BEYOND THE NUMBERS

The widespread drop in state support for schools over the past decade — which we’ve documented in our new report — reflects outside factors, such as weak revenues and rising costs, as well as state policy choices, such as relying on spending cuts to close budget shortfalls and cutting taxes.

- State revenues have recovered slowly from the recession. Unemployment doubled between 2007 and 2010 and the economy’s recovery since then has been slow. Median household income fell by $2,228 between 2007 and 2015, adjusted for inflation. Plus, housing values plummeted and remain below their pre-recession peak in some parts of the country, leaving many homeowners more cautious about drawing on home equity to make large purchases. As a result, states’ income and sales tax revenues ― their main revenue sources for education and other services ― were hit hard. State revenues have improved lately but not enough to keep pace with needs; they are only about 6.6 percent above pre-recession levels, after adjusting for inflation.

- States relied heavily on spending cuts after the recession hit. States disproportionately relied on spending cuts to close their large budget shortfalls, rather than a balanced mix of spending cuts and revenues. Between fiscal years 2008 and 2012, states closed 45 percent of their budget gaps through spending cuts and only 16 percent through taxes and fees. (They closed the rest with federal aid, reserves, and other measures.)

- Federal aid to states has fallen. States used emergency fiscal relief from the federal government to cover a large share of their shortfalls through 2011. After 2011, federal policymakers largely allowed this aid to expire, even though states faced large shortfalls in 2012 and beyond.

Federal policymakers also cut ongoing funding for states and localities. Federal spending for Title I — the major federal assistance program for high-poverty schools — is down 8.3 percent since 2010, after adjusting for inflation. Federal spending on education for disabled students is down 6.4 percent.

-

Costs are rising. Costs of state-funded services have risen since the recession due to inflation, demographic changes, and rising needs. For example, there are about 1.1 million more K-12 students and 1.5 million more public college and university students now than in 2008, the U.S. Department of Education estimates.

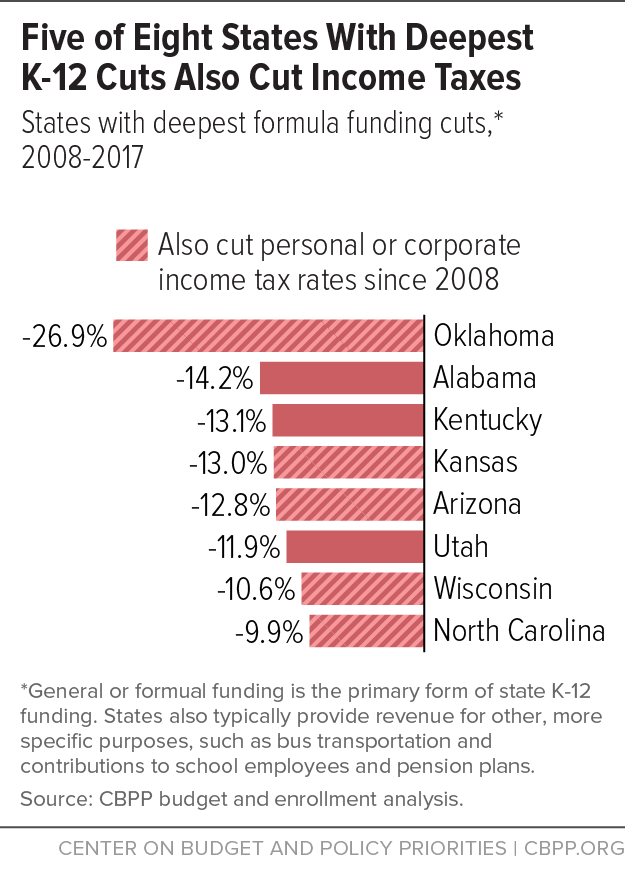

- Some states cut taxes deeply. Not only did many states avoid raising revenue after the recession hit, but some enacted large tax cuts, further reducing revenues. Five of the eight states with the biggest cuts in general school funding since 2008 ― Arizona, Kansas, North Carolina, Oklahoma, and Wisconsin ― also cut income tax rates in recent years. (See graph.)