BEYOND THE NUMBERS

The Problems With the House Approach to Tax Extenders

As the House plans to vote this week on a permanent, unfinanced extension of a corporate tax break — the first of several such bills that the Ways and Means Committee has approved — our new report outlines the problems with this approach. Here’s the opening:

The House on May 7 is expected to consider a bill to permanently extend — and expand — the research and experimentation tax credit, the first of six bills that the House Ways and Means Committee recently approved to make permanent various “tax extenders.” There is widespread bipartisan support for continuing the research and experimentation credit, as well as some of the other extenders (so named because Congress routinely extends them for only a year or two at a time). But the Way and Means bills, which wouldn’t offset the costs of making these provisions permanent (by, for instance, scaling back or eliminating other tax subsidies that litter the tax code), are seriously flawed, as they would:

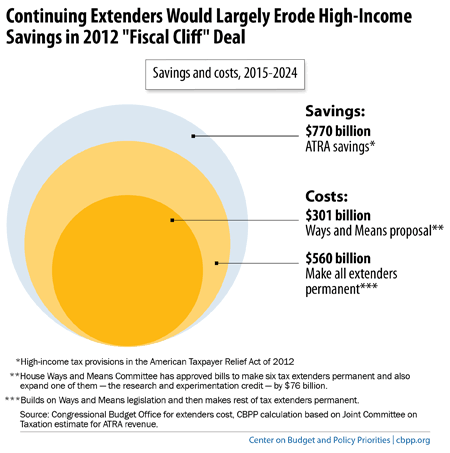

- Undo a sizeable share of the savings from recent deficit-reduction legislation. At a combined ten-year cost of $301 billion (or $310 billion over 11 years, 2014-2024), the six bills would give back two-fifths of the $770 billion in revenue raised by the 2012 “fiscal cliff” legislation. If policymakers go further and make permanent all of the roughly 80 extenders, the ten-year cost would rise to about $560 billion, cancelling nearly three-quarters of the “fiscal cliff” savings (see chart).

- Constitute a fiscal double standard. Failure to pay for making the extenders permanent would contrast sharply with congressional demands to pay for other budget priorities, from easing the sequestration cuts to providing permanent relief from cuts in doctor payments under Medicare to restoring emergency federal unemployment insurance.

- Leave out other priorities. The process to date cherry picks several of the most heavily lobbied corporate tax extender provisions, while leaving behind expired provisions for hard-hit homeowners, teachers, and distressed communities, as well as alternative energy. Moreover, the push for permanence would mean that these corporate provisions would leap-frog over more important tax provisions that are scheduled to expire in coming years — notably key improvements to the Earned Income Tax Credit and Child Tax Credit for low-income working families and the American Opportunity Tax Credit for college students.

- Bias future tax reform efforts against reducing deficits. If policymakers make the extenders permanent in advance of tax reform, a future tax reform plan would no longer have to offset the extenders’ cost to achieve revenue neutrality (much less meet the more appropriate goal of raising revenue to reduce deficits). This would free up hundreds of billions of dollars in tax-related offsets over the decade that policymakers could then channel towards lowering the top tax rate, while still claiming revenue neutrality, even though deficits would be higher.

- Violate budget enforcement rules. Both last December’s Murray-Ryan deal and the House-passed budget resolution require policymakers to pay for any tax extenders that they continue or for any new tax cuts. The Ways and Means bills violate this requirement and also undercut a widely touted feature of the House-passed budget — its claim to balance the budget in 2024 — by adding to deficits.