BEYOND THE NUMBERS

Some policymakers seek to justify radical changes in Medicare by claiming that the program is nearing “bankruptcy.” Some of these same people also call for repealing the Affordable Care Act — a step that would make Medicare’s long-term finances much worse. Here, from our new report on the issue, are three basic facts.

- Medicare is not nearing “bankruptcy.” The 2011 report of Medicare’s trustees finds that Medicare’s Hospital Insurance (HI) trust fund can pay 100 percent of the costs of the hospital insurance coverage that Medicare provides through 2024. At that point, the payroll taxes and other revenue in the trust fund will still be sufficient to pay 90 percent of those costs.

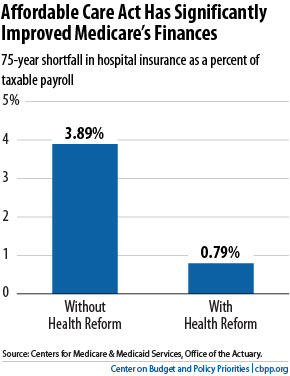

The other major parts of Medicare — Part B, which pays for physician and outpatient costs, and Part D, which pays for outpatient prescription drugs — cannot run short of funds. Under federal law, Medicare sets premiums for Parts B and Part D each year at levels that cover 25 percent of their costs; general revenues pay the remaining 75 percent. As a result, the Supplementary Medical Insurance (SMI) trust fund, which pays for Parts B and D, always has sufficient financing. - The Affordable Care Act has significantly improved Medicare’s long-term outlook. The trustees project that the hospital insurance program faces a shortfall over the next 75 years equal to 0.79 percent of taxable payroll — that is, 0.79 percent of the total amount of earnings that will be subject to the Medicare payroll tax over this period. The Medicare actuary estimates that if Congress repealed health reform, HI’s long-term shortfall would increase from 0.79 percent to 3.89 percent of taxable payroll (see chart). Put another way, health reform has shrunk the HI shortfall by four-fifths. Without health reform, HI would become insolvent eight years earlier, in 2016, and SMI costs would rise more rapidly in the years ahead.Image

- Medicare faces substantial long-term financial challenges stemming from the aging of the population and rising costs throughout the health care system. But replacing it with private health insurance, as the House-passed budget would do, would represent a big step in the wrong direction. Policymakers need to do much more to curb the growth of health costs throughout the health care system as we learn more about how to do so effectively in both public programs and private-sector health care. The Medicare research and pilot projects that the Affordable Care Act establishes should yield important lessons. But until these efforts bear fruit, it will be difficult to achieve large additional Medicare savings without shifting substantial costs to beneficiaries or greatly reducing payments to providers, either of which would likely endanger access to care for low- and moderate-income beneficiaries.The House plan would increase total health care spending attributable to Medicare beneficiaries — the beneficiaries’ share plus the government’s share — by upwards of 40 percent, according to the Congressional Budget Office (CBO). It also would reduce the federal government’s contribution to cover those costs. As a result, it would massively shift costs to beneficiaries —the elderly and people with disabilities. The average 65-year-old beneficiary’s out-of-pocket costs would more than double, from $6,150 a year under a continuation of traditional Medicare to $12,500 under the House plan, according to CBO.

Traditional Medicare, not private health insurance, has been the leader in reforming payment systems to improve efficiency and constrain costs. That’s one reason why Medicare has outperformed private insurance in holding down the growth of health costs. Between 1970 and 2009, Medicare spending per enrollee grew by an average of 1 percentage point less each year than comparable private health insurance premiums. By eliminating traditional Medicare, the House-passed budget plan would discard the opportunity to use the program to promote cost reduction throughout the health care system.