BEYOND THE NUMBERS

Federal taxes are generally designed to ensure that federal income and payroll taxes don’t tax people into — or deeper into — poverty. The glaring exception is childless adults, more than 8 million of whom are, in fact, taxed into or deeper into poverty.

That’s mostly because they’re largely excluded from the Earned Income Tax Credit (EITC), which, for them, is too small (or, for many of them, non-existent) to offset their income taxes and the employee share of their payroll taxes.

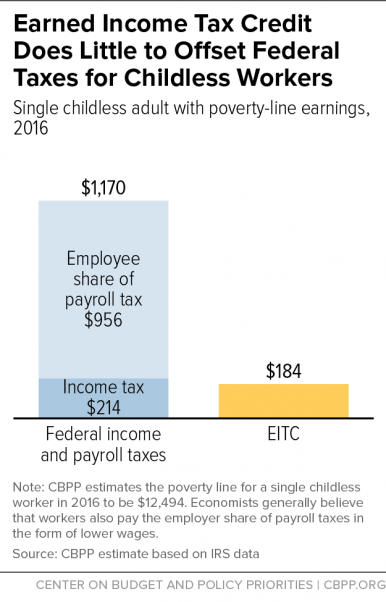

This chart highlights an example: a 25-year-old single woman making poverty-line wages in 2016 ($12,494) as a retail salesperson. Under current law, she’s taxed nearly $1,000 into poverty:

- She will have $956 (7.65 percent of her earnings) in Social Security and Medicare payroll taxes deducted from her paychecks.

- Her taxable income, after subtracting a $6,300 standard deduction and a $4,050 personal exemption, is $2,144. She’s in the 10 percent bracket, so she’ll have a $214 income tax liability.

- Together, her $214 in income tax liability and $956 in payroll taxes add up to $1,170.

- Yet, she’s eligible only for a small $184 EITC, so her federal tax liability will be $1,170 minus $184 — or $986.

Policymakers should make it a top priority to fix this glaring flaw in the tax code by strengthening the EITC for childless workers.