BEYOND THE NUMBERS

A recent New York Times story on the rise in Social Security Disability Insurance (DI) spending understates the large role of demographic factors and, as a result, may give undue ammunition to critics who urge harsh cuts to the program.

The story says that demographic factors — the aging of the baby boomers and the rise in women’s labor-force participation (which means more of them are insured against disability) — “account for only a small share of the growing cost.”

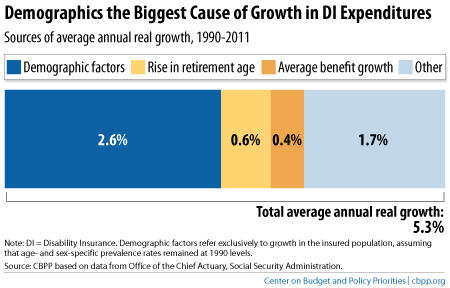

In reality, over the 1990-2011 period that the Times cites, demographic factors account for nearly half of the growth in DI spending, based on data from the Social Security Administration (see chart).

Two other factors — the rise in Social Security’s full retirement age and in its real average benefit — together account for another one-sixth of the growth. (Initial Social Security benefits for each new generation of beneficiaries grow with average wages in the economy, so it’s no surprise that the average benefit slightly outpaces inflation.) Various other factors account for the remaining one-third.

The number of disabled workers has nearly tripled since 1990 and, as the Times correctly notes, that far outpaces the growth in the working-age population. But that comparison misses a key point: disability is most likely to affect older workers. People are twice as likely to be disabled at age 50 as at age 40, and twice as likely at 60 as at 50, as Congressional Budget Office data show.

While the working-age population as a whole grew by just 25 percent from 1990 to 2011 (and the number of “insured workers” — those eligible for DI in the event of disability — grew just a bit faster), the number of insured workers over age 50 more than doubled. So, as the baby boom — the generation born between 1946 and 1964 — has moved squarely into its high-disability years, it has driven up the DI rolls.

The Times is also right that DI spending has risen much faster than spending for the retirement and survivors’ program since 1990. But that’s not a mark against the DI program because few boomers had reached retirement age. (The population age 65 or older grew by just 1 percent a year during this period, on average.) That’ll change over the next few decades, as the retirement and survivors’ program grows much faster than DI.

Understating the role of demographics, as the Times story did, could encourage policymakers to tackle DI’s solvency issues separately from Social Security as a whole. That would be a mistake. Policymakers would have few — and unduly harsh — options, and would risk ignoring the strong interactions between Social Security’s disability and retirement components.

The article’s headline announced, “Disability Insurance Causes Pain,” but we would create far worse pain by enacting deep and poorly informed cuts to this essential program.