BEYOND THE NUMBERS

Taking Stock of the Safety Net, Part 2: Meeting Families’ Basic Needs Through TANF

About 3.5 million children and 1.1 million parents receive cash assistance each month from the Temporary Assistance for Needy Families (TANF) program to help cover their basic needs.

Families turn to TANF at times of major economic or personal distress, usually when they have lost a job or are facing a crisis such as fleeing an abusive situation or caring for a sick child. Many also face serious personal and family challenges, such as mental or physical health problems. In spite of the barriers they face, nearly all adult recipients must look for work and participate in approved work activities for 20 to 30 hours per week in order to receive benefits. Most recipients receive assistance for two years or less.

Congress created TANF as part of the 1996 welfare reform law to serve two different functions: (1) help parents find and maintain employment and (2) provide a safety net for families when they cannot work. Unfortunately, flaws in TANF’s design have limited its success on both fronts, and the economic downturn has exposed its serious weaknesses. In fact, TANF has grown weaker at the very time that the need for it has increased.

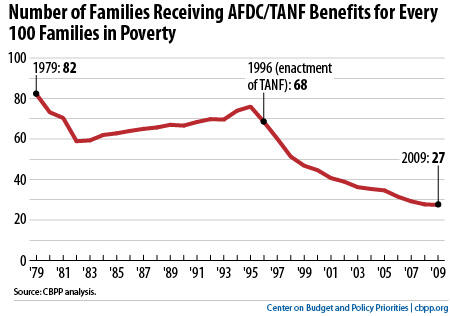

- In 1996, TANF helped 68 families for every 100 families in poverty; in 2009, it helped just 27 families for every 100 families in poverty (see graph).

- In 1995, TANF’s predecessor, Aid to Families with Dependent Children (AFDC), lifted 2.2 million children out of “deep poverty” — that is, it lifted their family’s income above 50 percent of the poverty line. In 2005 (the last year for which these data are available), TANF lifted just 650,000 children out of deep poverty. Half of the poverty line in 2011 is $9,265 for a family of three.

- TANF benefit levels are so low that they do not, in any state, raise a family’s income above 50 percent of the poverty line. In most states, TANF benefits are worth at least 20 percent less than when TANF was created, after adjusting for inflation. In 2011, six states — the highest number ever in one year — cut their already low TANF benefits.

TANF is up for renewal in 2012. Congress should use this opportunity to make improvements like:

- Strengthening access to the program. A big reason why so many families who need TANF don’t receive it is that many states have made it unnecessarily difficult to apply for (and remain on) it because federal TANF rules essentially reward states for reducing their caseloads. Families who need temporary cash assistance to meet their basic needs should not be left out in the cold.

- Redefining how TANF measures state performance. States receiving TANF funds must have a certain percentage of their TANF caseload participating in work activities. The easiest way for states to meet this requirement is to avoid serving families with the biggest employment barriers, even though they are the very families that most need the help. Instead, the federal government should measure state programs according to how well they help people gain a foothold and advance in the work force.

- Giving states funds to create subsidized employment programs. The TANF Emergency Fund, for example, enabled states to provide subsidized jobs in the private, public, and non-profit sectors for nearly 250,000 otherwise unemployed parents and youth, but it expired last September. When unemployment is high and jobs are scarce, states need additional options to help maintain TANF’s focus on work.