off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

The EITC’s Far-Reaching Benefits

Receive the latest news and reports from the Center

The Earned Income Tax Credit (EITC) “may ultimately be judged one of the most successful labor market innovations in U.S. history,” says the University of California’s Hilary Hoynes in a new article, explaining that the EITC not only encourages work and reduces poverty but produces gains that extend into the next generation:

The effects of EITC extend well beyond simple income support and poverty reduction. By increasing the income of poor families, it generates additional spending and hence “downstream” economic effects. It leads to various improvements in the mental and physical health of mothers. It brings about a reduction in low birth weight among infants. And it improves the performance of children on cognitive tests. This burgeoning body of work suggests, then, that income support programs have benefits that extend well beyond an increase in cash flow for families in poverty.

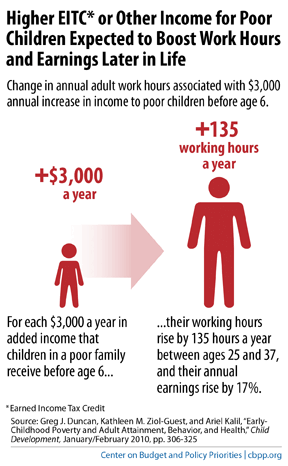

We’ve highlighted findings by Hoynes, a leading researcher, and others on the benefits of the EITC and related income support, including a study suggesting that more adequate income during early childhood can lead to greater work effort later in life (see chart).