BEYOND THE NUMBERS

In Case You Missed It . . .

This week at CBPP, we focused on health care, state budgets and taxes, the federal budget and taxes, housing, Social Security, and the economy.

- On health care, Aviva Aron-Dine pointed out that the addition of $8 billion to the House Republican health bill won’t meet Republicans’ commitments to protecting coverage for people with pre-existing conditions. Tara Straw explained that the House bill would block most New Yorkers and Californians from using tax credits to help pay for health insurance. Jacob Leibenluft noted that the GOP proposal to let states waive protections for people with pre-existing conditions, coupled with President Trump’s promise to let insurers sell across state lines, would mean that if just one state waived those protections, they would be eliminated nationwide. Sarah Lueck warned that repealing the Affordable Care Act’s (ACA) protections for people with pre-existing conditions would mean a return to the pre-ACA market, when such people often found it impossible to get adequate, affordable coverage.

Following the House vote on the GOP bill, Robert Greenstein issued a statement warning that it would rip coverage away from millions, require people to pay more for worse coverage, and strip $800 billion from Medicaid over the next decade. He also cautioned that Republicans’ refusal to guarantee continued payment of the ACA’s cost-sharing reductions in the 2017 spending bill endangers coverage for millions of Americans. Sarah Lueck outlined how a bill from Senators Alexander and Corker designed to improve the availability of marketplace plans would actually reduce consumers’ health insurance options. And we updated our Sabotage Watch page tracking efforts to undermine the ACA.

- On state budgets and taxes, Iris J. Lav detailed how the new Trump tax plan would rob states of badly needed revenues and explained why repealing the federal estate tax would make it difficult for states to maintain their own estate taxes.

- On the federal budget and taxes, Chad Stone warned that if the President’s 2018 budget reflects very rosy economic growth assumptions, its projections of federal revenues and deficits under Trump policies will be highly unrealistic. Chloe Cho and Chye-Ching Huang updated their paper on ten facts you should know about the federal estate tax. In a tax policy brief, we explained that cutting taxes for high-income people and corporations won’t spur large job growth.

- On housing, Will Fischer continued our Housing Vouchers Work series by highlighting that vouchers reduce rents for low-income families at a lower cost to the government than other forms of housing assistance.

- On Social Security, Kathy Ruffing outlined four reasons why Social Security Disability Insurance benefits are especially important to workers who’ve earned only a high-school diploma or less.

- On the economy, we updated our chart book on the legacy of the Great Recession.

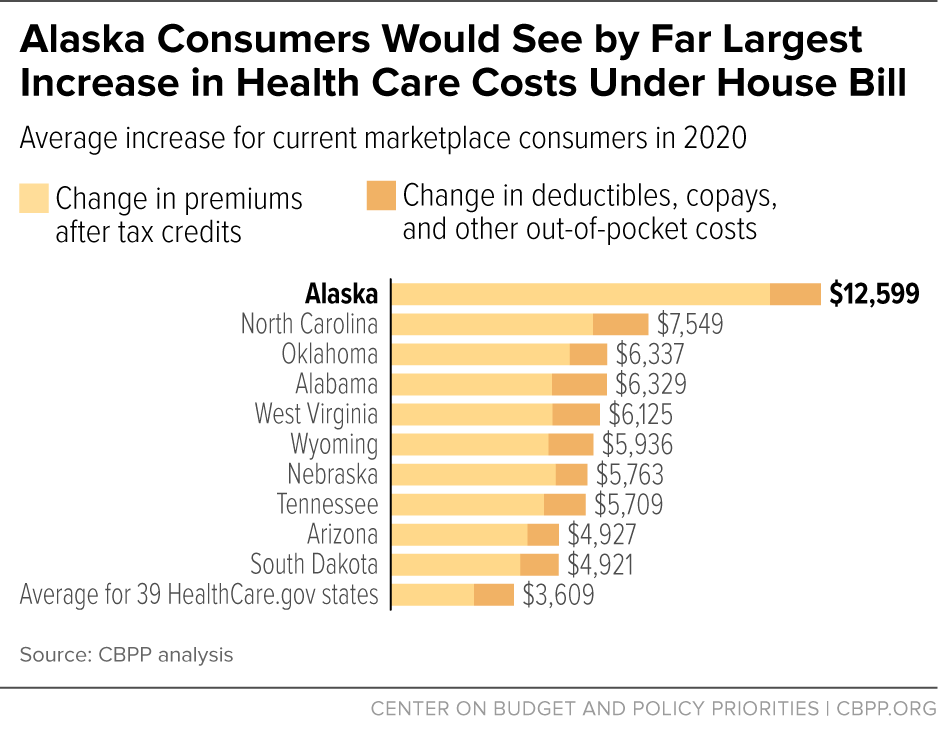

Chart of the Week: Alaska Consumers Would See by Far Largest Increase in Health Care Costs Under House Bill

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Who gets hurt — and when — if Trumpcare becomes law<

The Washington Post

May 5, 2017

How the GOP House Health bill would affect you

CBS News

May 5, 2017

These are all the people the Republican health care bill will hurt

Vox

May 4, 2017

An urgent message about the latest GOP health bill

The Last Word with Lawrence O’Donnell

May 3, 2017

Even Families Making $100K Won’t Be Better Off Under New Tax Plan

NBC News

May 2, 2017

How Republicans’ Bill to Replace Obamacare Could Cut Billions of Dollars From America’s Schools

The 74

May 2, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.