off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

A recent Associated Press story on Social Security’s Disability Insurance (DI) program raised some important issues but, like much of the recent spate of coverage of this important program, could create the misimpression that the program is fundamentally flawed. So it’s worth reviewing once again the facts about Disability Insurance.

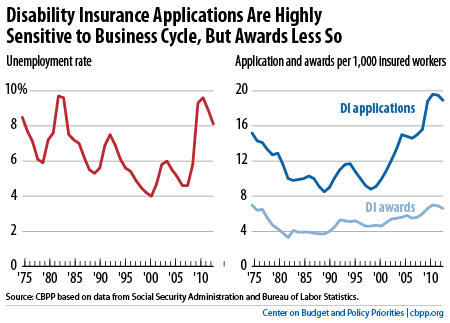

- Demographic trends explain most of the program’s recent growth. Three big factors — the aging of the baby boomers into their 50s and early 60s, the rising labor force participation of women, and the increase in Social Security’s full retirement age — have caused most of the recent growth in the disability rolls.Other factors — including the recent economic downturn — have boosted the number of disability recipients, but researchers generally find that a sour economy swells applications more than awards (see graph). That is, more claims get denied in recessions.

- It’s not easy to qualify for benefits. Applicants must have a steady work history, be unable to work enough to earn $1,040 a month; must have a severe medical impairment that has already lasted five months and will last at least 12 more months (or result in death); and must submit detailed medical evidence from acceptable sources.If denied, they may appeal. Administrative law judges approve many of these appeals, but it’s important to realize that, in many cases, claimants’ condition has deteriorated in the year or so since they were first denied or they have much better documentation for their case. Ultimately, only about 40 percent of applications are allowed.

- Underfunding by Congress has badly hampered the reviews of DI recipients to weed out those who have recovered. These “continuing disability reviews” shrink eventual benefit payments by over $9 for every $1 they cost, according to the actuaries at the Social Security Administration (SSA). But Congress has spurned the President’s request to approve the full funding that the 2011 Budget Control Act allows for reviews like these, and this policy of starving the watchdogs has created a big backlog at SSA.

- The DI trust fund must be replenished by 2016 to avoid a cut in benefits, but that’s neither a surprise nor a crisis. Presidents and Congresses often have reallocated taxes between Social Security’s retirement and disability trust funds, in either direction. In 1995, shortly after the last reallocation, the Social Security trustees predicted that it would keep the DI trust fund solvent until 2016 — the same year the fund is now expected to need more resources.Another modest reallocation from the retirement trust fund into the DI trust fund would advance the retirement fund’s insolvency date, but by a mere two years, from 2035 to 2033. We urge Congress to act long before then to enact a balanced and comprehensive solvency package for all of Social Security.

Image

Topics:

Stay up to date

Receive the latest news and reports from the Center