BEYOND THE NUMBERS

The House GOP health plan would repeal, starting in 2018, two Medicare taxes in the Affordable Care Act (ACA) that fall only on high-income filers: the additional Hospital Insurance payroll tax on high earners and the Medicare tax on unearned income. These tax cuts together would cost $275 billion over ten years, according to the Joint Committee on Taxation, and they’re raising increased concerns even within Republican circles.

For example, California House Rep. Tom McClintock told MSNBC’s Chris Hayes last week, “I don’t think it’s defensible or sustainable for us to be giving massive tax cuts to investors while we have not assured that the tax system is supporting low-income families as they try to reach out for new health care insurance in the new market we are creating.”

Three resources help to explain how these tax cuts would harm health coverage and benefit high-income earners and corporations:

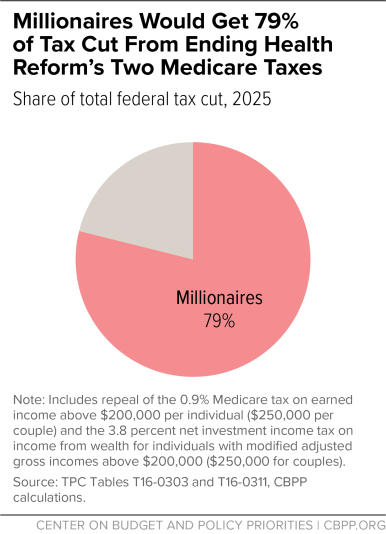

- Our updated paper explains what these tax cuts are, why they’d overwhelmingly benefit the highest-income filers — 79 percent of their value would go to millionaires in 2025 (see chart) — and how one would weaken Medicare.

- My new commentary explains how repealing the ACA’s Medicare taxes and providing other tax cuts — paid for with cuts to Medicaid and other provisions that would leave 24 million more people uninsured by 2026 — are tied to Republican plans to cut corporate taxes as part of a separate tax reform effort. House Speaker Paul Ryan has stated clearly recently that he hopes the health-related tax cuts will facilitate deeper corporate tax cuts in an eventual tax reform package.

- The Institute on Taxation and Economic Policy has issued state-by-state estimates of the small percentage of filers in each state who have incomes high enough to benefit from repealing the ACA Medicare taxes.