BEYOND THE NUMBERS

Ways and Means Bill Would Dramatically Expand Health Tax Shelters for High-Income Earners

Update, June 21: For more on this legislation, which the House will consider on June 22, click here.

The House is expected this week to consider legislation from House Ways and Means Committee member Rep. Erik Paulsen that would expand health savings accounts (HSAs) by allowing high-income taxpayers to shelter much more of their income each year.

Under current law, individuals in a high-deductible health plan (with a deductible of at least $1,300 for individuals and $2,600 for family coverage) that meets other federal requirements may establish an HSA to save money for out-of-pocket health expenses. The accounts offer unprecedented tax-sheltering opportunities for high-income taxpayers: (1) contributions are tax deductible, and participants can contribute up to $3,350 for individual coverage and $6,750 for family coverage in tax year 2016; (2) participants may put their contributions in stocks, bonds, or other investments, with earnings accruing tax free; and (3) withdrawals are tax exempt if used for out-of-pocket medical or long-term care costs.

No other savings vehicle offers all three tax benefits. For example, 401(k) contributions and earnings are tax-free but withdrawals are taxed.

In its chief provision, the Paulsen bill would nearly double the maximum annual HSA contribution starting next year. If it were in effect in tax year 2016, taxpayers could contribute up to $6,550 for individual coverage and up to $13,100 for family coverage. This expanded tax break would cost nearly $20 billion over ten years, according to the Joint Committee on Taxation (JCT).

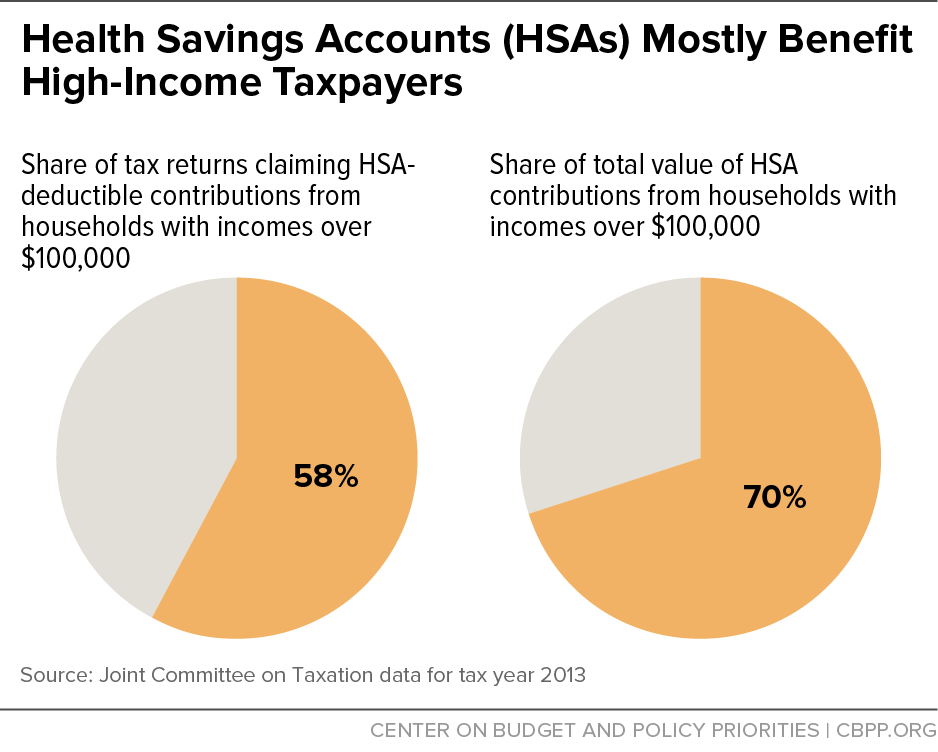

This expansion would likely benefit high-income taxpayers overwhelmingly. That’s because a tax deduction’s value rises with an individual’s tax bracket, so HSAs provide the largest tax benefits to high-income individuals. Households with incomes of $100,000 or more account for about 58 percent of tax returns claiming an HSA deduction and for 70 percent of the total amount of deductible contributions made to HSAs, JCT data for 2013 show (see graphic).

In addition, research shows that high-income people are the likeliest to make the maximum annual contributions to HSAs now and would be those most able to take advantage of these higher contribution limits. Moreover, with no income limits on HSA participation, affluent people whose incomes are too high to qualify for individual retirement accounts (IRAs) or who have maxed out their 401(k) contributions can shelter additional funds tax-free in HSAs. Once reaching age 65, people can then withdraw funds from their HSAs for non-medical reasons without owing a penalty. They’d have to pay income taxes on those withdrawals, as is already the case with IRAs and 401(k) plans.