BEYOND THE NUMBERS

“Every decision on trade, on taxes, on immigration, on foreign affairs, will be made to benefit American workers and American families,” President Trump said in his inaugural address. But, two major pieces of tax-related legislation at the top of the GOP agenda — Affordable Care Act (ACA) repeal and a broad package of tax cuts — fail to meet that standard.

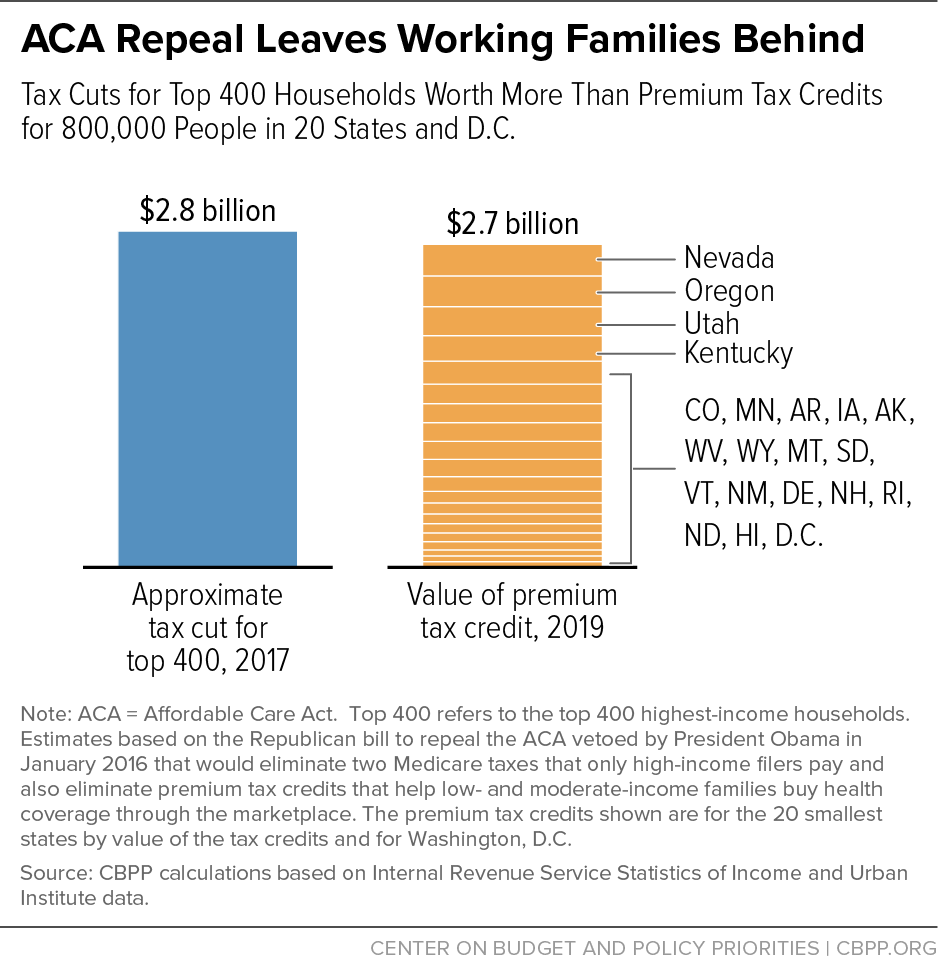

- ACA repeal. Not only would repealing the ACA’s coverage expansions cause tens of millions of Americans to lose their health insurance (the large majority of whom are in low- and moderate-income working families), but more than half of the benefits of repealing the ACA taxes would flow to people with incomes over $1 million in 2025, according to the Tax Policy Center (TPC). CBPP estimates that the highest-income 400 households would receive tax cuts averaging about $7 million a year. (See chart.) At the same time, eliminating the ACA’s premium tax credits would raise taxes on 7 million low- and moderate-income families who use those credits to buy insurance and pay for a doctor visit.

- Broad tax package. The tax plan that President Trump outlined during the campaign would deliver a $387,000 average tax cut in 2025 for people with incomes over $1 million, TPC estimates, raising their after-tax incomes by 14 percent. Meanwhile, people making between $40,000 and $50,000 would receive $500 on average, or just 1 percent of their after-tax income.

Similarly, the “Better Way” tax plan that House Speaker Paul Ryan and other House GOP leaders outlined last year would deliver tax cuts averaging $302,000 apiece to people with incomes over $1 million in 2025, raising their after-tax incomes by more than 11 percent, TPC finds. By contrast, the bottom 80 percent of Americans wouldn’t see their after-tax incomes rise or fall by more than one-half of 1 percent, on average.

In short, these plans aren’t designed to benefit working families. In fact, they embody skewed priorities that ignore working families and focus strictly on cutting taxes at the top.