BEYOND THE NUMBERS

Explaining Federal Taxes

In anticipation of April 15 — Tax Day — we’ve updated several of our backgrounders on how the federal government collects and spends tax dollars.

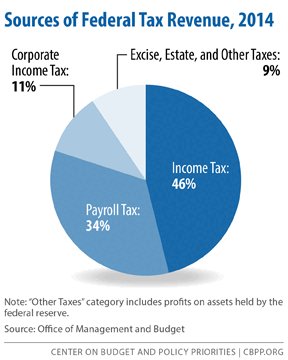

Where Do Our Federal Tax Revenues Come From? The three main sources of federal tax revenue are individual income taxes, payroll taxes, and corporate income taxes; other sources include excise taxes, the estate tax, and other taxes and fees (see chart).

Where Do Our Federal Tax Dollars Go? In fiscal year 2014, the federal government spent $3.5 trillion, amounting to 20 percent of the nation’s Gross Domestic Product (GDP). Of that $3.5 trillion, over $3.0 trillion was financed by federal revenues. Three major areas of spending each make up about one-fifth of the budget: Social Security; Medicare, Medicaid, the Children’s Health Insurance Program, and marketplace subsidies; and defense and international security assistance.

Marginal and Average Tax Rates: A taxpayer’s average tax rate (or effective tax rate) is the share of income that he or she pays in taxes. By contrast, a taxpayer’s marginal tax rate is the tax rate imposed on his or her last dollar of income. Due to higher tax rates that kick in at higher income levels, taxpayers’ average tax rates are lower — usually much lower — than their marginal rates.

The Federal Estate Tax: The federal estate tax is a tax on property (cash, real estate, stock, or other assets) transferred to heirs when very wealthy people die. Roughly two of every 1,000 estates have to pay any estate tax this year, largely because of its generous exemption levels before estates are subject to any tax.

Federal Payroll Taxes: The federal government levies payroll taxes on wages and self-employment income. In fiscal year 2014, federal payroll taxes generated $1.02 trillion, which amounts to 5.9 percent of the nation’s GDP, or 34 percent of all federal revenues.

Tax Exemptions, Deductions, and Credits: Tax exemptions, deductions, and credits all can reduce the taxes that a person owes. Some of these tax benefits are designed to reflect a person’s ability to pay tax; the Child Tax Credit, for example, recognizes the costs of raising children. Other tax benefits, such as the deductions for charitable donations and home mortgage interest payments, are incentives to advance specific social policy goals.

Tax Expenditures: “Tax expenditures” are subsidies delivered through the tax code as deductions, exclusions, and other tax preferences. Tax expenditures reduce the amount of tax that households or corporations owe. In fiscal year 2014, tax expenditures reduced federal income tax revenue by over $1.1 trillion, and they reduced payroll taxes and other revenues by an additional $122 billion. Stay tuned — in the coming days we’ll post this year’s top federal and state tax charts, along with posts on other key tax topics.