BEYOND THE NUMBERS

The Congressional Budget Office’s (CBO) financial projections for Social Security — published in June and clarified this month — paint a gloomier outlook than those of the program’s trustees. But that’s no reason to panic or call for sharp cuts in Social Security’s modest and vital benefits.

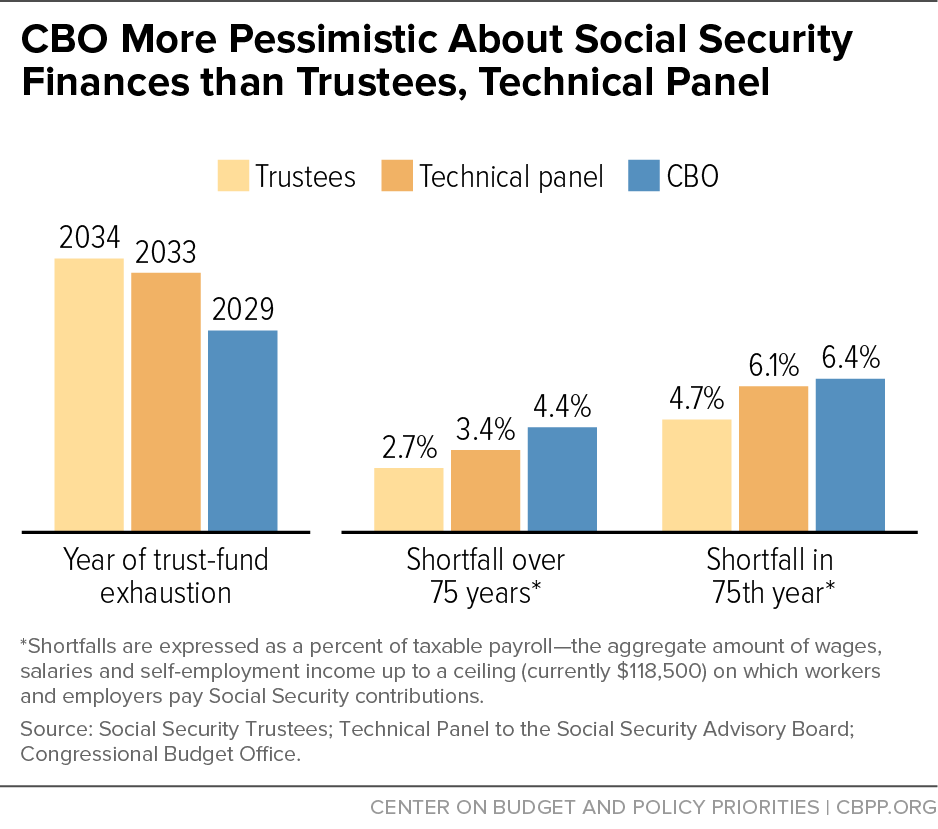

Here are the key numbers and dates: CBO judges that Social Security’s combined retirement and disability trust funds will need replenishing by 2029, while the trustees put that date at 2034. Even if lawmakers very unwisely took no steps to shore up the program, it could still pay the large majority of scheduled benefits after that — more than two-thirds according to CBO, three-fourths according to the trustees — from scheduled tax revenues. Over the next 75 years, CBO puts the program’s deficit noticeably higher than do the trustees, but both expect the biggest deficits in the furthest years — where the projections are highly uncertain.

CBO’s outlook also sets it apart from the 2015 Technical Panel, a group of economists, demographers, and actuaries appointed by the independent Social Security Advisory Board to advise Social Security’s trustees and staff. Under the Technical Panel’s recommended assumptions, Social Security’s 75-year shortfall is higher than the trustees’ estimate but well below CBO’s. (See figure.)

Different assumptions about the economy seem to account for most of the variation in the projections over the next decade; CBO foresees lower tax revenues than the trustees. In the longer run, CBO cites three points of contrast:

- Lower mortality. Longer life spans — which are certainly good news for Americans — worsen Social Security’s financial outlook. CBO thinks death rates will improve by much more than the trustees assume, while the technical panel stands in the middle. Furthermore, CBO assumes death rates will improve equally at all ages, whereas the other two sets of projections “taper” the improvement at the oldest ages. This is by far the biggest difference in the projections, but it’s also highly uncertain.

- Lower interest rates. CBO thinks that real interest rates — the rate paid on ten-year Treasury notes, minus inflation — will be noticeably lower than the trustees assume. (Again, the technical panel lies in the middle.) That means we’d have to squirrel away more money in the trust funds today to generate more interest income in future decades. But this factor contributes only modestly to CBO’s larger estimated long-term gap.

- Higher disability rates. CBO thinks that disability awards will stabilize at 5.6 new beneficiaries per year for every 1,000 workers insured for disability benefits. That’s barely above the trustees’ and technical panel’s assumption (5.4 awards per 1,000 insured workers), and it makes little difference to the projections.

The assumptions by CBO, the trustees, and the technical panel all fall within a plausible range. The biggest uncertainty is future mortality, whose effects will take decades to compound — and which demands a careful policy response since the greatest gains in life expectancy are accruing to higher earners. Mortality improvement rates fluctuate significantly over time, so policymakers should avoid overreacting to short-term ups and downs.

But here’s something lawmakers should address soon: the rising earnings inequality that CBO highlights. Because top earners are outstripping the rest — and because Social Security taxes apply only to earnings up to a cap, currently $118,500 — CBO expects the share of earnings that are taxable to slip below 79 percent. That’s far below the 90 percent envisioned in the 1977 Social Security Amendments and even below the 82 percent foreseen by the trustees and the technical panel. At a minimum, lawmakers should take steps to raise that ratio back to 90 percent and index it against future erosion. By enacting this and other carefully crafted changes, policymakers can strengthen the future solvency of this essential and popular program.