BEYOND THE NUMBERS

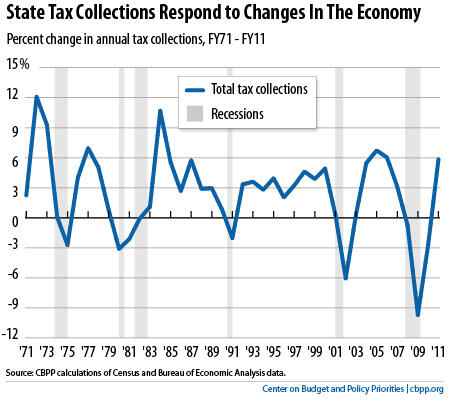

State revenues plummet in recessions as struggling households and businesses pay less in taxes, and it occurs just when states can least afford the loss (see chart). Some states, including Louisiana, Nebraska, and North Carolina, have recently considered replacing state personal income taxes with sales taxes, in part to reduce this volatility. But that switch wouldn’t solve the problem. In fact, it would make the states’ tax systems more regressive (that is, fall harder on middle- and low-income people) and would reduce significantly the revenues available to fund schools and other public services — without improving volatility much.

But states can better address revenue volatility with such strategies as stronger reserve funds and better mechanisms for managing budget surpluses, as we explain in a new paper. Here are five strategies that states should put in place now — during an economic recovery — to prepare for the next recession.

- Build stronger reserve funds. They can use rainy day funds to smooth out the ups and downs of collections from an income tax and other taxes when a recession hits. They can deposit income tax (or other tax) revenues that rise rapidly in good times in the fund for use during economic downturns. States can’t make replenishment of rainy day funds a priority until revenues rise well above pre-recession levels and they’ve restored programs cut during the recession, but they can take a number of steps now to improve how their funds function.

- Avoid new long-term spending or tax-cut commitments that are unfunded or that are funded in the short term with unsustainable revenue spikes. Instead, when a tax is growing at above-normal rates, states should set aside the revenue that is not placed in reserves for expenditures that are one-time in nature, such as certain infrastructure projects, early retirement of debt, or improved pension funding. This avoids long-term problems created when policymakers cut taxes permanently or create new programs with uncertain revenues.

- Diversify the mix of taxes. States should rely on a variety of taxes that respond differently to economic changes to further reduce ups and downs in total tax collections. For example, the growing number of states with significant oil and gas production could increase their reliance on severance taxes in conjunction with other measures to address volatility. States can also insure a balanced mix of revenue by avoiding measures that limit local governments’ ability to levy adequate property taxes.

- Use temporary tax changes to smooth out short-term dips or spikes in collections. In times of above-average economic growth, states should consider one-time tax rebates as an alternative to permanent cuts. Conversely, during recessions, they can temporarily increase income or sales tax rates. This type of tax structure can allow a state to have lower permanent rates on all taxes in times of normal growth.

- Work with the federal government to make emergency aid an automatic response to recessions. States should be able to access emergency federal aid during recessions to help balance their budgets. In each of the last two recessions, such aid helped states avert a substantial amount of spending cuts and tax increases. It also helped strengthen the U.S. economy, in part by reducing the number of people out of work.

Click here to read the full paper.