BEYOND THE NUMBERS

The House will begin to consider a bill today to make permanent the federal deduction for state and local sales taxes. The bill is the latest in a series of bills that House leaders are expected to move to make permanent costly “tax extenders” — a set of tax provisions that policymakers routinely extend for a year or two at a time, most of which expired at the end of 2014. This approach represents both ill-advised fiscal policy and misguided priorities, as we explain in our updated paper.

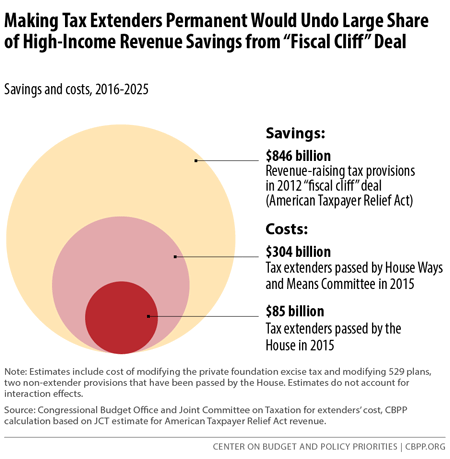

The House has already passed two bills this year to make permanent seven provisions at a ten-year cost of $85 billion (see chart). Making permanent the state and local sales tax deduction would add another $42 billion to the deficit over the next decade. Further, it would send the message that policymakers can make permanent such costly measures without offsetting their cost, thus opening the door for the same action on other (mostly corporate) provisions.

The House approach also places the tax extenders, which mostly benefit businesses, ahead of other, more critical tax provisions scheduled to expire in coming years — notably, key provisions of the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) for low-income working families. If those measures expire, more than 16 million people in low-income working families, including 8 million children, would fall into — or deeper into — poverty in 2018. And some 50 million Americans would lose part or all of their EITC or CTC.