BEYOND THE NUMBERS

Important Improvements to Two Key Tax Credits, Explained

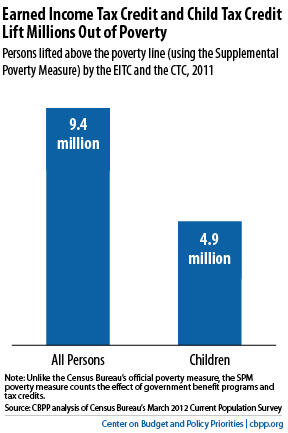

The Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) lift millions of Americans — including millions of children — out of poverty (see graph), and they encourage and support work.

ATRA extended EITC improvements that in 2011 together lifted an estimated 500,000 people out of poverty and reduced the severity of poverty for about 10 million poor people:

- The additional credit of up to $655 that families with three or more children may receive. This addition recognizes that larger families face a higher cost of living and that families with three or more children are more than twice as likely as smaller families to be poor.

- Expanded marriage penalty relief, reducing the financial penalty that some couples receive when they marry by allowing married couples to receive larger benefits at modestly higher income levels.

ATRA also renewed the CTC provisions from the 2001 and 2003 Bush tax cuts that expanded the credit from $500 per child to $1,000 and made it partly refundable, and the improvements from the 2009 Recovery Act that further strengthened the CTC to reach many more low-income working families and boosted the credit for many families who were receiving only a partial credit.

CBPP analysis of Census data shows that these changes lifted 900,000 people above the poverty line in 2011, under a poverty measure that counts not only cash income but also taxes and government benefits.

Click here for the Earned Income Tax Credit Policy Basic and here for the Child Tax Credit Policy Basic.