BEYOND THE NUMBERS

Effort to Make Bonus Depreciation Permanent Is Economically Unjustified and Fiscally Irresponsible

House Ways and Means Committee Chairman Dave Camp (R-MI) is proposing to make permanent a tax provision known as “bonus depreciation,” which lets businesses take bigger upfront tax deductions for certain new purchases such as machinery and equipment. The proposal to make it permanent, which Chairman Camp plans to bring before his committee today, is economically unjustified and fiscally irresponsible, as we explain in a new analysis.

Ways and Means voted in April to make permanent six corporate “tax extenders” — so named because Congress routinely extends them for a year or two at a time — at a cost of more than $300 billion. (The full House earlier this month passed one of those measures, which would make permanent, and expand, the Research and Experimentation Tax Credit.) Now, Chairman Camp is calling for making permanent the bonus depreciation provision, which is not an “extender” and which, historically, policymakers have enacted only on a temporary basis when the economy is weak and allowed to expire when the economy has recovered.

In bringing such a measure before his committee and signaling his support for it, Chairman Camp is reversing course on his own tax reform plan, which proposed to end bonus depreciation.

Policymakers should not reinstate, and make permanent, bonus depreciation for at least two compelling reasons:

- Bonus depreciation was meant to be only a temporary incentive. Congress enacted the provision solely to bolster the economy during the recession, and not with the intent of making it a permanent feature of the tax code (or extending it year after year like a tax extender). In the previous economic downturn, Congress enacted bonus depreciation in 2002 — and then a Republican President, House, and Senate let it expire after 2004, when the economy was stronger. Moreover, studies have shown that bonus depreciation “is largely ineffective as a policy tool for economic stimulus,” according to the Congressional Research Service.

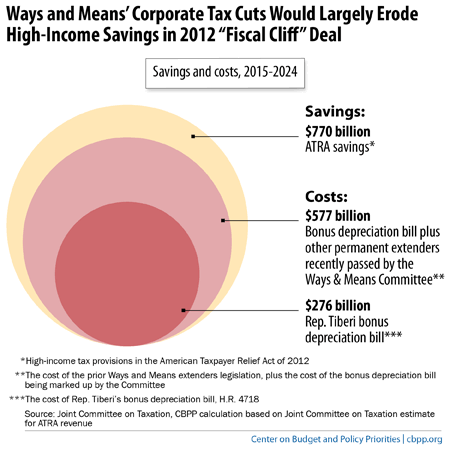

- Making bonus depreciation permanent would be very expensive. The bill would cost $276 billion in forgone revenues over 2015 to 2024, according to the Joint Committee on Taxation, adding to deficits and debt. The Ways and Means Committee already has passed bills to make permanent a number of other tax extenders at a cost of $301 billion over the coming decade. Adding bonus depreciation to this tally would bring the cost of unpaid for tax breaks passed by the Ways and Means Committee to $577 billion, enough to wipe out more than three-quarters of the $770 billion in revenue raised by the 2012 “fiscal cliff” legislation (see chart). And if Congress also made the remaining tax extenders permanent, the overall revenue loss would wipe out all of the fiscal cliff savings, setting long-term deficit reduction back.

Click here to read the full paper.