BEYOND THE NUMBERS

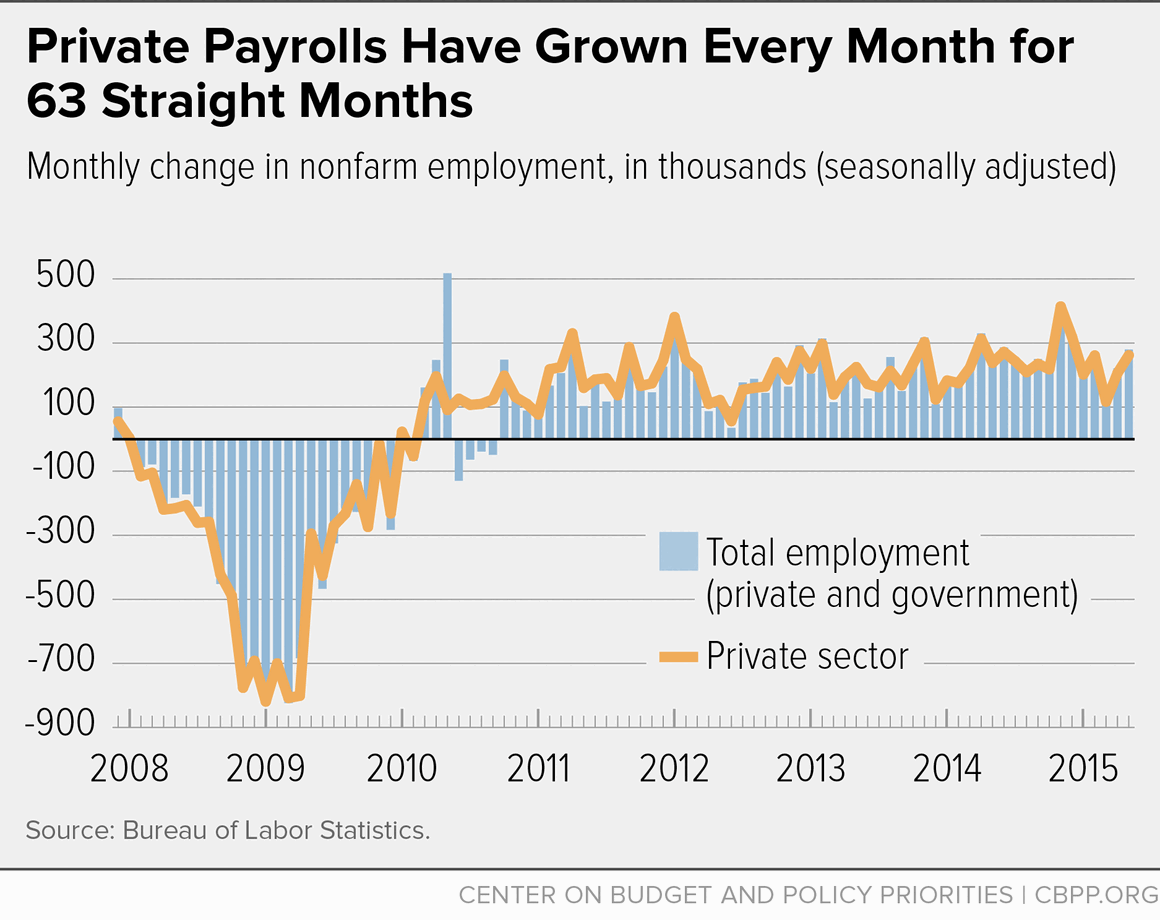

Tomorrow’s monthly jobs report will likely show that private employers added jobs in June for the 64th straight month (see chart) but that unemployment remains above 5 percent, its rate at the December 2007 start of the Great Recession. Here are some key facts to put the headline numbers in perspective.

Payroll employment growth. Private and government employers together have added about 250,000 jobs a month over the past 12 months. Private forecasters generally expect that they added more than 200,000 jobs in June. Sustained payroll growth in that range lowers unemployment, since fewer than 100,000 jobs a month are needed merely to keep pace with population growth. A job-growth figure for June of more than 250,000 or less than 150,000 would be notable, but one month’s data don’t say much about the underlying trend. (The employer survey used to estimate payroll employment growth has a margin of error of plus or minus 105,000 jobs.)

Unemployment and underemployment. The unemployment rate of 5.5 percent in May was down from 6.3 percent a year earlier. It has changed little in recent months, however, and it’s expected to remain around 5.5 percent in June. Anything above 5.6 percent or below 5.3 percent would be notable.

It’s important to look at the unemployment rate in conjunction with the labor force participation rate (the share of the population ages 16 and over working or actively looking for work). Labor force participation fell as job opportunities dried up in the Great Recession and continued to fall until about a year ago. It’s been essentially flat since then, as many people who’d like to work aren’t looking because they don’t think jobs are available.

A drop in unemployment together with a rise in labor force participation in June would be the best sign of an improving labor market. It would mean that more people have the confidence to look for work and more people are finding jobs. The converse — a rise in unemployment and decline in labor force participation — would be unwelcome, but fortunately is unlikely.

Underemployment (people who want to be working full-time but can only find part-time jobs) also rose sharply in the Great Recession. It’s been declining but still remains high. The Labor Department’s U-6 unemployment rate, which takes into account people who want to be working but aren’t actively looking and people working part-time when they want to be working full-time, was 10.8 percent in May, nearly twice the official unemployment rate.

Wages. Despite significant increases in payroll employment and declines in unemployment, there are only glimmering signs that workers’ wages may start to rise. For some time, average hourly earnings have risen at roughly 2 percent a year — only a bit more than inflation. Faster growth would be a sign that the benefits of the recovery are spreading more widely.

Note: CBPP will no longer issue a jobs statement or “Today’s Jobs Report in Pictures” blog post on the morning of the jobs report. Instead, look for me on Twitter @ChadCBPP in the morning and check out our chart book on the legacy of the Great Recession for a historical perspective on the monthly report.