off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Understanding the Federal Tax Debate

| By

CBPP

Below is a compilation of key CBPP analyses, blog posts, and graphics that provide context for the debate around federal taxes.

Overview

- Policy Basic: Where Do Our Federal Dollars Go?

August 13, 2011

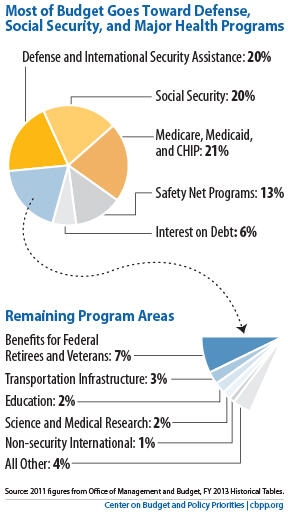

The federal government collects taxes in order to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

Image

- Policy Basic: Where Do Federal Tax Revenues Come From?

August 20, 2012

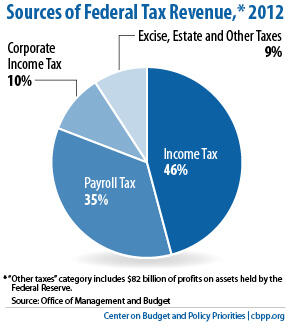

In fiscal year 2011, the federal government spent $3.6 trillion on the services it provides, such as national defense, health care programs like Medicare and Medicaid, Social Security benefits for the elderly and disabled, and investments in infrastructure and education, in addition to interest on the debt. Of that $3.6 trillion, $2.2 trillion was financed by federal tax revenues and $83 billion by excess profits on assets held by the Federal Reserve. The three main sources of federal tax revenue are individual income taxes, payroll taxes, and corporate income taxes; other sources of tax revenue include excise taxes, the estate tax, and other taxes and fees.

Image

- Analysis: Misconceptions and Realities About Who Pays Taxes

September 17, 2012

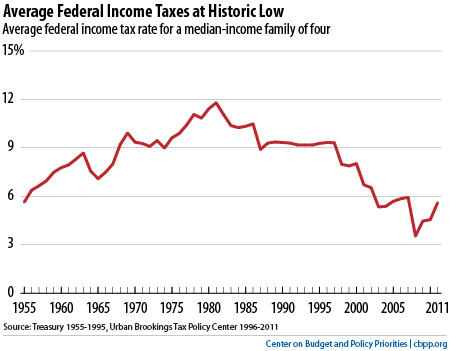

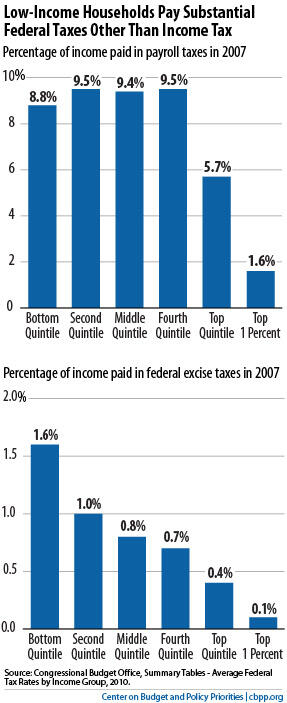

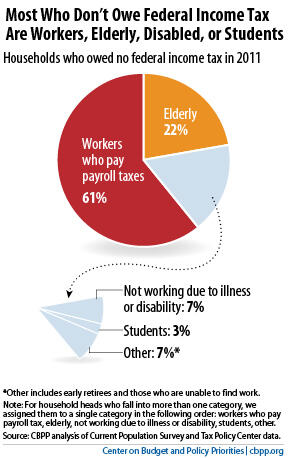

Close to half of U.S. households currently do not owe federal income tax. The Urban Institute-Brookings Tax Policy Center estimates that 46 percent of households will owe no federal income tax for 2011. A widely cited figure is a Joint Committee on Taxation estimate that 51 percent of households paid no federal income tax in 2009. (The TPC figure for 2009 also is 51 percent.) These figures are sometimes cited as evidence that low- and moderate-income families do not pay sufficient taxes. Yet these figures, their significance, and their policy implications are widely misunderstood.

- Blog Post: Top Ten Federal Tax Charts

April 17, 2012

A collection of our top ten charts related to federal taxes. Together, they provide useful context for the coming debates about how to reduce soaring budget deficits and reform the tax code.Image

Individuals and Families

- Blog Post: Reality Check on Who Pays Taxes

Updated September 18, 2012

Have you heard that close to half of U.S. households currently don’t owe federal income tax? Does that mean, as some policymakers and pundits claim, that low- and moderate-income families don’t pay taxes, or don’t pay enough of them? Not at all, as our updated analysis of this widely misunderstood issue explains. This post relies in large part on data from the Urban-Brookings Tax Policy Center.

Image

- Blog Post: Who Doesn’t Owe Federal Income Tax – in One Graph

September 20, 2012

Given all the talk about who does or doesn’t pay federal income taxes and what this means for tax policy, here are a few basic facts.

Image

- Blog Post: Meet Some Makers

September 25, 2012

The idea that this nation is divided into “takers” (that is, non-taxpayers) and “makers” is just plain wrong. For example, the largest category of people who didn’t owe federal income tax last year is working-class people who go to work each day to support their families and who contribute much to our society. - Blog Post: Who Pays Income Taxes? A Lifetime Perspective

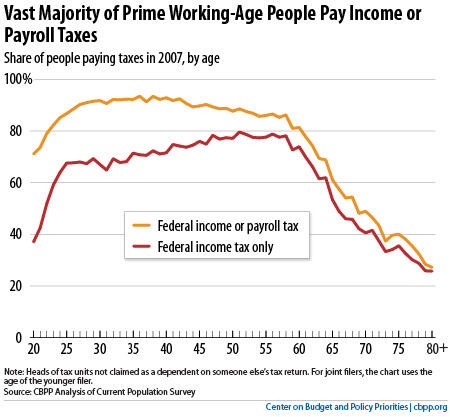

September 20, 2012

People are much less likely to owe income taxes at the end or the beginning of their careers. Many non-income taxpayers are age 55 and over and have paid considerable income taxes during their younger, working years. Others are students under age 25 who will pay income taxes when they complete their education and enter the full-time workforce.

Image

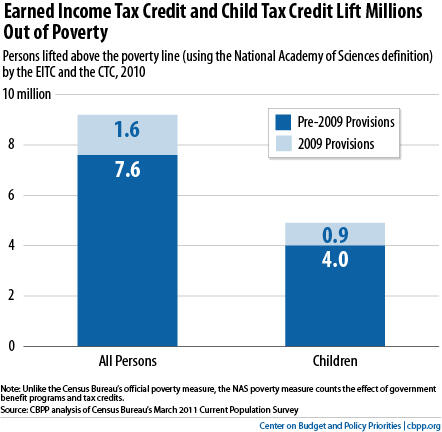

- Analysis: Studies Show Earned Income Tax Credit Encourages Work and Success in School and Reduces Poverty

June 26, 2012

Some 27 million working adults with low and moderate incomes, most of whom are raising children, received the Earned Income Tax Credit (EITC) in 2009 to reduce their taxes and supplement their earnings. Studies have found that the EITC encourages work, reduces poverty, helps families meet basic needs, and improves children’s achievement in school and likely increases their earnings as adults. The Child Tax Credit, a related tax credit designed to help offset the cost of raising children, also plays a pivotal role in helping low-income families

Image

Taxes and the Economy

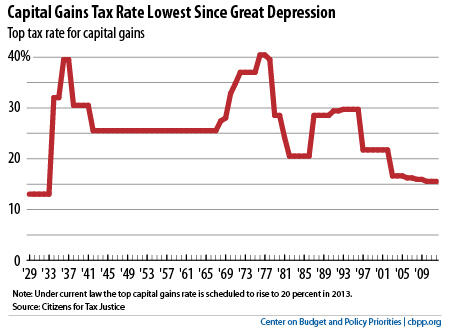

- Blog Post: New Study: No Evidence that High-End Tax Cuts Help the Economy

September 19, 2012

Many policymakers cite as fact that cuts in the top income and capital gains tax rates spur much greater economic growth and that increases in those tax rates significantly hurt growth. A new Congressional Research Service report suggests, however, that such easy assumptions are highly problematic. The report found no statistically significant correlation, all the way back to 1945, between the top capital gains or top marginal income tax rates and: (1) economic growth (in real per capita GDP); (2) private saving; (3) investment; or (4) growth in labor productivity.

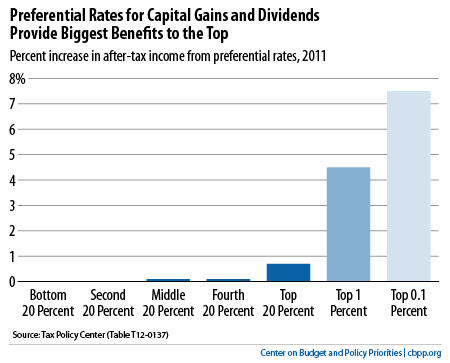

- Chart Book: 10 Things You Need to Know About the Capital Gains Tax

July 2, 2012Image

- Blog Post: Low- and Moderate-Income Tax Credits Deliver More Bang for the Buck Than High-Income Tax Credits

August 3, 2012

The Congressional Budget Office estimates that refundable tax credits added between 40 cents and $2.10 to economic output per dollar of budgetary cost and that a one-year tax cut for higher-income people added between 10 cents and 60 cents. That’s a potency advantage of 3-to-1 or 4-to-1 for the credits.

- Analysis: Raising Today’s Low Capital Gains Tax Rates Could Promote Economic Efficiency and Fairness, While Helping Reduce Deficits

September 19, 2012

The large tax preferences that capital gains enjoy over “ordinary” income, such as salary and wages, add to budget deficits, widen income inequality, and do little if anything to promote economic growth.

Image

Stay up to date

Receive the latest news and reports from the Center