BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on federal taxes, the federal budget, health care, state budget and taxes, family income support, poverty and inequality, and the economy.

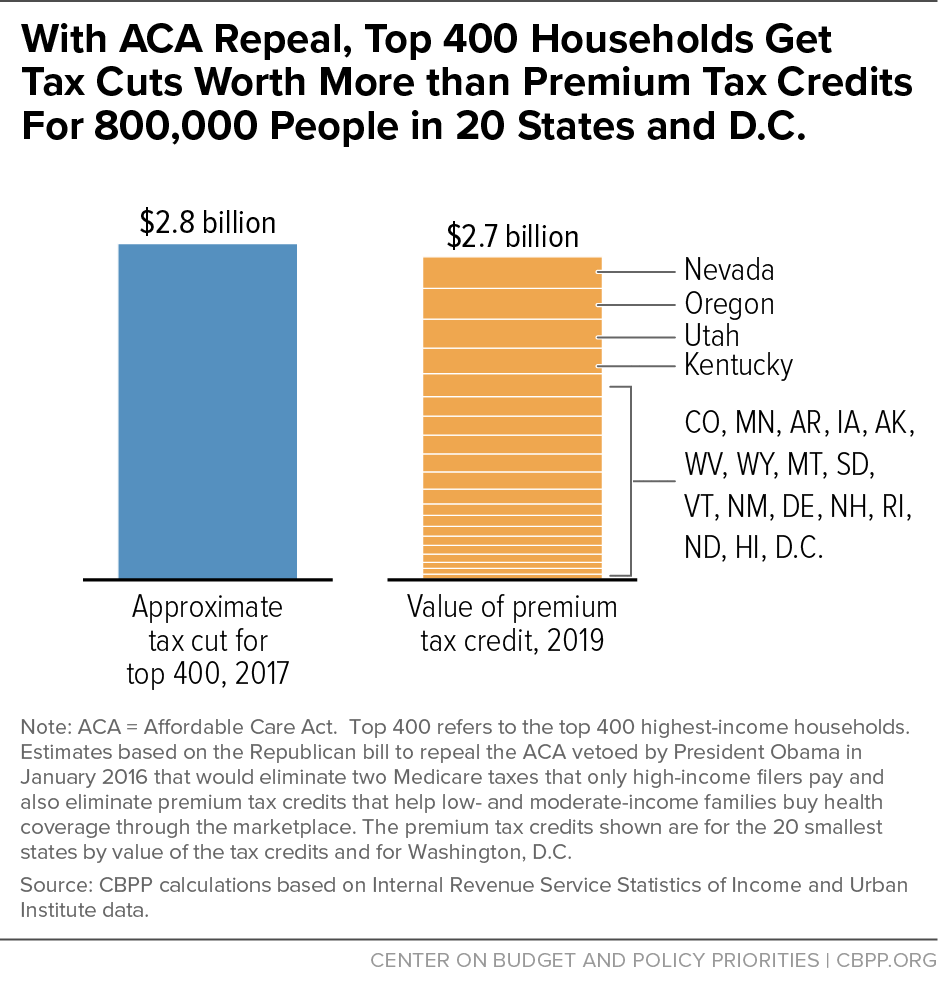

- On federal taxes, Brandon DeBot, Chye-Ching Huang, and Chuck Marr reported that repealing two Affordable Care Act (ACA) Medicare taxes would give the 400 highest-income households an average annual tax cut of roughly $7 million each, and explained that millionaire households would get 80 percent of the total tax cut. Huang pointed out that the tax cut to the very top won’t meet the test set by President-elect Trump’s Treasury nominee, Steven Mnuchin, that we won’t see an “absolute tax cut for the upper class.” Huang and Paul Van de Water emphasized that Republican plans to repeal the ACA means providing tax cuts for drug companies and health insurers. Robert Greenstein, John Wancheck, and Chuck Marr clarified basic facts about the Earned Income Tax Credit’s error rate and described how to reduce EITC overpayments.

- On the federal budget, Isaac Shapiro noted that federal employment is at a record low as a share of the nation’s workers, while President-elect Trump has proposed freezing most federal hiring. Joel Friedman urged congressional Republicans to provide greater details in their budget resolution that would repeal the ACA. Ahead of Paul Ryan’s town hall, we rounded up our reports on the House Republican “Better Way” proposals.

- On health care, Edwin Park noted that Senator Lamar Alexander’s ACA replacement plan leaves key questions unanswered. Hannah Katch profiled Hennepin Health, a renowned health program in Minnesota, as an example of the state innovations that could be at risk under ACA repeal. Sarah Lueck explained that millions of small-business workers who have gained coverage under the ACA are at risk of becoming uninsured. Shelby Gonzales highlighted that ACA signups continue rising.

- On state budgets and taxes, Elizabeth McNichol addressed criticisms from New Jersey officials about our report on state tax policies and income inequality. Tazra Mitchell gave a first-person account of her experience as a State Policy Fellow.

- On family income support, Liz Schott and Ife Floyd detailed how states spend their Temporary Assistance for Needy Families funds.

- On poverty and inequality, Nicholas Johnson and Arloc Sherman encouraged building on what works to improve racial equity and extend economic prosperity ahead of Martin Luther King, Jr. Day.

- On the economy, we updated our chart book on the Legacy of the Great Recession.

Chart of the week: With ACA Repeal, Top 400 Households Get Tax Cuts Worth More than Premium Tax Credits for 800,000 People in 20 States and D.C.

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Repealing Obamacare: Just what the doctor ordered for wealthy investors

CNBC

January 13, 2017

Obamacare Repeal Would Give 400 Super-Rich U.S. Households A Giant Tax Cut

Huffington Post

January 12, 2017

The Republicans Trying to Slow Down Obamacare Repeal

The Atlantic

January 9, 2017

Squeezed by congressional skinflints, Social Security axes more services

Los Angeles Times

January 7, 2017