BEYOND THE NUMBERS

President Trump’s tax plan contains large, specific tax cuts for the wealthy and corporations but few tangible proposals for working families; it’s even missing many details needed to assess whether the plan would raise their taxes. Administration officials, however, assert that its tax cuts for the wealthy and corporations will yield widespread benefits by boosting economic growth. But the historical record and careful, mainstream economic research show that huge tax cuts for those at the top don’t boost growth substantially or generate enough additional taxes from higher growth to pay for themselves. In fact, the higher deficits that the tax cuts would create — or the spending cuts that policymakers might enact to pay for them — could end up hurting most Americans.

Growth promises aren’t backed by evidence. Treasury Secretary Steven Mnuchin said of the plan, “What this is about is creating jobs and creating economic growth. And that’s what massive tax cuts and massive tax reform and simplifying the system . . . [are] going to do.” But there’s little evidence that the plan’s specified tax cuts, which flow overwhelmingly to the wealthy and corporations, would significantly boost growth or significantly benefit workers:

- As we’ve detailed, careful empirical research finds that tax cuts on high-income people’s earnings or on their income from wealth (such as capital gains and dividends) don’t substantially boost work, saving, and investment — contrary to overstated “supply side” predictions.

- Corporate tax cuts are a poor way to boost growth. Companies are posting record profits, and their tax burdens (after taking tax breaks and loopholes into account) are in line with those of companies in other high-income countries.

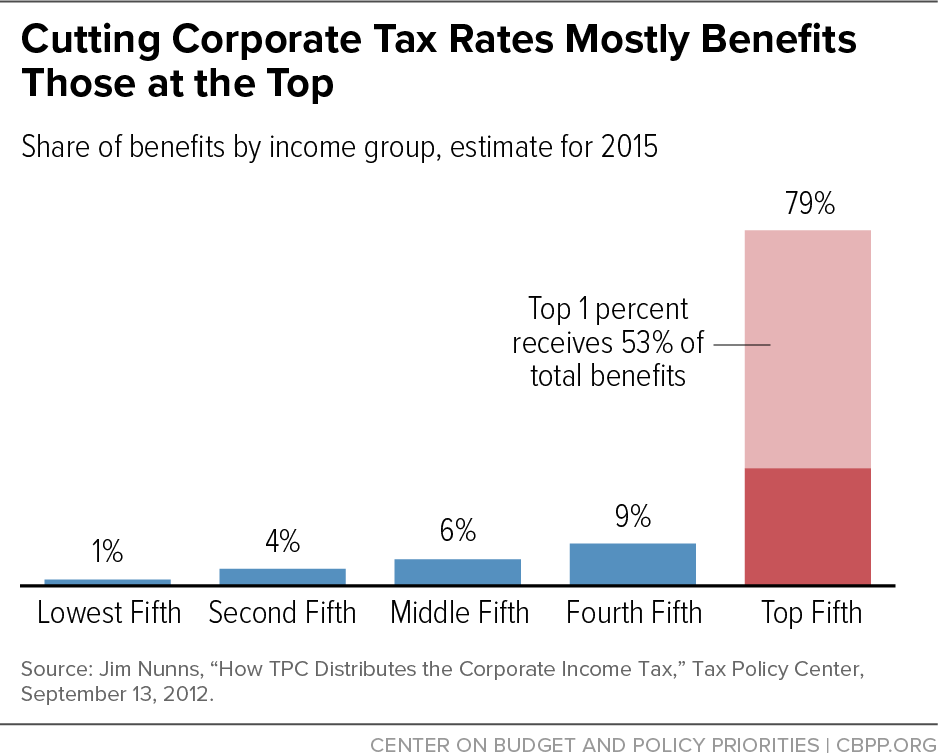

Moreover, the benefits of corporate rate cuts largely go to high-income investors rather than “trickling down” to workers. While proponents of corporate rate cuts often claim that workers will benefit because companies will invest more and therefore boost wages, mainstream estimates show that only a very small share of corporate rate cuts eventually flows to workers. And, even taking this effect into account, the Tax Policy Center finds that about 80 percent of the benefit of a corporate rate cut flows to the top fifth of households, and about 53 percent flows to the top 1 percent. (See chart.)

Growth won’t pay for the tax cuts. Because expectations of huge economic growth from the Trump tax plan are so unrealistic, it’s also unrealistic to think that growth generated by the plan could pay for a large share of its estimated cost of at least $5 trillion over ten years (even counting its limits on deductions and loopholes).

Using mainstream modeling and assumptions, the Tax Policy Center estimated that President Trump’s very similar campaign tax plan would only offset about 3 percent of its cost through slightly faster growth over the first decade — and would hurt growth in the long run by expanding deficits. Models showing that growth would offset a much higher share of the plan’s cost are out of line with mainstream economic thinking and empirical evidence.

It’s also highly unlikely that other parts of Trump’s regulatory and fiscal agenda would, together with the tax plan, boost economic growth to “3 percent or higher” and thereby pay for the plan, as Secretary Mnuchin has promised.

Bigger deficits will create pressure for large program cuts. The Trump tax cut plan could hurt growth and most Americans by increasing budget deficits or requiring cuts to investments that help working families and the economy. If unaddressed, the estimated $5 trillion or more in higher deficits over ten years would reduce national saving, meaning less capital would be available for investment in the economy.

At some point, policymakers would have to offset the costs of these tax cuts. Programs like Social Security, Medicare, and programs for low-income Americans would be especially vulnerable to budget cuts. Given these eventual financing costs, the plan’s tax cuts for the wealthy and corporations would likely leave most Americans worse off in the long run.

That would be on top of the harm that the rest of the President’s fiscal and regulatory agenda would do to most Americans — including ending health coverage for 24 million people, weakening worker safety regulations, and cutting housing, health, and other domestic programs below their already inadequate levels.