BEYOND THE NUMBERS

Kansas legislators passed a plan this past weekend to drain the state’s reserves, cut taxes for the rich, raise taxes for many lower-income families, and slash education in the process. The state is on a path to ruin unless it changes course.

The new budget is designed to move the state toward Governor Sam Brownback’s stated goal of totally repealing the income tax. That tax generates almost half of Kansas’ funding for schools, universities, health care, public safety, and so on. Last year, Kansas enacted income tax cuts that mainly benefitted the wealthy and exempted nearly 200,000 profitable businesses from paying any income tax on their profits. This year’s plan includes additional income tax rate cuts, again largely benefiting the wealthy few.

There is a tremendous cost to this approach — which ordinary Kansans will bear. We saw its first impacts last year, when the tax cuts blew a giant hole in funding for schools and other services to the point where a state district court found that Kansas is unconstitutionally underfunding its elementary and secondary schools. (The state has appealed the decision.)

The new budget goes further. It cuts spending on services over the next two years below current levels. It’s hard to imagine how the state can make those spending cuts without boosting K-12 class size, spiking tuition at public universities, making health care less available and less affordable, and so on.

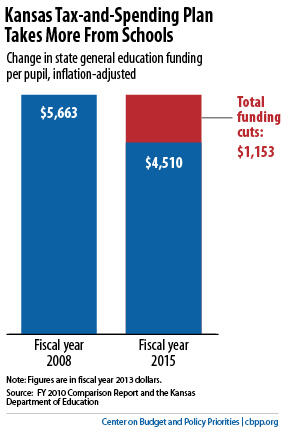

In fact, due to the new tax and budget plan, Kansas in 2015 will be spending 20 percent less per pupil on K-12 education than it did before the recession, after adjusting for inflation (see chart). In addition, lawmakers are cutting higher education again, after slicing higher education support by 24.5 percent since 2008.

Even those spending cuts won’t balance the budget, as state law requires. So Kansas is raising taxes — in the form of cuts to standard deductions and partial phase outs of itemized deductions that will take effect for the current tax year, 2013 — to pay for tax cuts that will take effect next year. Also, the state will partially roll back a scheduled drop in the sales tax. These changes are shifting the burden of paying taxes further toward low- and middle-income families and away from higher-income households.

And yet, even with those tax increases on top of spending cuts, the new budget plan remains unaffordable. Within five years, Kansas’ ending balance — its only cushion in bad times and one that state law mandates be kept at 7.5 percent of the state’s budget — will be completely gone, according to official state estimates.

And for what? Despite promises of a boost to the state economy, real-life experience in the states and extensive academic research show that income tax cuts don’t generate meaningful economic growth.

These tax-and-spending decisions come with a cost that Kansas simply can’t afford.