BEYOND THE NUMBERS

Poverty and incomes worsened last year for childless adults while improving for children and their families, the new Census data show. The new figures highlight the need to do more to help low-income workers not raising minor children, as both President Obama and House Budget Committee Chairman Paul Ryan, among others, have proposed.

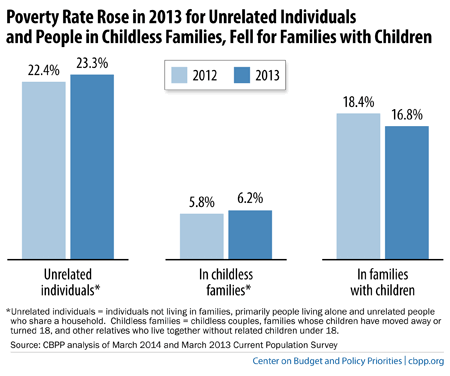

- The poverty rate for individuals not living in families (primarily people living alone and unrelated people who share a household) rose to 23.3 percent in 2013, the highest in over 30 years. The poverty rate for childless families (childless couples, elderly couples, families whose children have moved away or turned 18, and other relatives who live together), while much lower at 6.2 percent, was also the highest in over three decades. (See chart.)

- Median income fell 1.4 percent ($949) for childless families in 2013.

Working families with children receive significant help from the Earned Income Tax Credit (EITC) and the Child Tax Credit, which together lifted 10.1 million people (including 5.3 million children) out of poverty in 2012, under the government’s Supplemental Poverty measure, which, unlike the official measure, includes these tax credits. But poor workers without children receive little help in making ends meet. In fact, childless families and individuals are the only group that the federal tax code taxes into (or deeper into) poverty.

That’s in part because the EITC for childless workers (and for non-custodial parents) is very small. The average beneficiary receives about $270 from the EITC for workers without children, and workers with incomes of $14,340 earned “too much” to qualify at all in 2013.

A growing bipartisan group of policymakers — including House Budget Committee Chairman Paul Ryan and President Obama — as well as researchers and analysts from across the political spectrum have called for expanding the EITC for these workers. An expansion could both reduce poverty among these workers and encourage more individuals to enter the labor force, as the EITC has done with parents. A broad array of academic research has shown that the EITC has been highly effective at increasing parents’ employment and reducing poverty.