off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Slow Recovery Creates Continued State Budget Shortfalls

Receive the latest news and reports from the Center

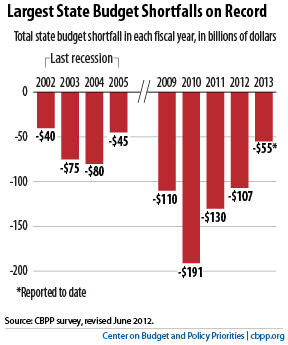

July 1 marks the start of the new fiscal year for most states. For 31 of them, it will start yet another year of budget gaps as states face a combined shortfall of $55 billion, according to our new report.

State revenues, which bottomed out in 2010, have begun to rebound. But they’re still 5.5 percent below pre-recession levels and are not growing fast enough to recover fully soon.

Consequently, states have closed the vast majority of their shortfalls through spending cuts and other measures. The spending cuts to come will take place on top of past years’ deep cuts in critical public functions like education, health care, and human services.

The additional cuts will cause state budgets to be a continuing drag on the national economy, threatening hundreds of thousands of private- and public-sector jobs, reducing the job creation that otherwise would occur. (States and localities already have laid off over 600,000 public workers since August 2008.)

Because existing revenues will not meet states’ needs and the federal government will likely cut its state funding, states need to consider other options to help build stronger economic futures for themselves. As we’ve explained, additional revenues — from raising taxes on high-income taxpayers and corporations, for example — could help policymakers prevent additional cuts to critical services and even reverse some of the cuts that they’ve already made.