BEYOND THE NUMBERS

Treasury Secretary nominee Steven Mnuchin emphasized the importance of sufficiently funding the Internal Revenue Service (IRS) today, saying:

I am concerned about the staffing of the IRS. It is an important part of fixing the tax gap and I am very concerned about the lack of first-rate technology at the IRS, the issue of making sure that we protect the American public’s privacy when they give information to the IRS, cybersecurity around that, and also customer service for the many hard-working Americans that are paying taxes.

As we’ve noted, policymakers have cut the IRS budget by 18 percent since 2010, after adjusting for inflation. These cuts have occurred even as the IRS’s responsibilities have grown due to its role in implementing new laws, a large increase in the number of tax returns filed, and growing threats such as tax-related identity theft.

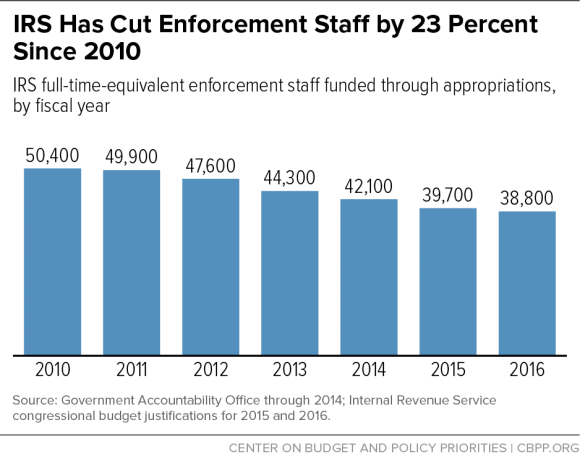

These funding cuts have forced the IRS to sharply reduce its workforce, as Mr. Mnuchin noted. The IRS has cut its workforce substantially — by about 13,000 full-time positions, or 14 percent, between 2010 and 2016. Enforcement activities have taken an even bigger hit, with funding cut by 20 percent, adjusted for inflation, and enforcement staff declining by 23 percent (see chart).

As Mr. Mnuchin noted, funding IRS enforcement activities is an important step toward reducing the “tax gap,” or the difference between what taxpayers should have paid and what they actually paid. The Treasury Department estimates that each additional dollar invested in IRS tax enforcement yields $6 or more in increased revenue. Greater enforcement funding also produces further, indirect revenue savings by deterring tax evasion; Treasury estimates those indirect savings to be at least three times the direct revenue impact.

Adequate IRS funding and staffing, especially for enforcement, are critical to ensuring the integrity of the tax system. They’ll be particularly important if Republican lawmakers enact fundamental changes to the tax system, as they intend to do this year. Some of these changes, such as a special reduced rate on “pass-through” business income, could create new opportunities for tax avoidance, placing a further strain on IRS enforcement.