BEYOND THE NUMBERS

Georgia is the latest state to consider large income tax cuts despite the growing evidence that such an approach is misguided.

Two bills before Georgia lawmakers would force short-sighted cuts in the income tax, seriously weakening a primary funding source for schools and other public investments that attract business and keep the state competitive. Specifically:

-

One bill (HB 238) would cut taxes primarily for corporations and well-off residents. It would replace the personal income tax structure — which is based on a taxpayer’s ability to pay — with a single, low rate and eliminate the “corporate net worth tax” (a minimum tax on certain businesses). While the bill’s limit on itemized deductions could raise taxes for certain high-income taxpayers, and its increases in the personal and dependent exemptions would help less-affluent filers, its benefits would mostly go to those who are well off, exacerbating the state’s high inequality.

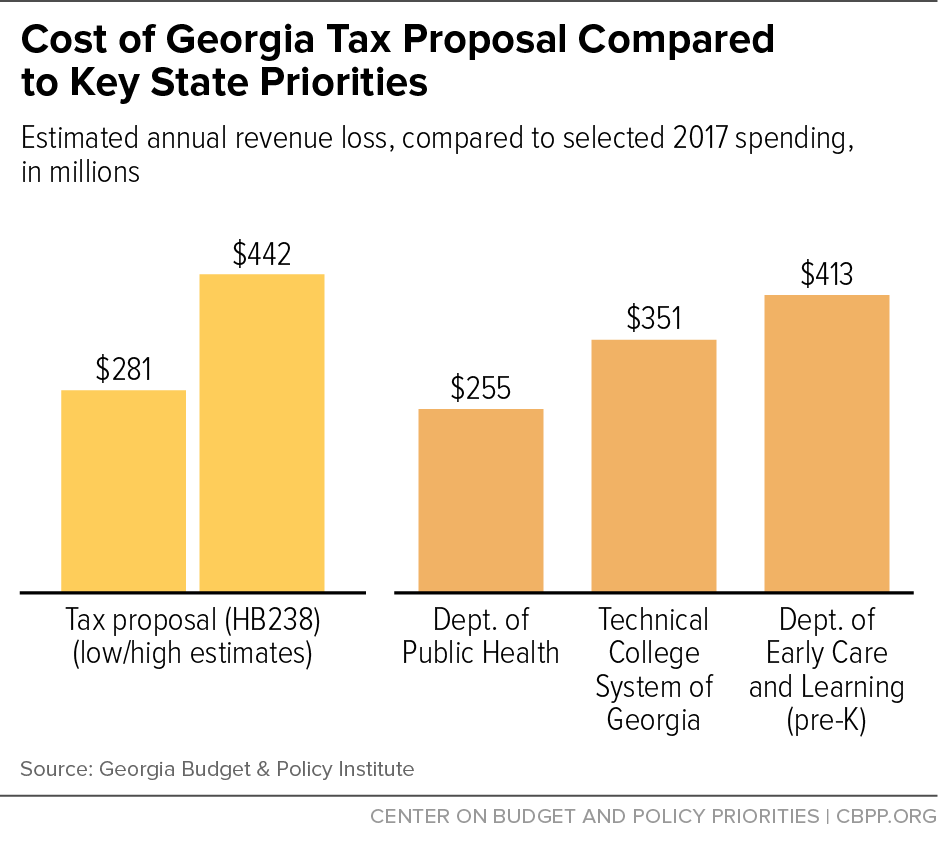

These changes would cost the state between $281 and $442 million annually — a large price tag which, on the high end, is more than what Georgia spends on pre-k programs, its technical college system, or the Department of Public Health.

- The other bill (SR 756) proposes a constitutional amendment that would gradually cut the income tax. The amendment would require Georgia to cut the top personal income tax rate by 0.1 percentage point in any year in which the general fund met certain revenue and reserve targets. It specifies no minimum “floor” for the personal income tax, so the tax ultimately could disappear altogether — making it nearly impossible for Georgia to pay for high-quality schools and other services without large sales or property tax increases in the future. Should the legislature pass this bill, the amendment would go to the ballot in the fall.

The experience of other states shows that personal income tax cuts are a poor strategy for economic growth and poorly targeted to support job growth. Georgia would be much better off instead reinvesting in its school system, which has faced some of the worst cuts to state funding nationally in recent years.