BEYOND THE NUMBERS

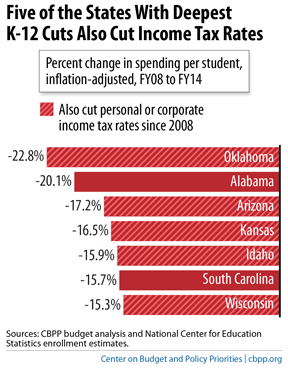

Not only have many states imposed deep funding cuts for K-12 schools since the recession hit, as our recent report explained, but most of the states that cut the deepest also cut income tax rates, reducing revenue that might have gone to schools.

- Kansas slashed its personal income tax rates in 2012, with the top rate dropping from 6.45 to 4.9 percent, while cutting other taxes. In 2013, the state cut its top rate again. All these tax cuts will cost an estimated $3.8 billion over the next five years.

- Idaho cut its top personal income tax rate from 7.8 to 7.4 percent and its corporate income tax rate from 7.6 percent to 7.4 percent, reducing revenues this year by an estimated $35 million.

- Oklahoma cut its top personal income tax rate from 5.5 to 5.25 percent, at a cost this year of $120 million.

- Wisconsin cut personal income tax rates across the board at a cost of about $650 million over the next two years.

- Arizona cut its corporate income tax rate, phased in over several years, to 4.9 percent from 6.98 percent. This rate cut, along with other business tax cuts, cost the state about $38 million in 2012 and will cost a projected $538 million by 2018, when the cuts are fully implemented.

Not all the states that cut income tax rates also imposed big cuts in school funding. (By the same token, two states that cut school funding by more than 15 percent — Alabama and South Carolina — didn’t cut broad income tax rates, though South Carolina did cut rates on business income at a cost of $20 million last year.) But there’s no question that tax cuts leave less revenue for schools and make school cuts more likely. Most serious studies find that state tax cuts produce little if any additional economic growth, let alone enough growth to offset fully the decline in state revenues.

Moreover, as the economy improves, states that cut school funding deeply will find it harder to restore that funding if they’ve permanently reduced their revenue by cutting income tax rates. And no state wants to face the future with underfunded schools.