BEYOND THE NUMBERS

Housing cost burdens for renters have risen to unprecedented levels but “can be efficiently and equitably addressed using the tax code, which has historically provided substantial federal housing subsidies to homeowners, particularly those with high‐incomes and wealth,” a new report finds. It proposes three options for a tax credit to help renters struggling to make ends meet, an idea that has received growing support from policy experts and others.

Carol Galante — former Assistant Secretary at the Department of Housing and Urban Development — and her colleagues at the University of California, Berkeley’s Terner Center for Housing Innovation authored the report, commissioned by the J. Ronald Terwilliger Foundation for Housing America’s Families.

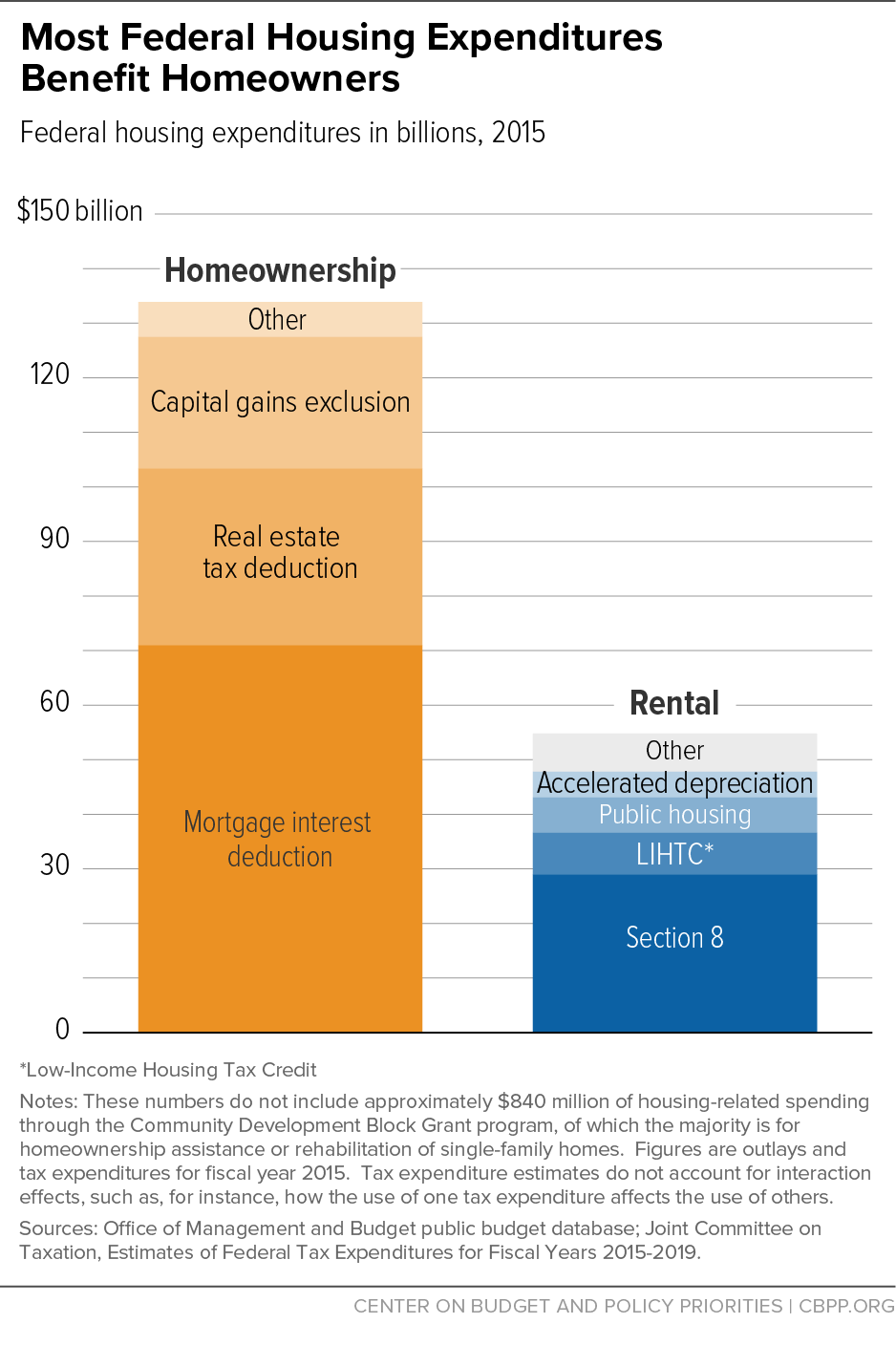

A new renters’ credit would help address the serious imbalance in federal housing spending. The federal government spent $190 billion in 2015 to help Americans buy or rent homes, but 70 percent of it went to homeowners (see graph) — even though most families that pay more than half of their income for housing are renters. The poorest renters face a far greater risk than other households of eviction, homelessness, and other hardship, but only one in four eligible low-income families receives rental assistance due to funding limitations.

One of the report’s renters’ credit options includes a “targeted component” allowing states to allocate a capped amount of credits to building owners who agree to reduce rents for extremely low-income families (with incomes below 30 percent of the local median or below the federal poverty line) to affordable levels. While the report’s other options would also provide important benefits, we think this targeted component is the most promising design. It would limit the credit’s budgetary cost but still provide subsidies that are large enough and frequent enough (delivered monthly, as opposed to annually when the family files its taxes) to enable even the poorest families to afford decent, stable housing.

As a compelling body of research — including a major new evaluation — shows, assistance that lowers rental cost burdens for the lowest-income families to around 30 percent of their income can sharply reduce homelessness and housing instability. It can also have long-run benefits such as raising children’s adult earnings and reducing the chances they will be incarcerated, a recent paper finds. The report’s targeted renters’ credit would extend comparable assistance to hundreds of thousands of additional needy families.

The Terner Center’s proposal joins statements from the Bipartisan Policy Center, Democratic Governors Association, Center for American Progress, Urban Institute, Enterprise Community Partners, Center for Global Policy Solutions, Mortgage Bankers Association, and others highlighting a renters’ credit as a promising strategy to address poverty, homelessness, and high rent burdens. When the new Administration and Congress consider options for helping struggling Americans, they should give strong consideration to establishing a new tax credit to help the lowest-income renters.