BEYOND THE NUMBERS

New Jersey lawmakers in the coming weeks can level the playing field for small, in-state corporations competing with large multistate and multinational corporations that exploit domestic and foreign tax havens to cut their state taxes.

The state Senate will vote on a bill requiring corporations to use “combined reporting” when calculating their income taxes, eliminating loopholes that some large corporations use to avoid taxes and boosting New Jersey’s corporate income tax revenues by an estimated $100 million to $300 million a year. Combined reporting treats a business consisting of a parent corporation and one or more subsidiaries as a single corporation for tax purposes, nullifying a host of tax avoidance strategies in one fell swoop.

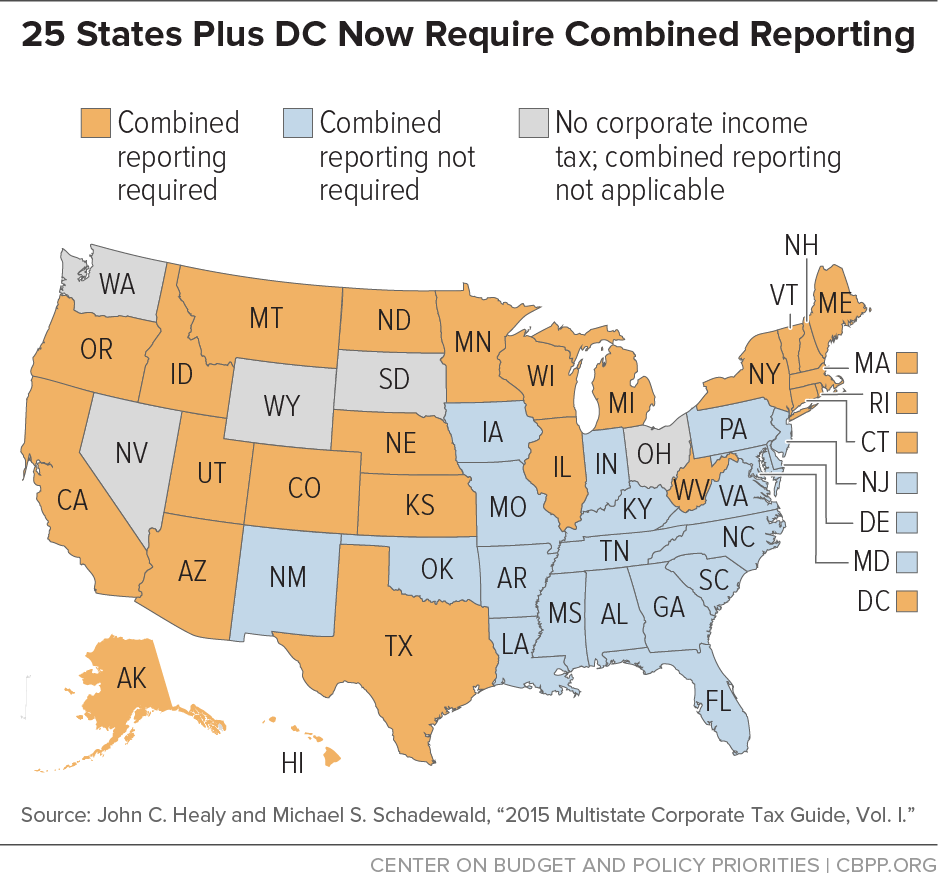

Some 25 states and the District of Columbia have adopted this key reform (see map), and the U.S. Supreme Court has twice upheld it as applied to multinational corporations.

The recently released “Panama Papers” show how law and accounting firms set up shell companies in low-tax jurisdictions to help wealthy individuals hide income-producing assets from tax authorities. The papers revealed the popularity of Delaware, Nevada, and Wyoming as places to form these shell companies — along with, of course, such notorious foreign tax havens as Bermuda and the Cayman Islands.

Similarly, multistate and multinational corporations commonly form shell companies in these same places to slash their state and federal income taxes. New Jersey’s combined reporting bill would require in-state and out-of-state corporations with the same parent company and engaged in the same line of business to pay taxes based on their combined profit. That largely nullifies any tax savings that a corporation would enjoy from artificially shifting its income to related non-New Jersey companies.

The proposal also covers related companies formed in foreign tax havens — an important provision that only a handful of the 25 combined reporting states have adopted, but that more are considering.

Corporations claim that combined reporting will hurt New Jersey’s economy by driving firms out of the state. But 92 of the state’s 98 large corporations are already subject to combined reporting in at least one state, most of them in multiple states, a study by New Jersey Policy Perspective found. If they keep doing business in combined reporting states, there’s no reason to believe they would shun New Jersey for future investing should it adopt this policy.

Combined reporting can help preserve New Jersey’s tax base from further erosion, providing revenue to finance critical public investments in education, transportation, and other areas. These investments benefit businesses as well as families. And, by mandating combined reporting, New Jersey can stop rewarding the large multistate and multinational corporations that are best-equipped and most willing to pursue aggressive tax avoidance.