BEYOND THE NUMBERS

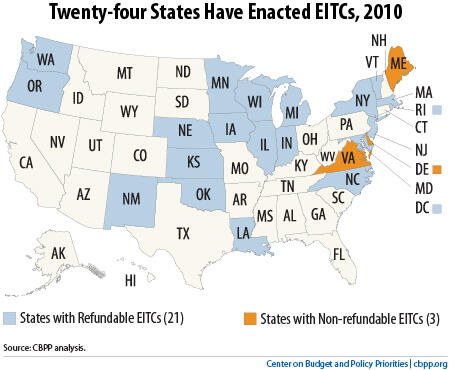

As we pointed out recently, roughly half the states have Earned Income Tax Credits to help low-income working families make ends meet (see map), and nearly all of them are preserving their EITCs even in the face of severe budgetary challenges. Our new report discusses how state EITCs, in concert with the federal EITC, are providing much-needed support to working families with low earnings. State EITCs play a particularly important role in the current economic climate, as many families have seen their wages or hours cut back or have lost a wage earner due to the recession. As we explain, state EITCs:

- Help offset state and local taxes. In every state, low-income working families pay a substantial share of their income in state and local taxes. State EITCs can help ensure that these taxes don’t push working families into — or deeper into — poverty. Without state EITCs, the number of states taxing the income of married-couple families below the poverty line would double to 26 from 13 and the number of states taxing the income of single parents below the poverty line would near double to 21 from 11. State EITCs also help to offset sales, excise, and property taxes, which disproportionately affect low-earning families.

- Help “make work pay.” The typical person who leaves welfare for work earns about $7.75 an hour and has a family income of around $12,400 a year. That’s not enough to lift a single-parent family of three above the poverty line, even with the federal EITC. A combination of the federal EITC and a state EITC, however, can close the poverty gap for many former welfare recipients as they struggle to stay on their feet and remain in the workforce.

- Lift families out of poverty and boost living standards. The federal EITC lifts more working families out of poverty than any other government program; in 2009 it lifted 6.5 million people out of poverty, including 3.3 million children. But wages plus the EITC don’t guarantee an escape from poverty for all families, partly because the wages of low-earning U.S. workers have been stagnant for some time. State EITCs can build on the success of the federal EITC in combating poverty and economic hardship among working families with children.

State EITCs also combat hardship among many families with incomes somewhat above the poverty line. The EITC phases out gradually as income rises, phasing out entirely by the time a family’s income rises to about $50,000.

The many benefits of state EITCs help explain why most states have maintained or even expanded their credits since the recession hit. (Only New Jersey has scaled its back thus far.) With working families facing their most severe economic challenges in decades, state EITCs are playing a critical role in stabilizing incomes and easing hardship.