BEYOND THE NUMBERS

The Labor Department will announce the Consumer Price Index (CPI) for September 2013 tomorrow — the last missing piece that’ll determine the January 2014 cost-of-living adjustment (COLA) in Social Security. The department would normally have announced the CPI on October 16, but — like many other economic indicators — it fell victim to the government shutdown.

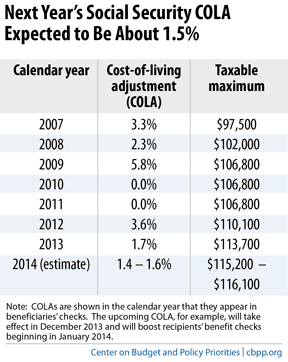

The COLA for Social Security and several other programs — including Supplemental Security Income, federal civil-service and military retirement, and payments to disabled veterans — is pegged to the CPI in the July-September quarter. Based on what we know, we expect the upcoming COLA to be between 1.4 percent and 1.6 percent. (See table.) That’d be just a hair smaller than last January’s COLA.

Social Security COLAs have a long history: Congress voted overwhelmingly in 1972 to pay them beginning in 1975, pegged to the CPI for Urban Wage and Clerical Workers (the CPI-W), which tracks inflation for an average consumer. Automatic COLAs were paid in every year from 1975 through 2009. In 2010 and 2011, there were no COLAs because prices had dropped from their peak in summer 2008. (Fortunately for recipients, their benefits didn’t go down even when prices fell.) Once prices surpassed their summer 2008 level, COLAs resumed.

For an average beneficiary, we expect the COLA to mean an extra $18 per month. In added good news, the government has announced that premiums for Medicare Part B — which covers doctor and outpatient services — will remain flat in 2014. Because most elderly or disabled Social Security beneficiaries enroll in Medicare Part B and have the premium deducted from their monthly check, that means the entire COLA will go toward boosting their monthly check.

In 2013, workers and their employers pay Social Security tax on earnings up to $113,700. That taxable maximum will also rise in 2014. Because of rising inequality, that ceiling now encompasses about 83 percent of covered earnings, well below the 90-percent target that policymakers envisioned in the 1977 Social Security amendments.

Social Security benefits are modest, both in dollar terms (the average retired worker gets about $1,270 a month, and only 9 percent receive more than $2,000 a month) and by international standards. They’re the foundation of retirement income — and they also provide essential protection for workers who become disabled and to families of workers who die young.

For most Americans, Social Security will be the only source of retirement income that’s guaranteed to last as long as they live and to keep pace with inflation. It’s vital for policymakers to keep those protections as they work to ensure this popular program’s long-run solvency.