BEYOND THE NUMBERS

The House Ways and Means Committee continues to pursue tax bills that advance misplaced priorities. On Wednesday, the committee will consider a bill that focuses on the Child Tax Credit (CTC), which helps working families offset the cost of raising children. It’s just the opposite of what’s needed: it would provide new permanent tax cuts to many affluent families who have incomes too high to qualify for the credit under current law, while letting the CTC disappear altogether for many of the nation’s poorest working families after 2017, thereby casting millions of children in these families into, or deeper into, poverty.

The CTC, which now provides up to $1,000 per eligible child, was enacted in 1997 and expanded in 2001. Recognizing the particular challenges that child-rearing costs create for working-poor families — many of whom were shut out of the credit before 2009 because their incomes weren’t high enough to qualify — Congress made more working-poor families eligible in 2009 by beginning to phase it in as a family’s earnings increased above $3,000 (instead of not starting to phase in the credit until a family had earned far more than that, as prior law required). This critical improvement, along with important enhancements to the Earned Income Tax Credit (EITC), was extended through 2017 under the “fiscal cliff” law of early 2013 that made most of President Bush’s tax cuts permanent.

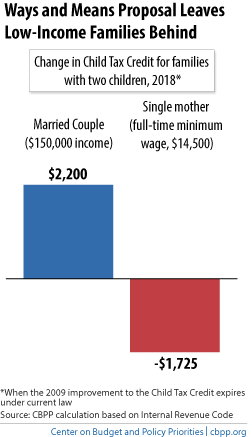

Policymakers’ top CTC-related priority should now be making this improvement permanent. Yet the bill before Ways and Means not only fails to address this need, but extends the CTC farther up the income scale, providing a new tax cut to many rather affluent families even as the credit was ending for millions of the working poor. The bill also would index the credit for inflation.

Couples with two children making between $150,000 and $205,000 would be newly eligible for the credit; a family making $150,000 a year would receive a new tax cut of $2,200 in 2018. Meanwhile, a single mother with two children who works full time throughout the year at the minimum wage and earns $14,500 would lose $1,725, as her CTC was eliminated after 2017.

The EITC and the low-income component of the CTC are pro-work success stories. Research demonstrates that they increase work among parents, while also boosting school performance and college attendance among the children in these families, as well as the children’s work effort when they grow up.

Furthermore, letting these improvements to the CTC and EITC expire would mean that about 10 million people nationwide — the majority of them children — would fall into, or deeper into, poverty.

The Committee should start by addressing this issue — not by ignoring it while providing a new tax cut for more affluent families whose children have many more advantages than the children growing up in working-poor families.