BEYOND THE NUMBERS

In Case You Missed It...

This week on Off the Charts, we focused on House Budget Committee Chairman Paul Ryan’s budget, the federal budget and taxes, Tax Day (April 15), health care, the safety net, and full employment.

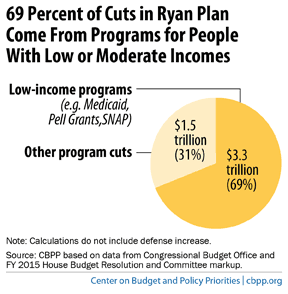

- On the Ryan budget, we featured a comprehensive roundup of CBPP analysis on the budget. Richard Kogan illustrated that the Ryan budget gets 69 percent of its cuts from low-income programs. Robert Greenstein rebutted Chairman Ryan’s criticism of our 69 percent figure and debunked Ryan’s attempt to deny that his budget deeply cuts low-income programs. Dottie Rosenbaum warned that the Ryan budget’s SNAP (food stamp) cuts would affect millions of low-income Americans. Chad Stone excerpted his US News & World Report post on how the Ryan budget could affect the economy. Paul Van de Water analyzed Ryan’s Medicare proposals.

- On the federal budget and taxes, Joel Friedman underscored the stark difference between the recent Obama and Ryan budgets on non-defense discretionary funding. Chuck Marr explained the problems with inadequate regulation of commercial tax preparers and noted recent calls to give the IRS needed authority to oversee all preparers. Robert Greenstein corrected a misrepresentation in congressional testimony regarding IRS training of tax preparers. Chye-Ching Huang highlighted a New York Times editorial criticizing the Senate Finance Committee’s vote to reinstate dozens of tax cuts without paying for them. Chuck Marr pointed out that tying federal unemployment insurance to extending the “bonus depreciation” tax cut would be unwise.

- On Tax Day, we excerpted our paper on why the Tax Foundation’s annual “Tax Freedom Day” report gives a misleading impression of tax burdens. We also highlighted several newly updated backgrounders on federal and state taxes and spending: where our federal tax dollars go, sources of federal revenues, payroll taxes, tax expenditures, and where our state tax dollars go.

- On health care, Judy Solomon listed three things that people who have yet to enroll in marketplace health coverage should keep in mind. Edwin Park explained that overpayments to Medicare Advantage insurers help the insurers more than beneficiaries and argued that policymakers should resist calls to roll back health reform’s Medicare Advantage savings. He also highlighted early data showing a decline in the number of uninsured under health reform.

- On the safety net, Brynne Keith-Jennings pointed to new data confirming that SNAP caseloads and spending continue to decline. Will Fischer explained that President Obama’s plan to raise rents on the rural poor is the wrong way to save money.

- On full employment, we highlighted Former Treasury Secretary Larry Summers’ keynote speech at the launch of CBPP’s and Senior Fellow Jared Bernstein’s year-long project on making full employment a national priority.

In other news, we issued Robert Greenstein’s statement on House passage of the Ryan budget plan. We issued papers on reducing overpayments in the Earned Income Tax Credit, Medicare in Ryan’s 2015 budget, seven myths about Medicaid, Ryan’s budget cuts in programs for people with low or moderate incomes, and the Tax Foundation’s misrepresentation of typical households’ tax burdens.

CBPP’s Chart of the Week:

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

House passes GOP budget plan despite bipartisan opposition

MSNBC

April 10, 2014

How Some Tax Preparers Feed on the Working Poor

Colorlines

April 10, 2014

We Should Be in a Rage

New York Times

April 9, 2014

Paul Ryan’s poor ‘savings’ plan

Washington Post

April 9, 2014