BEYOND THE NUMBERS

Tomorrow’s December jobs report is the first since Federal Reserve policymakers lifted their target for short-term interest rates off zero. That’s a very small step, and policymakers didn’t claim that the labor market was fully healed. If they remain true to their word, the path of future rate hikes should be gradual, leaving room for further labor market improvements.

Unemployment, which was 5.6 percent a year ago, has fallen to 5.0 percent. That’s very close to the “full employment” unemployment rate, according to conventional wisdom and Fed policymakers’ long-term expectations. But we don’t actually know what the lowest sustainable unemployment rate is, and with interest rates still very low, the Fed has more room to raise rates to rein in unexpected inflation than it has to lower them in the face of unexpected job market weakness. There are fewer risks to plumbing how much lower unemployment can go than to tightening monetary policy prematurely.

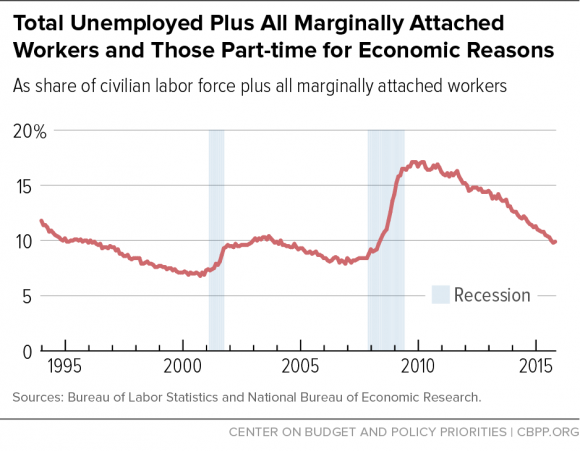

Further labor market improvements can show up in indicators other than unemployment. Many people say they want a job but haven’t actively looked for one recently (those “marginally attached” to the labor force) or have a job but aren’t working as many hours as they’d like. These numbers have fallen over the course of the recovery, but the Labor Department’s broadest measure of unemployment and underemployment (U-6), which was 9.9 percent in November, remains elevated compared with past recoveries (see first chart).

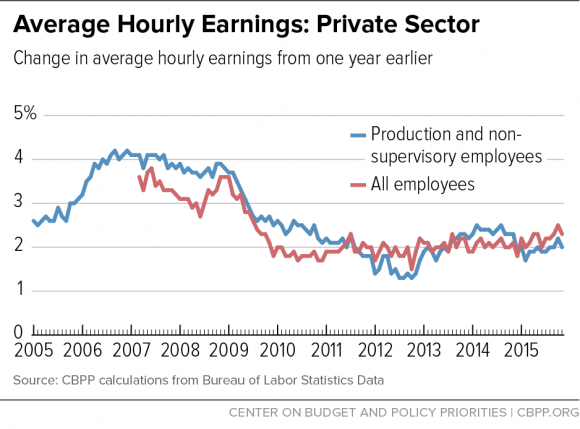

While many labor market indicators have improved during the recovery, wage growth has been disappointing. Average hourly earnings — the wage measure reported in the monthly jobs report — have grown at about 2 percent a year for several years (see second chart). Lately, that has exceeded inflation, which has been temporarily low due to falling oil prices. But if the Fed is right that inflation will return to its target of 2 percent, wages will have to grow substantially faster than 2 percent to achieve satisfactory real (inflation-adjusted) wage growth.

A strong jobs report tomorrow would show the kind of solid payroll job growth we’ve seen over the past year together with a drop in U-6 and stronger growth in wages.