BEYOND THE NUMBERS

When Speaker Paul Ryan releases the House GOP tax plan tomorrow, a key question is whether it’s closer to the plan from presumptive GOP presidential nominee Donald Trump or to a very different one from then-Ways and Means Chairman Dave Camp in 2014, the last time the House GOP presented a comprehensive tax reform plan.

The answer will offer an early indication of possible GOP tax policy in 2017 if Trump is elected. And press reports suggest the plan will be closer to Trump than Camp, with a large cut in the top tax rate and few if any specific revenue-raising proposals to help offset its large cost.

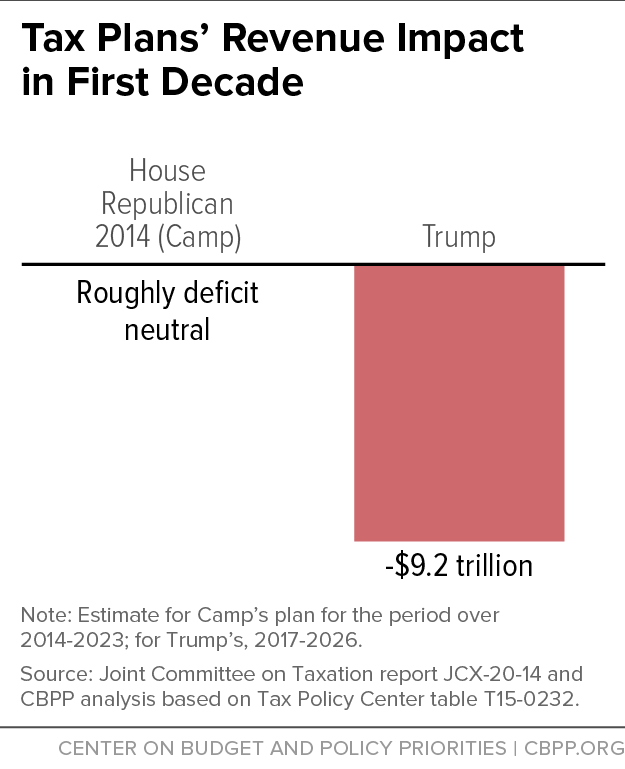

Impact on revenues. The Camp plan was designed to be revenue neutral, and Congress’ Joint Tax Committee said it effectively would be over the first ten years. (It would very likely raise deficits after that.) To his credit, Camp provided specific revenue increases — namely, scaling back various costly tax breaks. Prior House GOP budgets advertised deep rate cuts at the top of the income scale but lacked specific offsets.

The Trump tax plan, in contrast to the Camp plan, would lose $9.2 trillion over the next decade, as the first graph shows. (This CBPP estimate adjusts the Tax Policy Center’s (TPC) estimate of $9.5 trillion to reflect more recent economic data.)

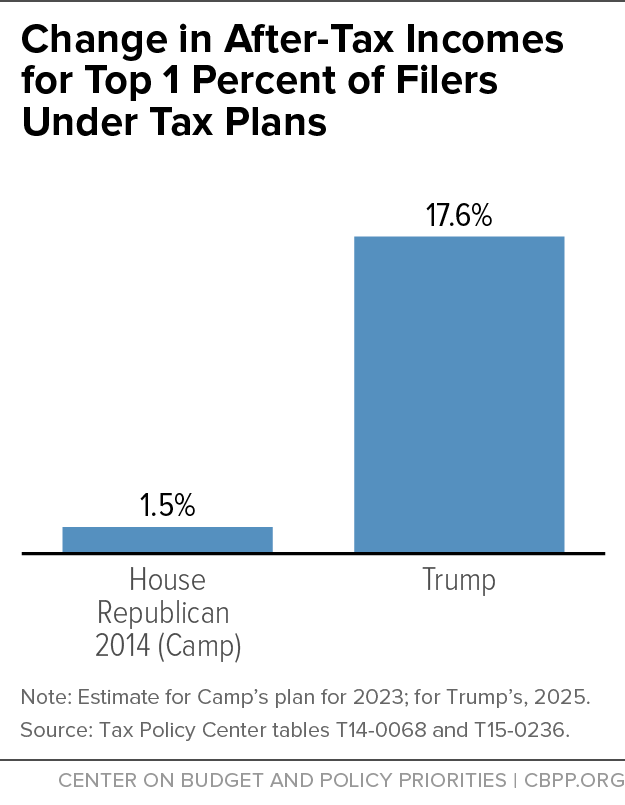

Distribution of benefits. The Camp plan also was “roughly distributionally neutral,” TPC found, raising after-tax incomes for different income quintiles by fairly similar percentages, ranging from 0.1 percent to 0.8 percent (though the increase for the top 1 percent of filers was higher at 1.5 percent). The Trump plan, in contrast, would boost after-tax incomes by 17.6 percent ($329,000 a year) for the top 1 percent of filers but only by 4.9 percent ($3,000 a year) for middle-income households. (All figures are in 2016 dollars.) Further, middle-income households would almost certainly lose more from the large spending cuts that would be needed to offset the Trump plan’s massive tax cuts than they would gain from the tax cuts themselves.

One final point: the gains to the top 1 percent under Trump dwarf the gains under Camp, as the second graph shows.

Prominent provisions. Here are some issues to pay particular attention to:

-

Top rate. The Camp plan dropped the top individual tax rate from 39.6 percent to 35 (while capping the value of itemized deductions at 25 percent for those with higher tax rates). The Trump plan, by contrast, cuts the top rate substantially, to 25 percent. Press reports suggest the House GOP plan will propose a lower top rate than Camp (perhaps 30 percent) and largely avoid specific offsets.

-

Capital gains. Capital gains income, which is extremely concentrated among those at the top, enjoys many tax advantages, including a special rate (now 23.8 percent) that’s well below the top rate for ordinary income. The Camp plan lowered the rate only slightly, to 23.3 percent; Trump proposes to cut it to 20 percent. Press reports suggest that the forthcoming House GOP plan may be even more generous than Trump’s, cutting the rate to 15 percent, which would be costly and tilt more of the plan’s tax-cut benefits to people at the top.

-

“Pass-through” business income. The tax code allows certain business entities (such as S corporations and partnerships) to enjoy the legal benefits of a corporation, such as the fact that its owners aren’t personally liable for the firm’s debts, while avoiding the corporate income tax. Instead, shareholders and partners in these “pass-through” entities pay individual income tax on this business income. The Trump plan magnifies this tax advantage.

If the House GOP plan features an aggressive cut in the top individual and corporate income tax rates with few specifics on how to pay for them, and sharply lower rates for capital gains and pass-through income, the risks of the plan resulting in fiscal recklessness and increased inequality will be considerable.