BEYOND THE NUMBERS

We described yesterday how five demographic factors — population growth, the aging of the baby boom, the hike in Social Security’s full retirement age, the rise in women’s labor force participation, and “women’s catch-up” — explain most of the increase in Social Security Disability Insurance (DI) recipients. But not all. What else is going on?

Here are other factors that have boosted DI enrollment, though we can’t quantify their contributions as readily:

- Workplace changes. Globalization and technological change have been particularly harsh to older, less-educated workers and those with cognitive impairments. And even in this era of “brain power,” many jobs — including those performed by older workers — still involve arduous physical demands or difficult working conditions.

- Lack of health insurance. DI beneficiaries qualify for Medicare after a two-year wait. As employer-sponsored health insurance eroded and individual plans became costlier or outright unavailable, Medicare eligibility may have loomed larger in some workers’ decisions to apply for DI. This suggests that health reform might diminish pressures on DI — as similar reforms apparently did in Massachusetts.

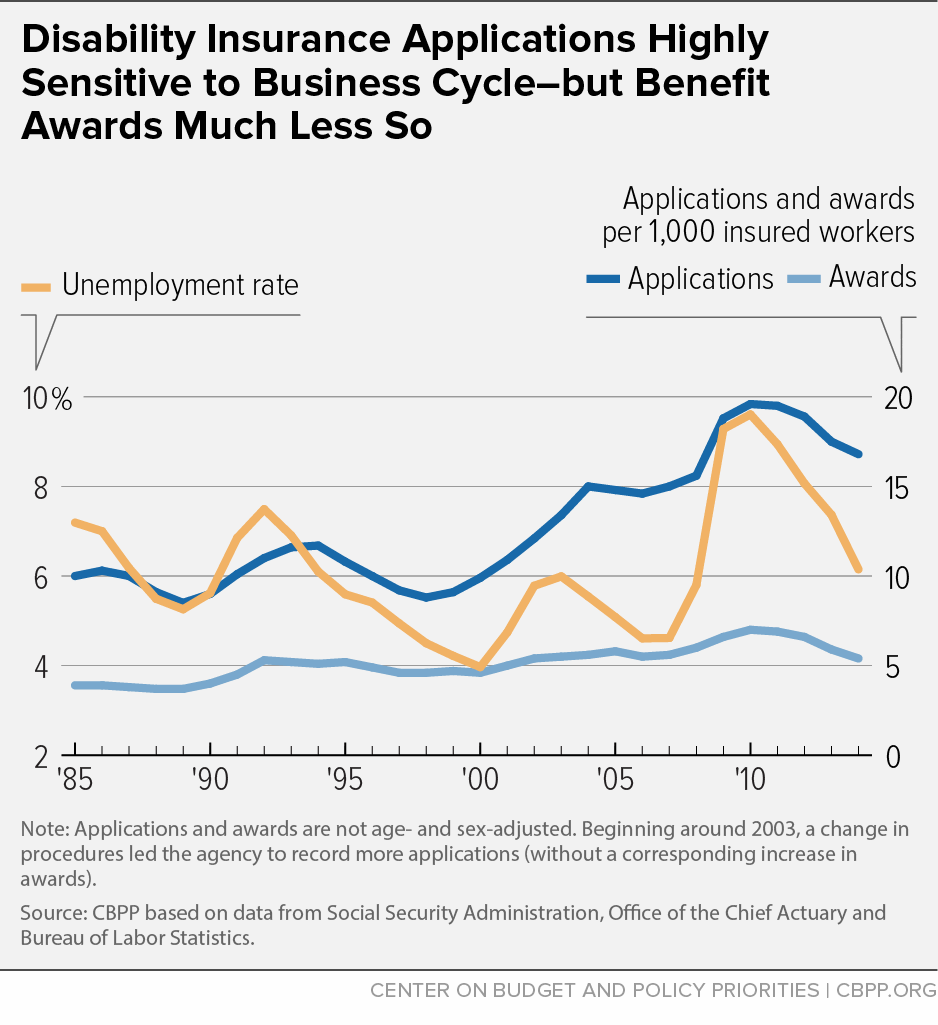

- Economic downturn. Some assert that the Great Recession greatly fueled the program’s growth, but its actual impact is less dramatic. While high unemployment tends to attract more applicants, those applications are more likely to be denied. (See graph.) DI had only 350,000 (or 4 percent) more beneficiaries in December 2014 than the trustees had expected in March 2008, when the trustees — like most forecasters — did not foresee the economic storm clouds ahead.

- Lower death rates. Death rates for DI beneficiaries are far higher than for the general population, but they have nonetheless fallen, from about 5 percent of beneficiaries each year in the mid-1980s to about 3 percent today. That means that beneficiaries tend to stay on the rolls longer.

- Lower recovery rates. Cases in which the Social Security Administration stops benefits as recipients return to steady work or their health improves were never high and have drifted down. That’s largely because Congress failed to fund medical reviews (known as continuing disability reviews) adequately — a backlog that the Obama Administration is aggressively tackling.

The growth in the disability rolls — and the resulting need to replenish the program’s trust fund in 2016 — were long expected and aren’t a crisis. Lawmakers should re-apportion taxes between Social Security’s retirement and disability funds and work to strengthen the overall solvency of Social Security, a vital and popular program.