BEYOND THE NUMBERS

“Egregious employment tax noncompliance” by employers has risen substantially in recent years while the IRS’s ability to recover the lost revenues and investigate fraud and embezzlement has fallen, a report by the Treasury Inspector General for Tax Administration (TIGTA) finds. More than 1 million employers owed over $45 billion in unpaid employment taxes as of December 2015, including interest and penalties. The report provides further evidence that the deep cuts to IRS funding since 2010 have weakened the agency’s ability to perform its core functions of collecting taxes and enforcing the nation’s tax laws.

This type of employer tax evasion is particularly harmful; it not only reduces federal revenues but it also hurts workers because employers often don’t report their earnings to the IRS and Social Security Administration. That makes it hard for employees and their families to claim the benefits they’ve earned when they retire, become disabled, or die and leave dependents behind.

Unpaid employment taxes include income taxes and Social Security and Medicare payroll taxes that employers withheld on behalf of employees but never paid to the IRS, as well as the unpaid employer share of payroll taxes. TIGTA found that as of December 2015, the number of employers with five or more years of unpaid employment taxes — what it considers “egregious noncompliance” — had risen more than 65 percent since 2007 and more than tripled since 1998.

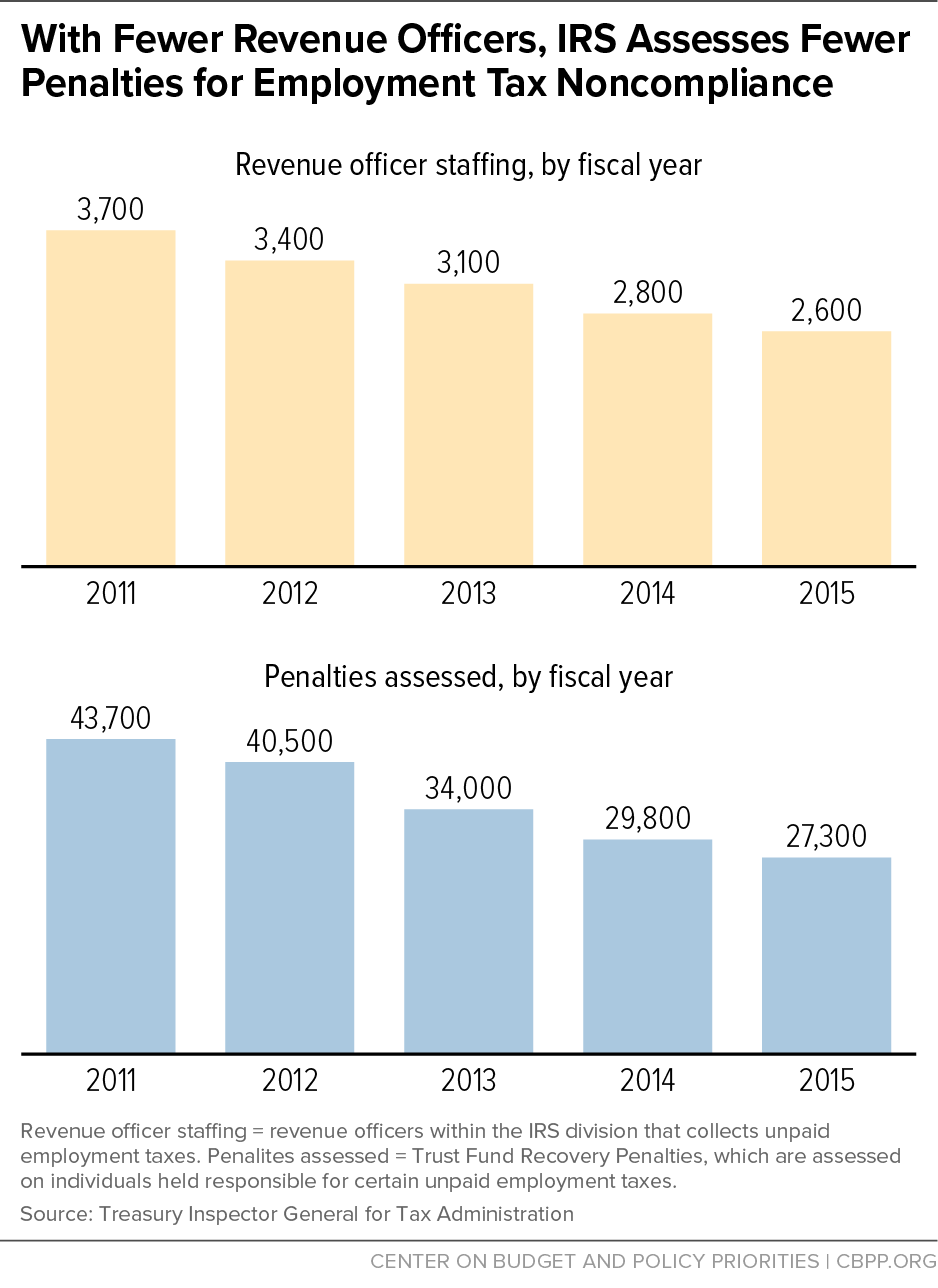

IRS funding for enforcement has been cut 20 percent in inflation-adjusted terms since 2010, and the overall enforcement workforce — which includes revenue officers investigating employment tax noncompliance — has fallen by almost one-quarter. As the number of revenue officers has fallen, so has the number of penalties assessed on people held responsible for unpaid employment taxes, which has declined by nearly 38 percent over the past five years (see chart). Similarly, the number of cases referred for criminal investigation has fallen by a third over this period.

Underfunding enforcement is penny-wise and pound-foolish. Treasury Secretary Steven Mnuchin acknowledged this basic fact during his confirmation hearing when he said that “[if] we add people, we make money” and called for increased IRS resources. Yet the President’s 2018 budget cuts IRS funding by another $239 million, on top of the cuts in recent years. These cuts would further compromise enforcement and other crucial IRS functions and could undermine the integrity of the tax system. Policymakers should reverse course and give the IRS sufficient resources to fulfill its mission.