BEYOND THE NUMBERS

House GOP Health Plan Would Accelerate Depletion of Medicare Trust Fund by Four Years

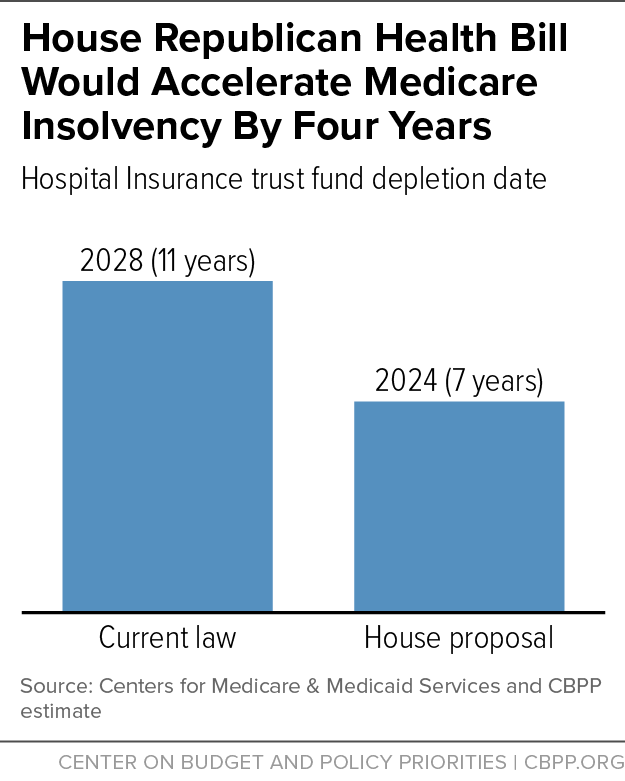

The House bill to repeal the Affordable Care Act (ACA) would move up the Medicare’s Hospital Insurance (HI) trust fund’s depletion from 2028 to 2024 (see graph). Repealing a payroll tax on high earners would advance the depletion date by three years, as we previously reported. Additional Medicare payments to hospitals that serve many uninsured payments would advance it one more year, we now estimate.

The ACA imposed an additional payroll tax of 0.9 percent on earnings above $200,000 for an individual and $250,000 for a couple, bringing the total payroll tax to 3.8 percent on earnings above those levels. Repealing the payroll tax add-on would reduce federal revenues by $117 billion over the 2017-2026 period, according to the Joint Committee on Taxation. This would undermine Medicare’s financing while providing a windfall to high earners.

It also would be highly regressive. Nearly two-thirds of the benefits would go to millionaires, who would get tax cuts of $13,700 each, on average, in 2025, according to the Tax Policy Center. At the same time, the House bill would undermine the financial security of millions of low- and moderate-income households by repealing the ACA’s coverage expansions and raising the cost of buying coverage and paying out-of-pocket expenses.

Medicare’s chief actuary estimates that repealing the additional payroll tax would harm Medicare’s financing in both the near and long term. It would advance the HI trust fund’s depletion date by three years and would increase HI’s 75-year deficit by more than half — from 0.73 percent to 1.12 percent of payroll subject to tax.

The House bill would also weaken Medicare’s financing in another way. Medicare makes additional “disproportionate share hospital” payments to facilities that serve many uninsured patients. Because the bill would reduce the number of people with Medicaid and increase the number of uninsured, it would increase these payments by $43 billion over ten years. This additional spending would hasten the depletion of HI’s trust fund by an additional year, we estimate.

Undercutting Medicare’s finances would further expose it to benefit cuts. Speaker Paul Ryan and other House Republican leaders have proposed converting Medicare to a “premium support” system, which would provide beneficiaries with vouchers whose purchasing power wouldn’t keep pace with health care costs. They’ve also proposed raising Medicare’s eligibility age from 65 to 67.

Ryan falsely claims that Medicare is “going broke” and that these radical changes are necessary to “save” the program. That’s nonsense; as I’ve explained, Medicare could still pay 87 percent of hospital insurance costs after HI’s trust fund is depleted, and Medicare’s coverage for doctor and outpatient costs and its prescription drug benefit have their own revenue sources and can’t run short of funds. By accelerating HI’s insolvency date, the House bill would only fuel these bogus charges and put Medicare coverage for seniors and persons with disabilities at greater risk.