuals, $250,000 for heads of households, and $300,000 for married couples filing joint returns, the rate increases to 7.85 percent from 6.85 percent. These rates are in effect for three years.

- In addition, New York placed limits on itemized state income tax deductions for taxpayers making over $1 million and reduced a state-funded credit on New York City’s personal income tax. The changes are projected to raise more than $4 billion a year.

- In 2009, North Carolina placed a temporary surcharge on upper-income taxpayers, effective for tax years 2009 and 2010. This surcharge is added to the filer’s tax liability. Married filers with income over $250,000 and single filers with income over $150,000 calculate their tax under previously existing law and then increase it by 3 percent. For married filers with income between $100,000 and $250,000, and single filers with income between $60,000 and $150,000, the surcharge is 2 percent. This is estimated to raise revenues by $177 million in 2009.

- Oregon enacted a measure adding two brackets at the top of the state’s income tax structure. Married couples will pay 10.8 percent on income between $250,000 and $500,000 and 11 percent on income over $500,000. These rates will be in effect through 2011. After 2011, the top rate will fall to 9.9 percent for joint filers with income over $250,000. These changes are projected to generate more than $230 million in each of the next two fiscal years. Oregon’s previous top rate was 9 percent on all income over $15,200. These measures were approved by the voters in January 2010.

- Rhode Island enacted legislation that will treat capital gains income as ordinary income for tax purposes regardless of how long an asset has been held. Previously, capital gains were given preferential treatment. It is expected to generate $23.6 million in the current year. At the same time, the state expanded personal income tax credits and continued to phase in an optional flat tax, which offset the revenue increase.

- Vermont enacted a budget that includes several major changes to the state’s income tax structure. Although all income tax rates were lowered, net revenue will increase. The package eliminated a 40 percent exemption on capital gains income, replacing it with a flat exemption of $2,500. This new exemption will rise to $5,000 beginning in tax year 2011. Lawmakers capped the amount of state and local income taxes that can be deducted from federal adjusted gross income at $5,000. On net, income tax provisions in Vermont will raise $9 million in new revenue in fiscal year 2010.

- Wisconsin enacted a new 7.75 percent income tax bracket on all income over $300,000 for married couples and $225,000 for individuals and heads of households. The exclusion for capital gains income was lowered to 30 percent from 60 percent. These changes will generate about $280 million in fiscal year 2010.

Sales Taxes

- California enacted a temporary 1 percentage point increase in the sales tax rate for two years. It is expected to generate about $4.5 billion in fiscal year 2010.

- The Colorado legislature temporarily extended the sales tax to the sale of tobacco products, which is estimated to raise $32 million in the coming fiscal year.

- In Delaware, the public utilities gross receipts tax was extended to include direct-to-home satellite services, for a revenue increase of almost $8 million.

- Illinois began taxing soda, energy drinks, certain candies, and personal hygiene products at 6.25 percent rather than the food tax rate of 1 percent. This is estimated to raise about $100 million.

- Indiana increased the sales tax rate to 7 percent from 6 percent for a revenue increase of almost $1 billion.

- Kentucky extended the state’s sales tax to include alcoholic beverages. The change will generate about $52 million each year.

- Maine expanded the sales tax to include amusement parks and sporting events and a range of maintenance and service transactions, including auto repair and dry cleaning. The meals and lodging tax was also increased to 8.5 percent from 7 percent. (The package also replaced the state’s graduated income tax structure with a flat 6.5 percent rate plus a 0.35 percentage point surcharge on income over $250,000.) In total, compared to current law, tax revenues were expected to be modestly higher in fiscal year 2010 as a result of these changes. The implementation of the reform package has been delayed, pending voter approval in June 2010.

- Massachusetts raised about $900 million in fiscal year 2010 by increasing the sales tax rate by 1.25 percentage points to 6.25 percent. The exemption on alcoholic beverages was eliminated, generating about $95 million in new revenues this year.

- In Nevada, the sales tax rate was temporarily increased to 6.85 percent from 6.5 percent. This change will raise revenues by $280 million over the next two years.

- New York raised sales tax revenues by about $73 million by taxing a broader range of companies previously selling tax-free over the Internet, and by an additional $23 million by taxing certain types of transportation services like limousine and car hires.

- North Carolina expanded the sales tax base to cover goods purchased over the Internet and temporarily increased the sales tax rate by 1 percent, for a net increase of almost $1.1 billion.

- Rhode Island enacted legislation requiring certain companies to collect sales taxes on goods purchased over the Internet, estimated to raise $3 million.

- Tennessee extended the sales tax to include software maintenance contracts and limited a sales tax exemption on computer software. These changes will generate about $10.5 million per year in new revenues.

- In 2008, the Utah legislature increased the sales tax rate to 4.7 percent from 4.65 percent.

- Vermont extended the sales tax to include liquor and digital downloads, for a revenue increase of around $3 million.

- Wisconsin entered the multi-state Streamlined Sales and Use Tax Agreement (SSUTA) — a compact that simplifies sales tax collections for participating businesses. The state also altered its method for taxing prewritten computer software and expanded the sales tax to include digital products, such as music and video downloads and subscriptions to online periodicals. Sales tax revenues will rise by over $30 million in fiscal year 2010 as a result of these actions.

Business Taxes

- California temporarily suspended the net operating loss deduction in 2008, a suspension which began phasing out in 2009; the state had a net increase of over $600 million over the two-year period. Starting in 2010, California will permit net operating losses to be applied to prior years, as is permitted under federal law. Also, the losses may be among the various subsidiary corporations within the unitary corporate group or family under the state’s combined reporting rules, thus resulting in a revenue loss in future years.

- Connecticut imposed a 10 percent surcharge for companies that make at least $100 million and pay at least $250 in taxes. This increase expires after three years. While Connecticut permits combined reporting on a voluntary basis, the state imposes a “preference tax” on companies that so elect. In 2009, Connecticut doubled the maximum preference tax. Along with other smaller changes, Connecticut will have a net increase of about $84 million in 2010.

- Delaware temporarily increased the maximum corporate franchise tax to $180,000 from $165,000, raised the gross receipts tax, and increased various smaller taxes and fees.

- Hawaii temporarily capped the use of various economic development credits for a $75 million revenue increase.

- Indiana capped the Media Production Expenditure Income Tax Credit for a revenue increase of nearly $10 million in fiscal year 2009.

- Maryland tightened the cap on corporate income tax credits for mined coal, which will increase business tax revenues by $5 million in fiscal 2010.

- Massachusetts instituted combined reporting in 2008, along with a phasing-in of corporate income tax rate reductions. These measures led to a net revenue increase of $390 million over the initial two years.

- Minnesota changed the rules surrounding foreign operating corporation, raising $76 million in 2008.

- Nevada temporarily altered its business payroll tax, generating $346 million in new revenue in the fiscal 2010-2011 biennium. For non-financial businesses, the tax rate on the first $250,000 in payroll is lowered to 0.5 percent from the flat rate of 0.63 percent. The tax rate on payroll over $250,000 rises to 1.17 percent.

- In New Hampshire, the interest and dividends tax was extended to include profits of limited liability companies and other types of entities. The state’s business profits tax filing threshold was changed; all businesses, regardless of their income level, are now required to file a return. These changes will increase business tax revenues by about $21 million each year.

- New York imposed a new payroll tax to support public transportation in the New York City metropolitan area, which is expected to generate $1.5 billion. In addition, the state reformed some tax credits and made a small expansion of firms covered by various business taxes. These changes are expected to generate an additional $400 million.

- North Carolina imposed a temporary surcharge on corporate taxpayers, but also expanded business tax credits, which offset the revenue increase.

- Oregon increased the corporate income tax rate for corporations with taxable income above $250,000 to 7.9 from 6.6 percent. This rate will be in effect for 2009 and 2010. It is then slated to fall by 1 percent for 2011 and 2012. After 2012, the higher rate will be applied only to taxable income over $10 million. The minimum corporate income tax was increased, depending on the amount of sales in Oregon. For a firm with more than $100 million in Oregon sales, the minimum tax is now $100,000; previously, the minimum tax was $10. These changes will increase business tax revenues by more than $200 million in the fiscal 2010-2011 biennium.

- In Rhode Island, the gross premiums tax on health insurance providers was extended to include previously excluded insurers and rates were increased in both years. The revenue increase is estimated to be $24.4 million annually.

- Tennessee increased franchise and excise tax revenues by eliminating an exemption on rental income earned by certain non-corporate businesses. This change increased revenues by more than $25 million per year.

- Wisconsin instituted “combined reporting,” which requires companies with subsidiaries to calculate their profits as one sum instead of allowing various entities to report separately. One result is that in-state and multi-state corporations will be taxed more equivalently. Under combined reporting, corporate income tax revenues will increase by over $90 million per year. The state also generated about $45 million per year in new tax revenues by adopting a “throwback rule,” which ensures that profits made in a state in which a corporation may be exempt from income tax are taxed instead by the corporation’s home state.

Motor Vehicle, Tobacco, and Alcohol Excise Taxes

- Arkansas raised the cigarette tax by 56 cents to $1.15 per pack. The tax on other tobacco products was increased to 68 percent of the wholesale price, from 32 percent. These changes are expected to generate over $70 million per year in new tax revenue.

- California made changes regarding the classification of malt beverages for a $38 million revenue increase.

- Connecticut added a dollar per pack to the cigarette tax, for an increase of nearly $100 million.

- Delaware increased the tax on cigarettes to $1.60 from $1.15 per pack. This is expected to generate $17.5 million.

- Florida enacted legislation adding a $1 surcharge to the tax on each pack of cigarettes. A surcharge equal to 60 percent of the wholesale price also was imposed on other tobacco products. These surcharges will increase tax revenues by $959 million in the coming fiscal year.

- Hawaii increased the cigarette tax by 2 cents per pack. The state also increased taxes on other tobacco products by various levels. Depending on the product, taxes on tobacco other than cigarettes will range up to 70 percent of wholesale price; the previous rate was 40 percent of the wholesale price. These changes will increase tax revenues by nearly $50 million in the upcoming fiscal 2010-2011 biennium.

- Idaho removed an exemption valued at 0.0401 cents per gallon on motor fuels blended with ethanol. This is estimated to raise $16 million in new revenues each year.

- Kentucky doubled its cigarette tax to 60 cents per pack from 30 cents, which will raise more than $106 million a year.

- Maine changed its method for calculating the tax on smokeless tobacco. Beginning in fiscal year 2010, taxes on smokeless tobacco will be based on weight, at a rate of $2.02 per ounce, for a revenue increase of about $2 million.

- Massachusetts added a dollar per pack to the cigarette tax for a revenue increase of $175 million.

- Minnesota instituted a two-step gas tax increase in 2008, for $157 million in increased revenue. Motor vehicle registration taxes were also raised for an additional $64 million.

- Mississippi increased the cigarette tax to 68 cents per pack from 18 cents, which is expected to raise more than $100 million in fiscal 2010.

- Montana eliminated its preferential tax treatment of ethanol, for an increase of $6 million.

- New Hampshire increased the cigarette tax to $1.78 from $1.33 per pack — a change that will increase revenues by $35.2 million in fiscal year 2010. In 2008, New Hampshire added 25 cents per pack to the cigarette tax for an additional $18 million.

- New Jersey increased the cigarette tax by 12.5 cents to $2.70 per pack and increased the tax on alcoholic beverages, excluding beer, by 25 percent. These changes will generate about $50 million in new tax revenues in fiscal year 2010.

- New York increased the cigarette tax in 2008 to $2.75 from $1.50, for a revenue increase of nearly $300 million. New York raised an additional $14 million in 2009 by increasing the state excise tax on beer and wine to 30 cents per gallon from 18.9 cents. The state also changed the method for taxing cigars to generate about $10 million in fiscal year 2010.

- North Carolina increased the excise tax on tobacco by 45 cents a pack and the excise taxes on beer, wine, and liquor by various rates, for a total increase of $94 million in 2011.

- Oregon added temporary surcharges of 50 cents on distilled liquor and 25 cents on miniature bottles through June 2011, increasing revenues by about $24 million for the biennium.

- Rhode Island increased its cigarette tax by $1 to $3.46 per pack. Rhode Island also added 2 cents to the gas tax for a $13 million increase.

- Vermont increased the cigarette tax by 25 cents, to $2.24 per pack from $1.99. The tax on other tobacco products was increased to 92 percent of wholesale price, from 41 percent. These changes will increase tax revenues by about $6 million.

- Wisconsin increased the cigarette tax by 75 cents to $2.52 per pack and changed the method of taxing moist snuff. These changes will increase revenues by about $170 million each year.

- Wyoming changed its method for taxing moist snuff tobacco, basing it on net weight. This is expected to generate about $820,000 in new tax revenues each year.

Other Taxes and Fees

- Arkansas changed the way the severance tax on natural gas is calculated, to be phased in over four years, for a revenue increase of $74 million in fiscal year 2009.

- California temporarily increased vehicle license fees to 1.15 percent of the vehicle’s value from 0.65 percent, raising about $1.7 billion in new revenues each year in fiscal years 2010 and 2011.

- Colorado raised several fees, fines, and surcharges to support transportation improvements and instituted a $2 per day rental car fee. These changes will generate about $250 million in new state revenues in fiscal year 2010 within the Transportation Fund. Additionally, a motor vehicle fee to support local emergency services was increased to $2 from $1.

- Connecticut increased environmental fees and placed a conveyance tax on foreclosed properties, for an increase of almost $90 million.

- Delaware temporarily reinstated the estate tax.

- Florida increased a variety of fees and licenses, including court- and vehicle-related licenses and fees, raising around $1 billion in new revenues each year.

- Hawaii temporarily increased the motel room tax by 1 percentage point to 9.25 percent. Hawaii also increased the conveyance tax on purchase of large properties and second homes.

- Idaho added fees for driver’s licenses, vehicle title transfers, copying records, and replacing registration stickers. These changes will generate about $23 million in new revenues beginning in fiscal year 2010.

- Maine raised various fees, including vehicle registration fees, for an increase of over $10 million.

- Massachusetts imposed a 5 percent excise tax on satellite broadcast services. This will increase revenues by nearly $26 million in fiscal year 2010. Additionally, Massachusetts increased driver’s license and vehicle registration fees for an $82 million increase in fiscal year 2010.

- Minnesota increased various vehicle related fees and court fees, one of which is temporary, for a revenue increase of over $15 million.

- Nevada temporarily increased the business license fee to $200 from $100 for a $31 million revenue increase. An increase in the hotel tax is expected to raise $110 million.

- New Hampshire increased the excise tax on hotels and meals to 9 percent from 8 percent and extended the tax to campsites, which will increase revenues by about $30 million per year. By temporarily increasing a number of fees related to motor vehicle and trailer registrations, New Hampshire will increase revenues by more than $40 million in fiscal years 2010 and 2011. The state also enacted a new tax on gambling winnings to raise about $8 million a year. Fees charged to insurance agents for obtaining vehicle records were increased, along with fees for vanity license plates. These changes will generate about $5 million per year in new revenues.

- New York increased a variety of fees, including the regulatory fee on public utilities for over $550 million and motor vehicle fees for over $100 million. The state also imposed additional vehicle fees to fund the Metropolitan Transportation Authority.

- Oregon increased the excise tax on gasoline by 6 cents to 30 cents per gallon and raised a range of fees — including on motor vehicle registrations and titles, road assessment, identification cards, and other items. These changes will increase revenues by $290 million in the fiscal 2009-2011 biennium.

- Rhode Island expanded the hours of the video lottery and increased vehicle license fees, raising almost $20 million in revenue.

- Utah increased some motor vehicle fees by $20, which will generate about $53 million per year.

- Vermont increased various fees for a revenue impact of $6 million.

- Wisconsin increased a variety of fees, including fees on securities trading and solid waste disposal, for a total increase of over $100 million.

- Wyoming raised vehicle fees for a revenue increase of nearly $4 million.

APPENDIX 2: Major 2009 Revenue Packages

Many states enacted a combination of measures to help close their fiscal gap in 2009. Some states both increased and decreased major taxes; others increased a series of taxes. The following table summarizes the various provisions from states that enacted revenue changes with a significant effect on state revenues.

| Major 2009 Tax Packages | |||

| Personal Income | Corporate Income | Sales and Excise | Other |

| California | |||

| Increase rate by 0.25%, expiring 12/31/2010 | Enact job creation credit* | Increase sales tax rate by 1%, expiring 6/30/2011 | Increase in vehicle license fees, expiring 6/30/2011 |

| Reduce tax credit for dependent temporarily, expiring 12/31/2010 | |||

| Enact credit for buying new homes* | |||

| Colorado | |||

| Eliminate capital gains deduction | Enact job creation credit* | Extend sales tax to tobacco products, expiring 6/30/2011 | Increase various fees, including vehicle registration |

| Connecticut | |||

| Create new high-income bracket | Impose surcharge on large companies, expiring 12/31/2011 | Increase cigarette tax | Increase various fees |

| Enact economic nexus standard | Enact economic nexus standard | Increase tax on tobacco products | Impose real estate conveyance tax on foreclosed properties |

| Increase “preference tax” for combined return filers | Increase threshold and reduce rates for estate and gift tax* | ||

| Delaware | |||

| Increase tax on top bracket, expiring 12/31/2013 | Increase maximum corporate franchise tax, expiring 12/31/2013 | Increase cigarette tax | Reinstate estate tax, expiring 6/30/2013 |

| Eliminate exclusion of lottery winnings | Increase rate on gross receipts tax | Extend public utilities gross receipts tax to direct-to-home satellite services. | Legalize sports betting |

| Florida | |||

| Increase cigarette and tobacco products tax | Increase a variety of fees and licenses, including court- and vehicle-related licenses and fees | ||

| Hawaii | |||

| Create new brackets and rates on high income filers, expiring 12/31/2015 | Impose investment tax credit cap, expiring 12/31/2010 | Increase cigarette tax and tobacco products tax | Increase motel room tax, expiring 6/30/2015 |

| Increase conveyance tax on large properties and second-home purchases | |||

| Massachusetts | |||

| Increase sales tax rate by 1.25% | Increase various fees | ||

| Extend sales tax to alcohol | Impose excise tax on satellite broadcast services | ||

| Nevada | |||

| Increase business payroll tax rate for larger firms; lower rate for small business, expiring 6/30/2011 | Increase sales tax rate by 0.35%, expiring 6/30/2011 | Increase hotel tax | |

| Increase car rental tax | |||

| Increase various fees, with business license fees expiring 6/30/2011 | |||

| New Hampshire | |||

| Extend interest and dividends tax to more types of companies | Increase cigarette tax | Increase excise tax on hotels and meals and extend tax to campsites | |

| Impose gambling tax | |||

| Increase various fees | |||

| New Jersey | |||

| Create new bracket and increase rates on upper brackets, expiring 12/31/2009 | Increase cigarette tax | ||

| Tax lottery winnings | Increase tax on alcohol (excluding beer) | ||

| New York | |||

| Create new top brackets and rates, expiring 12/31/2011 | Impose payroll tax in New York City metropolitan area | Tax certain transportation services | Raise tax on car rentals |

| Place limits on itemized deductions | Tax for-profit HMOs | Increase excise tax on beer/wine | Impose utility assessment tax |

| Reduce state-funded property tax credit | Modify tax incentives in development areas | Change method for taxing cigars | Increase various fees and auto insurance surcharge |

| Extend sales tax to Internet purchases | |||

| North Carolina | |||

| Place surcharge on top brackets, expiring 12/31/2010 | Impose tax surcharge, expiring 12/31/2010 | Increase sales tax rate by 1.25%, expiring 6/30/2011 | |

| Increase film tax credit* | Extend sales tax to Internet sales | ||

| Increase excise tax on tobacco and alcohol | |||

| Oregon | |||

| Add two new top income tax brackets, partially expiring 12/31/2011 | Increase corporate income tax rate, partially expiring 12/31/2012 | Impose surcharge on distilled liquor and miniature bottles, expiring 6/30/2011 | |

| Increase minimum corporate income tax | |||

| Rhode Island | |||

| Remove capital gains exemption | Extend sales tax to Internet sales | Expand hours of video lottery | |

| Increase gas tax | Increase various fees | ||

| Increase cigarette tax | |||

| Wisconsin | |||

| Create new top income tax bracket | Institute combined reporting, including adoption of a throwback rule for certain sales | Increase cigarette tax | Increase various fees |

| Lower capital gains exclusion | Adjust film tax credit | Alter method for taxing software | |

| Change method of taxing moist snuff | |||

| Expand sales tax to digital goods | |||

| *This change causes a decrease in revenues. | |||

Appendix 3: Methodological Note

The primary sources for the tax actions and the revenue estimates in this report are state budget proposals, fiscal notes prepared by the states, and adopted legislation. These sources are supplemented with additional information provided by state revenue offices, and other new reports. A major source for the aggregate dollar amounts of tax changes in the years 1990 through 2008 are the annual reports issued by the National Conference of State Legislatures (NCSL) entitled “State Tax Actions” (prior to 1993, “State Budget and Tax Actions”). The dollar totals in this analysis do not equal the total tax changes reported by NCSL in each of the years covered. Adjustments were made for a variety of reasons, as described below.

This report is based on a “taxpayer liability” method and tracks changes as to what taxpayers actually pay. It does not include actions that delay previously enacted tax changes that had not yet taken effect or actions that extend taxes that were scheduled to expire or sunset.

Tax changes are calculated on a full-year impact of the enacted change and are attributed to the fiscal year in which the change takes effect. If a major tax change went into effect partway through a fiscal year, the revenue estimate is based on its full-year impact. If the tax change is scheduled to be phased in over more than one year, the annual increment is allocated to each year of the phase-in.

Sometimes states enact tax changes on a one-time basis or with an expiration date. If the tax change is allowed to expire, this is counted as a tax change, just as if the legislature had acted affirmatively to undo a previously-enacted change. For example, if a state enacts a temporary, two-year rate increase, and if two years later the higher rate is allowed to expire automatically, this is counted in the same way that it would have been if the state had enacted a permanent rate increase and two years later had acted affirmatively to repeal it. The reason is that from the perspective of the taxpayer and of state revenue collections, the effect is the same.

Revenues from tax increases that were enacted with sunset provisions are included as tax increases in the year the increase is first in effect. If a tax increase is allowed to expire, it appears as a tax decreases in the year it sunsets. If the tax is extended beyond the initial expiration date, the extension is not considered a tax increase, as there is no change from the existing tax.

Tax actions include changes to state taxes only. This report generally excludes changes in local taxes even when those changes were mandated or financed at the state level or the state increase is designed to reduce taxes at the local level.

Health care provider taxes are not included in this report.

Not included here are any administrative changes that increase or decrease revenues, such as amnesty programs, increased audit compliance, reduced discounts or fees allowed for distributors or agents. Sales tax holidays also are not counted.

Tax changes are measured against annual revenues from the prior fiscal year, as reported by the U.S. Census Bureau. These revenues are generally broader than states’ general operating funds.

End Notes

[1] Elizabeth McNichol and Nicholas Johnson, “Recession Continues to Batter State Budgets; State Responses Could Slow Recovery,” Center on Budget and Policy Priorities, updated December 23, 2009.

[2] See Nicholas Johnson, “Budget Cuts or Tax Increases at the State Level: Which Is Preferable During a Recession?” Center on Budget and Policy Priorities, updated January 12, 2009.

[3] Appendix 2 contains a description of the tax packages that were enacted by states that increased taxes by 1 percent or more.

[4] Our data for New York’s personal income tax increases exclude a new tax on business payrolls, which is described below under “business taxes” but which is arguably a form of personal income tax because it is ultimately “paid” by workers in the form of lower wages.

[5] Indiana used this sales tax increase to partially offset the cost of a local property tax decrease.

[6] Michael Mazerov, “New York’s “Amazon Law”: An Important Tool for Collecting Taxes Owed on Internet Purchases,” Center on Budget and Policy Priorities, July 23, 2009.

[7] Michael Mazerov, “A Majority of States Have Now Adopted a Key Corporate Tax Reform,” Center on Budget and Policy Priorities, dated July 23, 2009.

[8] For years after 2009, firms may share net operating losses among the various subsidiary corporations within the unitary corporate group or family under the state’s combined reporting rules and also apply the losses to prior years, as is permitted under federal law. This results in a revenue loss in future years.

[9] Elizabeth McNichol and Nicholas Johnson, “Recession Continues to Batter State Budgets; State Responses Could Slow Recovery,” Center on Budget and Policy Priorities, updated December 23, 2009.

[10] See Nicholas Johnson, “Budget Cuts or Tax Increases at the State Level: Which Is Preferable During a Recession?” Center on Budget and Policy Priorities, updated January 12, 2009.

More from the Authors