BEYOND THE NUMBERS

Insurers, conservative analysts, and Senate Minority Leader Mitch McConnell in recent weeks have repeated the myth that the Medicare drug benefit’s lower-than-expected costs reflect efficiencies produced by competition among private insurers, citing this as a reason why the Administration should reverse proposed new Part D regulations.

We’ve explained in the past why this claim is incorrect, but it’s worth reiterating.

The Medicare Part D drug benefit, which private insurers deliver, did cost much less over its first five years (2006-2010) than the Medicare trustees and the Congressional Budget Office (CBO) originally expected. But, as a Kaiser Family Foundation analysis states, there “is compelling evidence that factors other than competition offer the best explanations for the lower-than-expected spending trend” in Part D.

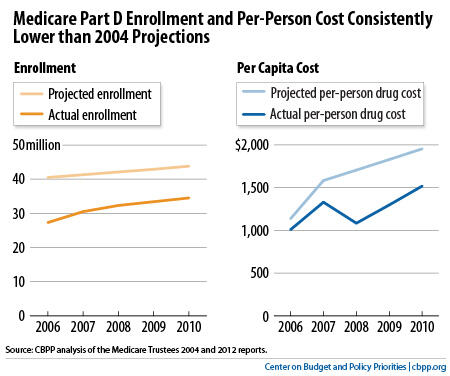

The biggest factor was lower-than-expected enrollment, according to both the Medicare trustees and CBO. Medicare trustees’ data show that actual average enrollment between 2006 and 2010 was 10.6 million — or 25 percent — lower than the trustees estimated when Congress enacted Part D (see chart).

This had a large impact on costs. Lower enrollment accounted for 51 percent of the difference between the trustees’ original cost projection and Part D’s actual costs over the first five years. (CBO data similarly show that enrollment was 18 percent lower-than-expected, which accounted for 57 percent of the difference between CBO’s projected costs for Part D and its actual costs between 2006 and 2010.)

Part D costs per beneficiary were also lower than projected, but this mostly reflects a slowdown in per-capita prescription spending throughout the U.S. health care system. Actual Part D costs per beneficiary in 2010 were 22 percent lower than the Medicare trustees originally projected and 16 percent lower than CBO had estimated. But overall prescription drug spending per capita in 2010 was 35 percent lower than what the Centers for Medicare & Medicaid Services (CMS) actuaries projected when Congress enacted the drug benefit.

Drug spending growth declined unexpectedly — both in Medicare and throughout the U.S. health care system — because major drugs went off-patent, fewer costly new blockbuster drugs came to market, and use of lower-cost generic drugs increased substantially, according to the CMS Office of the Actuary. The IMS Institute for Healthcare Informatics also found that as more generics became available, the average daily treatment costs of the ten classes of drugs most used by Medicare beneficiaries fell by about one-third between 2006 and 2010.

In fact, private plans have done a comparatively poor job of negotiating price discounts from drug manufacturers, despite insurers’ claims to the contrary. When Congress created Part D, it assumed that private insurers would negotiate larger discounts than the ones Medicaid requires for the drugs it covers for low-income beneficiaries switching from Medicaid to Medicare for their drug coverage, but the opposite happened. The Department of Health and Human Services’ Office of Inspector General found that in 2009, the discounts negotiated by private Part D plans reduced the costs of the most widely used brand-name drugs by only 19 percent; in comparison, the rebates that Medicaid requires cut costs for those drugs by 45 percent.

Last year, CBO estimated that requiring drug companies to give Medicare the same discounts for drugs provided to low-income Part D beneficiaries that Medicaid receives, as the Administration proposes again this year in its fiscal year 2015 budget, would reduce Medicare’s costs by $134 billion over ten years.