off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

The United States faces high unemployment, stagnant living standards for working and middle-class people, increasingly high inequality, and an unsustainable long-term fiscal path. Unfortunately, the main tax policy elements of the “House Republican Plan for America’s Job Creators” announced yesterday would ignore or significantly worsen each of these problems:

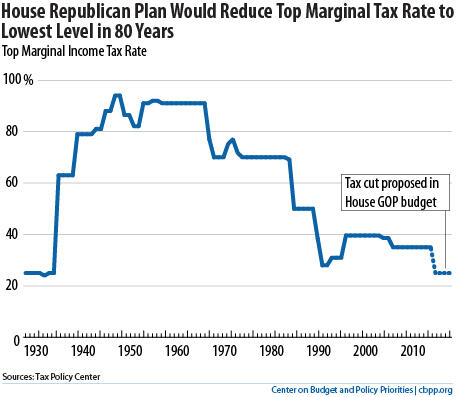

- Windfall for the wealthy. The GOP tax agenda would permanently extend the Bush tax cuts, which flow disproportionately to high-income people. (Households with annual incomes above $1 million receive $129,000 apiece, for example.) The plan’s “tax reform” component would cut the top marginal income tax rate to 25 percent, its lowest level since before the New Deal (see graph), which would do nothing for 95 percent of Americans but would provide $600,000 in new tax breaks to a “typical” taxpayer with a $10 million income.Republicans claim they will offset the cost of their “tax reforms” by broadening the tax base, but their plan provides no specifics. And as we explain here, unless these base-broadening measures tilt as heavily against high-income people as the “tax reforms” tilt toward them — which is hard to imagine, given Republicans’ stated opposition to raising capital gains and dividends taxes — middle-class Americans will essentially end up paying for wealthy people’s new tax breaks.

Image

- More debt. Making the Bush tax cuts permanent would add $3.8 trillion in deficits over the next decade, about $700 billion of it stemming from the tax cuts exclusively for high-income people. And the GOP plan’s “tax reform” component would continue to put top priority on cutting taxes for the wealthy over deficit reduction: the Tax Policy Center estimates that setting the top individual rate at 25 percent would cost $1.1 trillion over ten years, in addition to the $700 billion cost of extending the Bush tax cuts for those in the top brackets.While the plan calls for “eliminat[ing] the special interest tax breaks that litter the code,” it would devote the resulting savings not to deficit reduction but instead to more tax cuts for the nation’s wealthiest people. This approach would put tremendous additional pressure to cut Medicare, access to college, scientific research, and other national priorities in order to reduce the deficit.

- Incentives for overseas investments over domestic ones. The plan also endorses one of the worst policy ideas now before Congress: another tax holiday for overseas profits that corporations bring back to this country. Congress tried this in 2004 and it was a complete failure, as firms mostly used the repatriated earnings not to invest in U.S. jobs or growth but for purposes that Congress tried to prohibit, like repurchasing their own stock and paying bigger dividends to their shareholders. Congress’ Joint Tax Committee concluded that the 2004 holiday yielded “little macroeconomic benefit.”

A second holiday would be even worse than the first. Rational corporate executives would conclude that more tax holidays are likely in the future, which would make corporations more inclined to shift income into tax havens and less likely to make investments in the United States (see graph). As the Joint Tax Committee has stated, a tax holiday “encourages investments and/or earnings to be located overseas.” That’s why Congress, in enacting the 2004 tax holiday, explicitly warned that it should be a one-time-only event.

A second holiday would be even worse than the first. Rational corporate executives would conclude that more tax holidays are likely in the future, which would make corporations more inclined to shift income into tax havens and less likely to make investments in the United States (see graph). As the Joint Tax Committee has stated, a tax holiday “encourages investments and/or earnings to be located overseas.” That’s why Congress, in enacting the 2004 tax holiday, explicitly warned that it should be a one-time-only event.

This misguided proposal would cost $79 billion over the next decade.

To read this plan, you’d think that this nation is struggling with stagnating incomes among millionaires, a shrinking national debt, and the influx of too many jobs. That’s not how most of us see the world these days.

Topics:

Stay up to date

Receive the latest news and reports from the Center