BEYOND THE NUMBERS

Roundup: ACA Repeal Isn’t Just Bad Health Policy, It’s Also a Huge Tax Cut for the Wealthiest and Bad Tax Policy

As we’ve documented, Republican plans to repeal the Affordable Care Act (ACA) without an immediate replacement, like the bill President Obama vetoed in 2016, would unravel states’ individual insurance markets and cause 32 million people to lose health coverage. But they would also funnel most of the savings from rolling back the ACA’s coverage expansions into immediate tax cuts, mostly for the rich.

Repealing the ACA taxes would drain resources for a replacement — largely at the expense of low- and moderate-income families, millions of whom stand to lose their health coverage — while also widening inequality, cutting taxes on drug and insurance companies, and emboldening tax avoidance.

Here is a roundup of our recent analyses documenting the harmful impacts of repealing these taxes:

- Millionaires Big Winners From Repealing the Affordable Care Act: Plans to repeal the ACA would provide large, lopsided tax cuts to millionaires, the Urban-Brookings Tax Policy Center finds. Households with incomes over $1 million would receive tax cuts averaging more than $50,000 apiece in 2025, reaping 53 percent of the net tax cuts. Meanwhile, ACA repeal would significantly raise taxes on about 7 million low- and moderate-income families due to the loss of their premium tax credits that help them buy health coverage through the health insurance marketplaces and afford to go to the doctor when needed.

- Eliminating Two ACA Medicare Taxes Means Very Large Tax Cuts for High Earners and the Wealthy: ACA repeal would likely immediately eliminate two Medicare taxes that fall only on high-income filers: the additional Hospital Insurance tax on high earners and the Medicare tax on unearned income. Millionaires would be the overwhelming beneficiaries of repealing these two taxes, reaping 80 percent of the tax cuts in 2017.

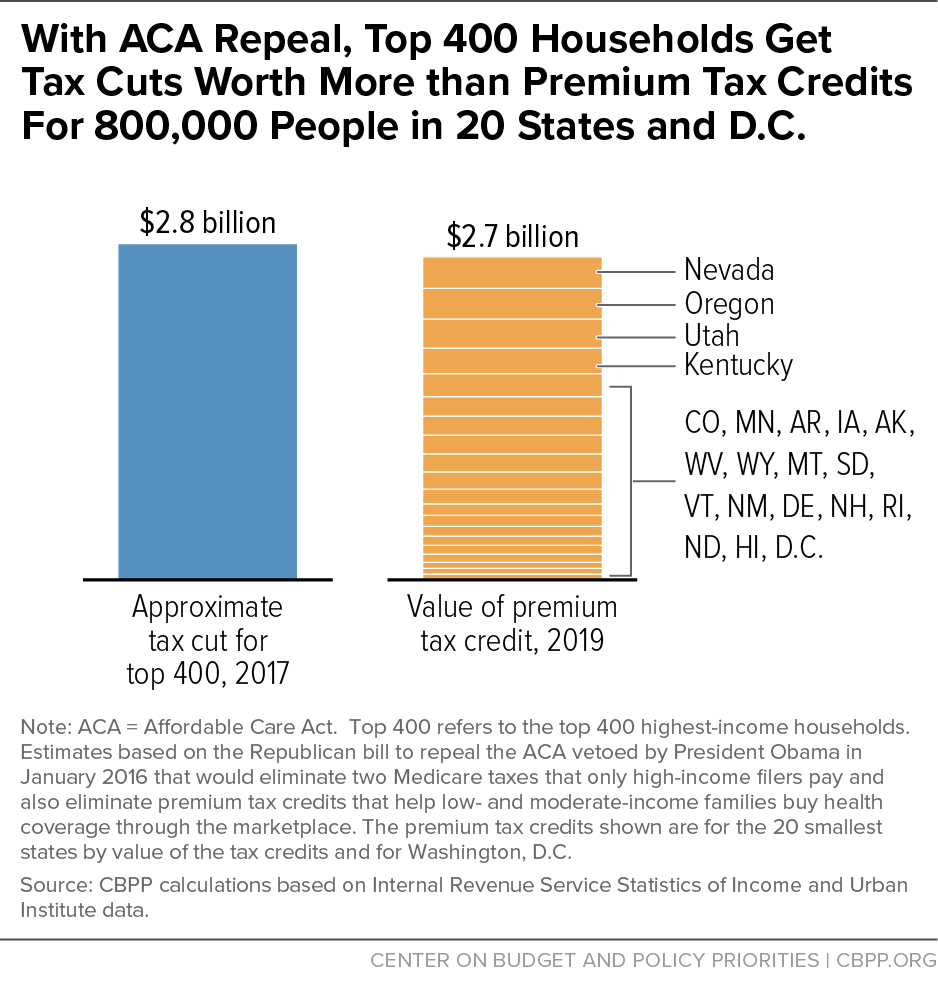

- ACA Repeal Would Lavish Medicare Tax Cuts on 400 Highest-Income Households: Eliminating the two ACA Medicare taxes that fall only on high-income filers would do even more for those at the very top, delivering an average annual tax cut of about $7 million to each of the top 400 highest-income taxpayers — whose annual incomes average more than $300 million apiece. This group’s tax cut would total about $2.8 billion a year, roughly equivalent to the value of premium tax credits that 813,000 people in the 20 smallest states and Washington, D.C. will lose if the ACA is repealed without a replacement. (For more on the “Top 400,” see Jared Bernstein’s piece in the Washington Post and John Harwood’s CNBC article.)

- ACA Repeal’s Tax Cut to the Very Top Colliding with “Mnuchin Test”: President Trump’s Treasury Secretary nominee, Steven Mnuchin, set the standard for tax reform that “there will be no absolute tax cut for the upper class.” Repealing the ACA’s taxes is a clear violation of this test, as are the broader tax packages that House Speaker Paul Ryan and President Trump put forward last year.

- ACA Repeal Means Tax Cuts for Drug Companies and Health Insurers: Republican plans to repeal the ACA are expected to repeal taxes on drug companies, health insurers, and medical device manufacturers. Cutting these taxes would reduce revenues by $180 billion over 2016 to 2025, according to the Congressional Budget Office. Repealing these taxes now would be unwise, as their revenue will likely be needed to help pay for subsequent legislation to replace the ACA and prevent millions of Americans from losing health insurance coverage.

- ACA Repeal Would Embolden Tax Avoidance: The Republican repeal bill is expected to eliminate ACA provisions that help prevent business tax shelters and raise penalties on tax avoiders. That could embolden tax lawyers, accountants, and businesses to devise and use complex tax-avoidance schemes — even as Republicans are planning to pursue fundamental tax changes later this year that could create new tax-avoidance opportunities.