BEYOND THE NUMBERS

It’s time to raise the federal minimum wage, as my colleague Isaac Shapiro wrote earlier today. In the meantime, states can help address stagnant wages and the struggles of working families by boosting the minimum wage within their borders, and by simultaneously adopting or expanding a state Earned Income Tax Credit (EITC).

Minimum wage increases and EITC improvements each help low-income workers and their families get ahead, but doing both is particularly beneficial, for a number of reasons.

- State minimum wages and EITCs reach overlapping but different populations. State EITCs primarily target low-income families with children and help working families earning as much as about $39,000 to $53,000 (depending on marital status and the number of children) in most states. The minimum wage goes to the very lowest-wage workers, regardless of factors like household income, family status, or age.

- Increasing both at the same time provides added support to the working families who need it most. Together, a minimum wage boost and a robust state EITC can move families beyond poverty and further toward economic security. Because a family’s EITC rises as its wages rise (up to a certain level), a minimum wage increase provides the added benefit of increasing the EITC for some families.

- The two policies’ benefits are timed differently. An expanded minimum wage increases every paycheck, which helps with routine expenses, like food, monthly bills, and rent. State EITCs are paid at tax time and can go for larger, one-time expenses, like car repairs or a security deposit.

- Improving both together allows the public and private sectors to share the cost of boosting incomes for those who work. State government, and by extension state taxpayers, largely bear the cost of the EITC. On the other hand, the private sector, especially employers and consumers, principally bears the cost of the state minimum wage. Improving both policies spreads the cost of making work pay more broadly than does either policy alone.

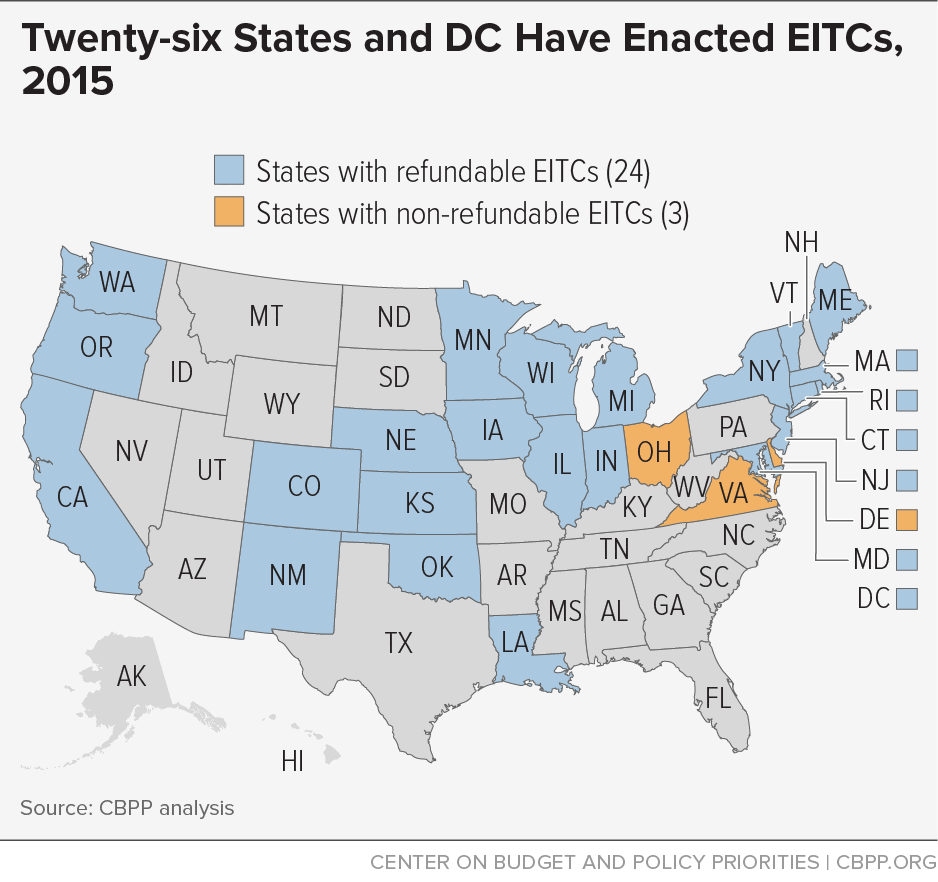

A number of states have taken steps this year to improve or adopt an EITC (see map). California adopted one, while Maine, Massachusetts, and New Jersey increased theirs. Rhode Island increased both its EITC and minimum wage. Other states should look to enact or expand a state EITC at the same time that they increase their minimum wage and set it to grow with the cost of living to make the biggest impact for working families most in need.